Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3918

Pages:83

Published On:November 2025

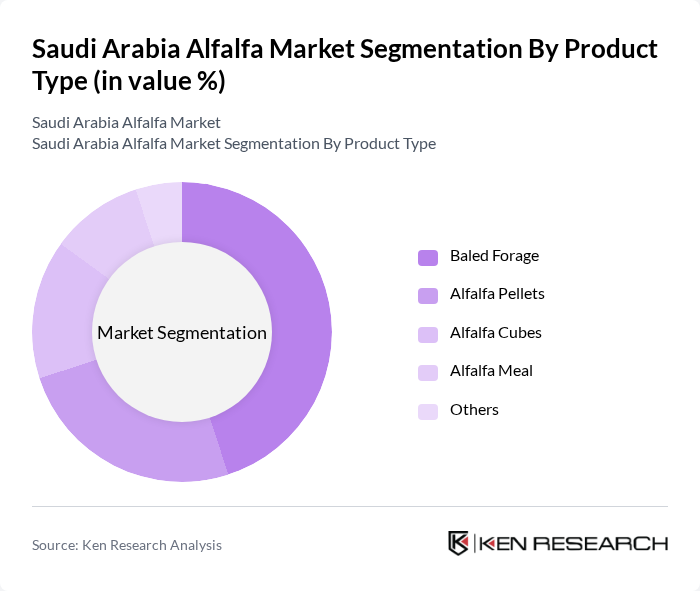

By Product Type:The market is segmented into various product types, including Baled Forage, Alfalfa Pellets, Alfalfa Cubes, Alfalfa Meal, and Others. Among these, Baled Forage is the most dominant segment due to its ease of storage and transportation, making it a preferred choice for livestock feed. Alfalfa Pellets and Cubes are also gaining traction as they offer concentrated nutrition and convenience for farmers. The demand for these products is driven by the growing livestock population and the need for high-quality feed .

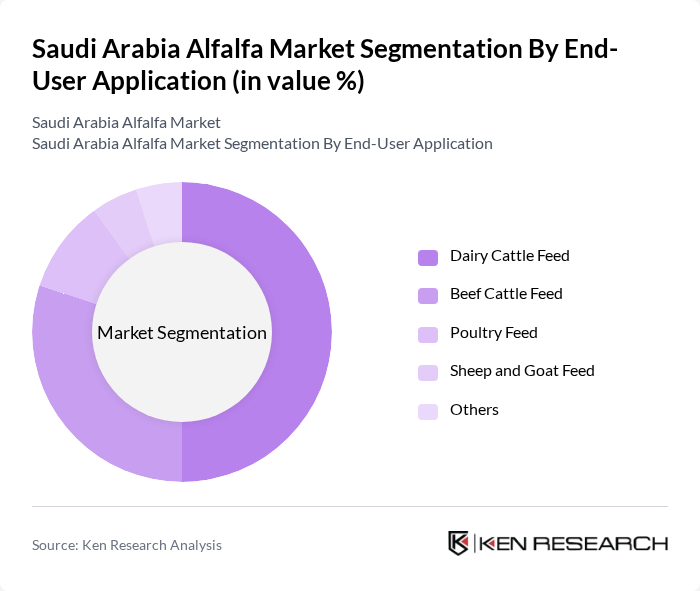

By End-User Application:The market is segmented based on end-user applications, including Dairy Cattle Feed, Beef Cattle Feed, Poultry Feed, Sheep and Goat Feed, and Others. Dairy Cattle Feed is the leading segment, driven by the increasing demand for milk and dairy products in the region. The growing awareness of the nutritional benefits of alfalfa for dairy cattle has led to its widespread adoption among farmers. Additionally, the beef cattle sector is also witnessing significant growth, contributing to the overall demand for alfalfa .

The Saudi Arabia Alfalfa Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, National Agricultural Development Company (NADEC), Al-Safi Danone, Al-Faisaliah Group, Al-Jazeera Agricultural Company, Al-Watania Agriculture, Al-Muhaidib Group, Al-Babtain Group, Al-Qassim Agricultural Company, Al-Mansour Group, Al-Salam Agricultural Company, Al-Fahd Agricultural Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia alfalfa market appears promising, driven by technological advancements and a strong governmental push towards agricultural sustainability. The integration of precision agriculture techniques is expected to enhance yield efficiency, while the increasing focus on organic farming will cater to the rising consumer demand for sustainable products. Additionally, strategic partnerships with international firms may facilitate knowledge transfer and investment, further bolstering the market's growth potential in future.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Baled Forage Alfalfa Pellets Alfalfa Cubes Alfalfa Meal Others |

| By End-User Application | Dairy Cattle Feed Beef Cattle Feed Poultry Feed Sheep and Goat Feed Others |

| By Region | Central Region Eastern Region Western Region Northern Region (Hail, Al-Jawf) Southern Region |

| By Quality Grade | Premium Grade Standard Grade Feed Grade Others |

| By Distribution Channel | Direct Sales to Farms Feed Manufacturers and Integrators Wholesale Distributors Retail Outlets Online Sales |

| By Packaging Type | Bulk Packaging Bagged Packaging Baled Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Alfalfa Farmers | 100 | Farm Owners, Agricultural Managers |

| Livestock Feed Distributors | 60 | Supply Chain Managers, Sales Representatives |

| Agricultural Policy Makers | 40 | Government Officials, Agricultural Advisors |

| Research Institutions | 40 | Agricultural Researchers, Economists |

| Exporters of Alfalfa Products | 40 | Export Managers, Business Development Executives |

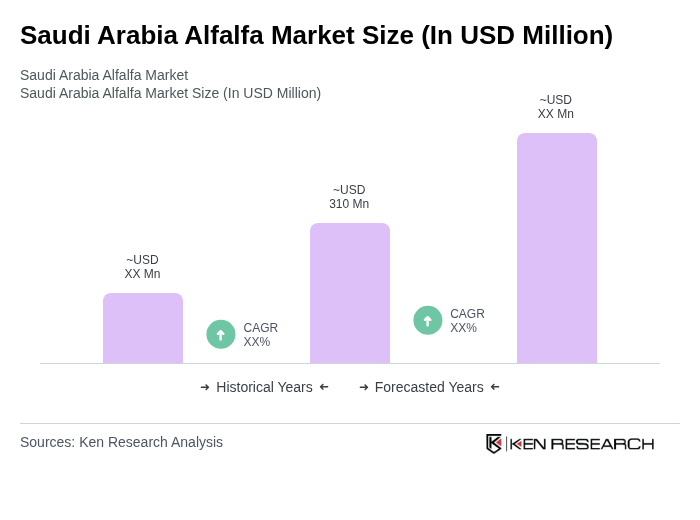

The Saudi Arabia Alfalfa Market is valued at approximately USD 310 million, reflecting a significant growth driven by the increasing demand for high-quality animal feed, particularly in the dairy and beef sectors.