Region:Middle East

Author(s):Dev

Product Code:KRAD5192

Pages:85

Published On:December 2025

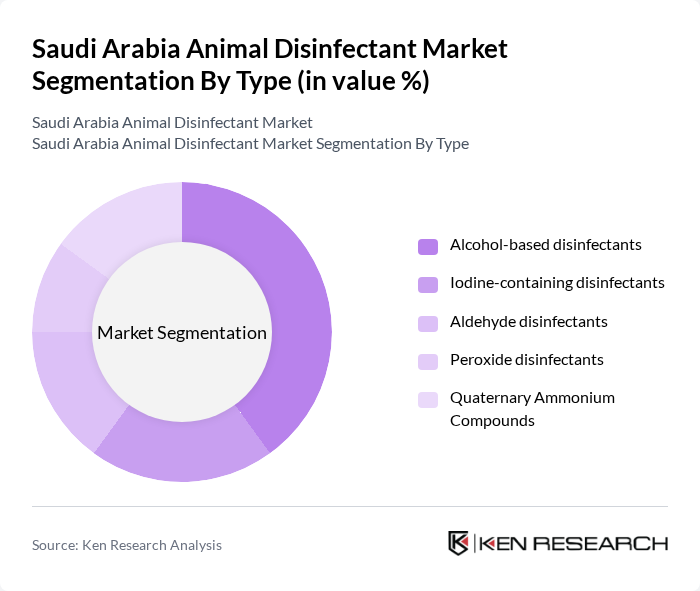

By Type:The market is segmented into various types of disinfectants, including Alcohol-based disinfectants, Iodine-containing disinfectants, Aldehyde disinfectants, Peroxide disinfectants, and Quaternary Ammonium Compounds. In Saudi Arabia, iodine-containing disinfectants account for the largest revenue share, supported by their extensive use in dairy and livestock hygiene protocols, while aldehyde and peroxide formulations are gaining traction for high?level disinfection in intensive poultry and livestock units. Alcohol-based disinfectants are widely used for rapid surface and equipment disinfection, especially in veterinary clinics and research or diagnostic settings, but their share in overall farm?level use is comparatively lower than iodine-based and quaternary ammonium compound formulations.

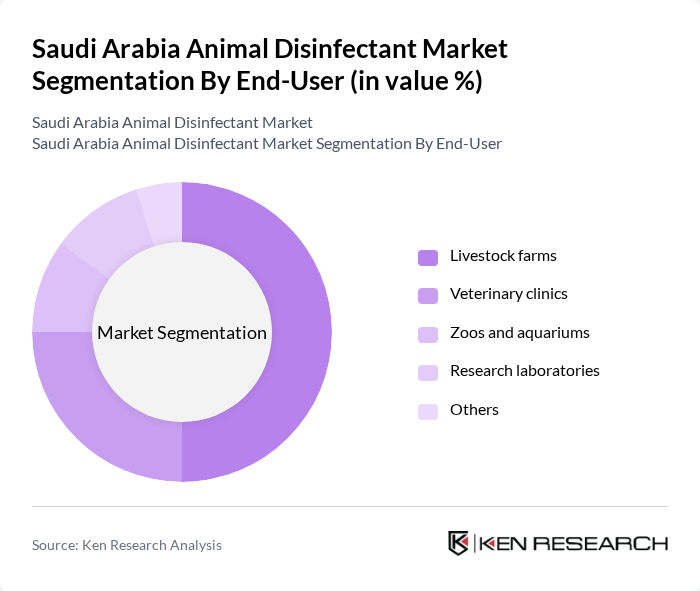

By End-User:The end-user segmentation includes Livestock farms, Veterinary clinics, Zoos and aquariums, Research laboratories, and Others. Livestock farms are the dominant segment, driven by the increasing need for biosecurity and disease prevention in commercial poultry, dairy, and red?meat operations, which rely on routine barn, equipment, and water?system disinfection. The growing livestock and poultry population, coupled with stricter hygiene protocols in line with One Health and food?safety standards, and rising awareness of animal health among farm operators and veterinarians, are key factors propelling the demand for disinfectants in this sector.

The Saudi Arabia Animal Disinfectant Market is characterized by a dynamic mix of regional and international players. Leading participants such as Neogen Corporation, Zoetis Inc., Merck Animal Health, Elanco Animal Health, Boehringer Ingelheim, Kersia Group, DeLaval, Solvay SA, GEA Group AG, Stepan Company, Phibro Animal Health, Kemin Industries, Huvepharma, Vetoquinol, Hester Biosciences contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia animal disinfectant market appears promising, driven by technological advancements and increasing regulatory support. The integration of automated disinfection systems is expected to enhance efficiency, while the shift towards sustainable products aligns with global environmental trends. Additionally, the growing demand for organic farming will likely spur innovation in eco-friendly disinfectants, creating new avenues for market growth and ensuring compliance with evolving regulations.

| Segment | Sub-Segments |

|---|---|

| By Type | Alcohol-based disinfectants Iodine-containing disinfectants Aldehyde disinfectants Peroxide disinfectants Quaternary Ammonium Compounds |

| By End-User | Livestock farms Veterinary clinics Zoos and aquariums Research laboratories Others |

| By Application | Dairy cleaning Poultry disinfection Swine disinfection Cattle and beef disinfection Others |

| By Distribution Channel | Online retail Offline retail Direct sales Distributors and wholesalers Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Product Formulation | Chemical-based disinfectants Natural disinfectants Biocides Others |

| By Packaging Type | Bulk packaging Retail packaging Industrial packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Livestock Farmers | 120 | Farm Owners, Animal Health Managers |

| Veterinary Clinics | 90 | Veterinarians, Clinic Managers |

| Disinfectant Manufacturers | 60 | Product Managers, Sales Directors |

| Government Regulatory Bodies | 40 | Policy Makers, Animal Health Inspectors |

| Animal Health Consultants | 50 | Consultants, Industry Experts |

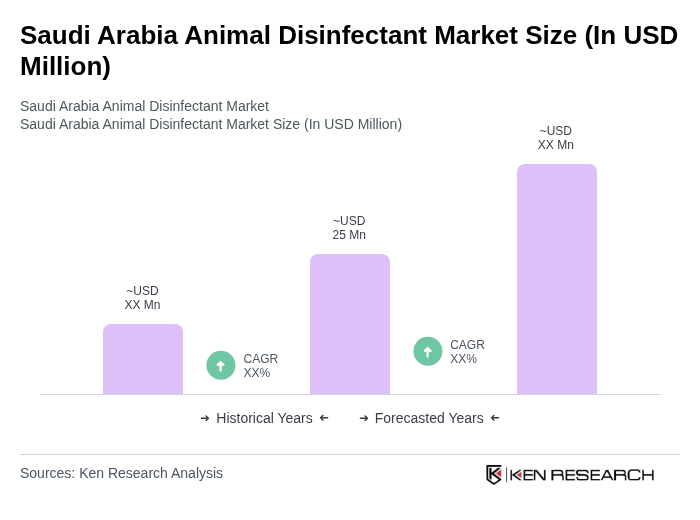

The Saudi Arabia Animal Disinfectant Market is valued at approximately USD 25 million, reflecting a significant growth driven by increasing awareness of animal health and biosecurity measures, as well as a rising livestock and poultry population in the region.