Region:Middle East

Author(s):Rebecca

Product Code:KRAC8548

Pages:84

Published On:November 2025

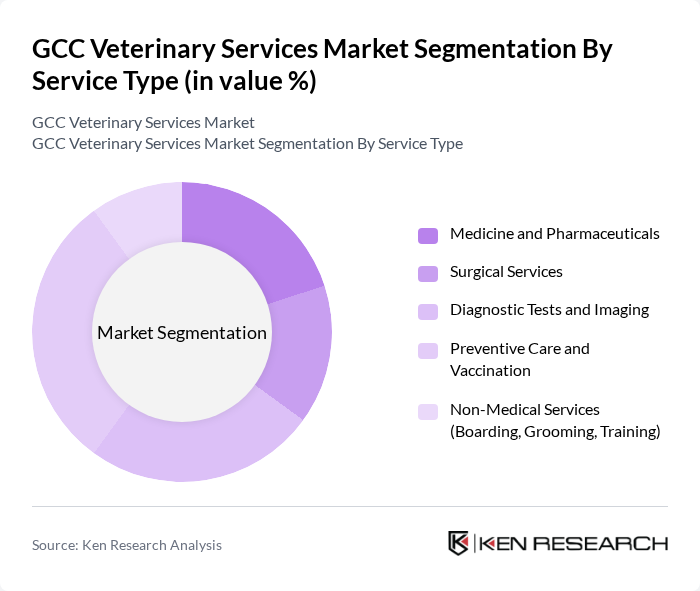

By Service Type:The service type segmentation includes Medicine and Pharmaceuticals, Surgical Services, Diagnostic Tests and Imaging, Preventive Care and Vaccination, and Non-Medical Services (Boarding, Grooming, Training). Preventive Care and Vaccination is the leading sub-segment, driven by increasing awareness of pet health, the importance of vaccinations in preventing diseases, and the rising number of pet owners who prioritize their pets' health and well-being. The adoption of subscription wellness plans and annual health screenings is also supporting growth in this segment.

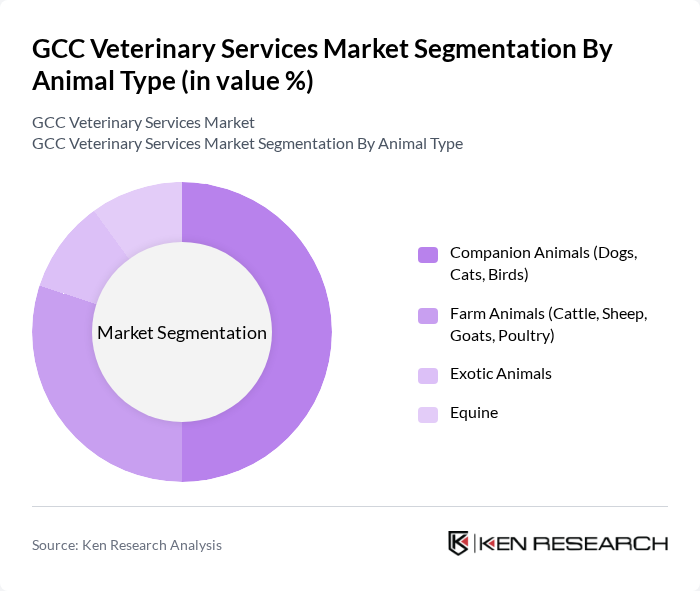

By Animal Type:The animal type segmentation encompasses Companion Animals (Dogs, Cats, Birds), Farm Animals (Cattle, Sheep, Goats, Poultry), Exotic Animals, and Equine. Companion Animals dominate this segment, driven by the increasing trend of pet ownership, the growing human-animal bond, and rising urbanization. Higher disposable income and the expansion of pet insurance options have led to more households adopting pets, thus increasing the demand for veterinary services tailored to companion animals.

The GCC Veterinary Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as British Veterinary Centre, Al Falah Veterinary Clinic, Modern Veterinary Clinic, Al Hayat Veterinary Clinic, Banfield Pet Hospital (Mars Veterinary Services), VCA Animal Hospitals (Mars Veterinary Services), IDEXX Laboratories (Diagnostics and Practice Management), Rover (Mobile-Based Pet Services Platform), Wagmo (Pet Insurance and Services), Emirates Veterinary Clinic, Dubai Veterinary Hospital, Riyadh Veterinary Center, Doha Pet Hospital, Kuwait Veterinary Services, Muscat Animal Care Clinic contribute to innovation, geographic expansion, and service delivery in this space.

The GCC veterinary services market is poised for continued growth, driven by increasing pet ownership and heightened awareness of animal health. Innovations in veterinary care, such as telemedicine and mobile services, are expected to enhance accessibility and convenience for pet owners. Additionally, the integration of technology in diagnostics and treatment will likely improve service quality. As the market evolves, a focus on preventive care and holistic approaches will further shape the future landscape of veterinary services in the region.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Medicine and Pharmaceuticals Surgical Services Diagnostic Tests and Imaging Preventive Care and Vaccination Non-Medical Services (Boarding, Grooming, Training) |

| By Animal Type | Companion Animals (Dogs, Cats, Birds) Farm Animals (Cattle, Sheep, Goats, Poultry) Exotic Animals Equine |

| By Geography | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Sector | Private Veterinary Hospitals and Clinics Government Veterinary Services Non-Profit Animal Welfare Organizations |

| By Treatment Type | Medical Treatment Surgical Treatment Rehabilitation and Specialized Care Emergency and Critical Care |

| By Customer Type | Individual Pet Owners Livestock Farmers and Agricultural Enterprises Animal Shelters and Rescue Centers Government Agencies |

| By Technology Used | Traditional Diagnostic Methods Advanced Imaging (CT, MRI, Ultrasound) Telemedicine and Digital Consultation Practice Management Software and AI-Assisted Diagnostics |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 100 | Veterinarians, Clinic Managers |

| Pet Owners | 150 | Pet Owners, Animal Care Enthusiasts |

| Animal Health Product Distributors | 75 | Sales Managers, Product Managers |

| Regulatory Bodies | 40 | Policy Makers, Veterinary Council Members |

| Animal Welfare Organizations | 50 | Directors, Program Coordinators |

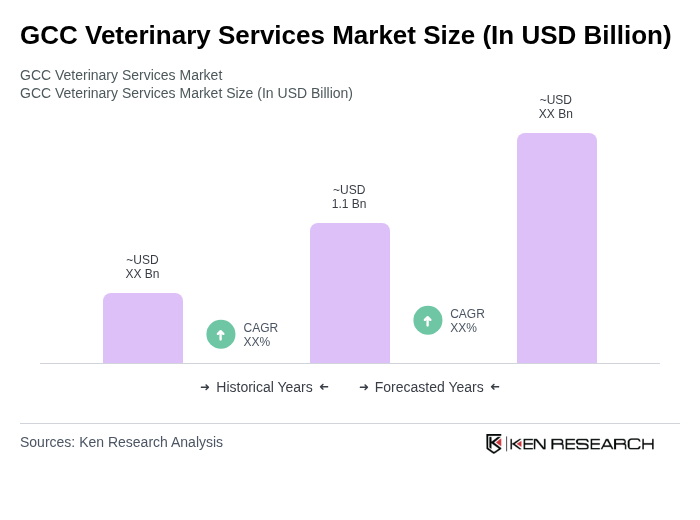

The GCC Veterinary Services Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by factors such as increasing pet ownership, urbanization, and the expansion of livestock farming across the region.