Region:Middle East

Author(s):Rebecca

Product Code:KRAC1185

Pages:89

Published On:October 2025

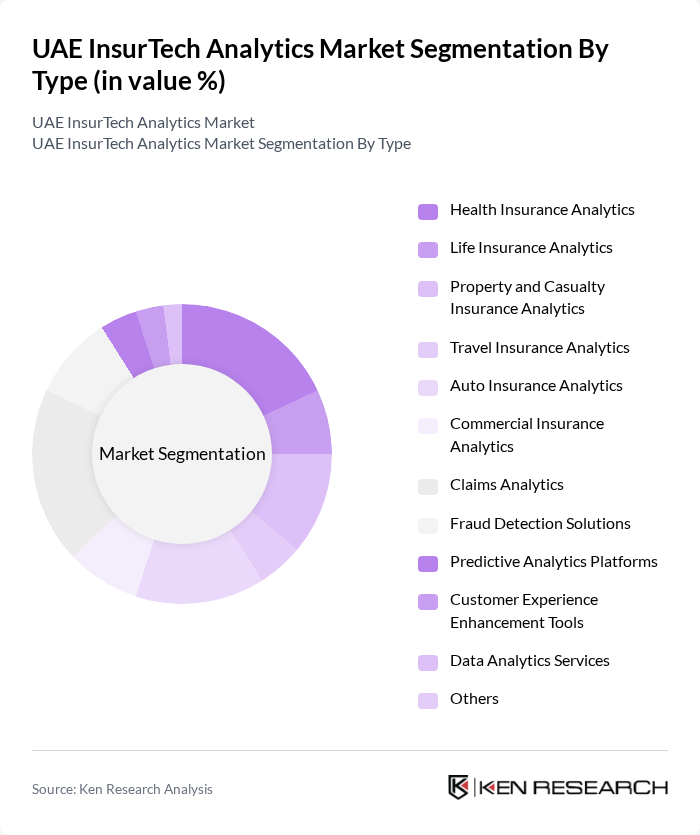

By Type:The InsurTech analytics market can be segmented into various types, including Health Insurance Analytics, Life Insurance Analytics, Property and Casualty Insurance Analytics, Travel Insurance Analytics, Auto Insurance Analytics, Commercial Insurance Analytics, Claims Analytics, Fraud Detection Solutions, Predictive Analytics Platforms, Customer Experience Enhancement Tools, Data Analytics Services, and Others. Among these, Claims Analytics and Fraud Detection Solutions are particularly prominent due to the increasing need for efficient claims processing and fraud prevention in the insurance industry .

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises, Large Corporations, Government Entities, Insurance Companies, Third-Party Administrators, Brokers and Agents, and Others. The segment of Insurance Companies is leading due to their significant investment in technology to enhance operational efficiency and customer engagement. Large Corporations and SMEs are also increasing adoption of InsurTech analytics to manage risk and optimize insurance processes .

The UAE InsurTech Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayzat, Yallacompare, Wellx, Policybazaar UAE, Daman (National Health Insurance Company), Abu Dhabi National Insurance Company (ADNIC), Sukoon Insurance (formerly Oman Insurance Company), Emirates Insurance Company, Noor Takaful, Al Ain Ahlia Insurance Company, RSA Insurance Group, Zurich Insurance Group, Allianz Insurance, MetLife, AIG, Chubb, Generali, Addenda, Democrance, Sehteq, Neuron, Aqeed, Click2SecureMe contribute to innovation, geographic expansion, and service delivery in this space .

The future of the UAE InsurTech analytics market appears promising, driven by technological advancements and evolving consumer preferences. As insurers increasingly adopt artificial intelligence and machine learning, operational efficiencies are expected to improve significantly. Additionally, the rise of on-demand insurance products is likely to reshape traditional insurance models, catering to the growing demand for flexibility. Collaboration between InsurTech firms and established insurers will further enhance innovation, creating a more dynamic and competitive landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Health Insurance Analytics Life Insurance Analytics Property and Casualty Insurance Analytics Travel Insurance Analytics Auto Insurance Analytics Commercial Insurance Analytics Claims Analytics Fraud Detection Solutions Predictive Analytics Platforms Customer Experience Enhancement Tools Data Analytics Services Others |

| By End-User | Individuals Small and Medium Enterprises Large Corporations Government Entities Insurance Companies Third-Party Administrators Brokers and Agents Others |

| By Application | Risk Assessment Fraud Detection Customer Segmentation Predictive Analytics Claims Management Underwriting Customer Experience Optimization Others |

| By Distribution Channel | Direct Sales Online Platforms Brokers and Agents Partnerships with Tech Firms Others |

| By Business Model | B2C (Business to Consumer) B2B (Business to Business) B2B2C (Business to Business to Consumer) Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Licensing Fees Freemium Others |

| By Customer Type | Individual Customers Small and Medium Enterprises Large Corporations Government Entities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance Innovations | 100 | Product Managers, Health Insurance Executives |

| Auto Insurance Technology Adoption | 70 | Operations Managers, Claims Adjusters |

| Life Insurance Digital Solutions | 60 | Business Development Managers, Actuaries |

| Consumer Perception of InsurTech | 90 | End-users, Customer Experience Managers |

| Regulatory Impact on InsurTech | 50 | Compliance Officers, Legal Advisors |

The UAE InsurTech Analytics Market is valued at approximately USD 8.5 billion, reflecting significant growth driven by digital technology adoption, consumer demand for digital insurance products, and regulatory support for innovation in the insurance sector.