Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4052

Pages:87

Published On:December 2025

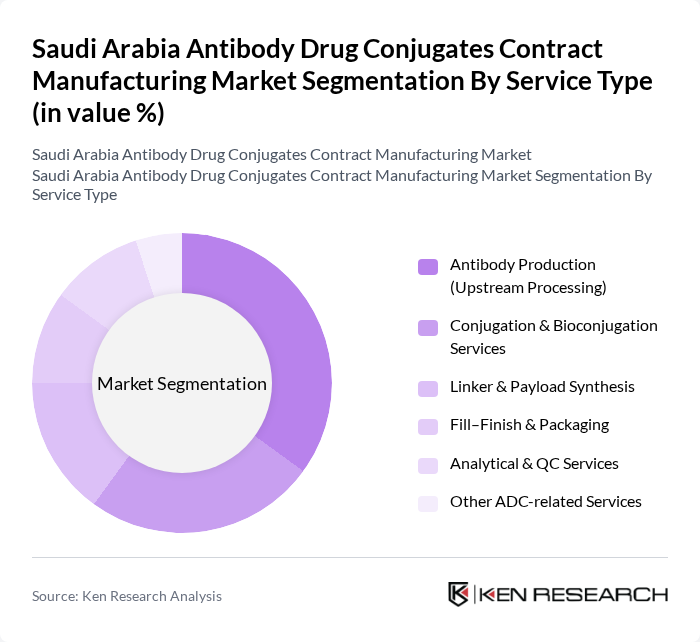

By Service Type:The service type segmentation includes various specialized services essential for the production of antibody drug conjugates. The subsegments are Antibody Production (Upstream Processing), Conjugation & Bioconjugation Services, Linker & Payload Synthesis, Fill–Finish & Packaging, Analytical & QC Services, and Other ADC-related Services. Among these, Antibody Production is currently the leading subsegment due to the increasing demand for high-quality antibodies in therapeutic applications. The focus on precision medicine and the growing number of clinical trials are driving the need for robust upstream processing capabilities.

By Stage:The stage segmentation encompasses Preclinical & Early Development Manufacturing, Clinical Trial Manufacturing, and Commercial-Scale Manufacturing. The Clinical Trial Manufacturing subsegment is currently leading the market, driven by the increasing number of clinical trials for new antibody drug conjugates. The demand for specialized manufacturing capabilities that can adapt to varying scales and regulatory requirements is also contributing to the growth of this segment.

The Saudi Arabia Antibody Drug Conjugates Contract Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Bio Industries (SBI), Saudi Biotech Manufacturing Company, Sudair Pharma Company, Lifera (formerly Saudi Biologics Company under PIF), SPIMACO Addwaeih (Saudi Pharmaceutical Industries and Medical Appliances Corporation), Tabuk Pharmaceuticals Manufacturing Company, Jamjoom Pharma, Riyadh Pharma (Riyadh Pharma Medical and Cosmetic Products Co.), Global CDMO: Lonza Group AG, Global CDMO: Samsung Biologics, Global CDMO: Catalent, Inc., Global CDMO: WuXi Biologics, Global CDMO: FuYu Biologics / ADC-focused CDMO, Regional Biologics / ADC Partnering Firms in GCC, Selected Academic & Research Partners (e.g., King Faisal Specialist Hospital & Research Centre, King Abdullah International Medical Research Center) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia antibody-drug conjugates contract manufacturing market appears promising, driven by ongoing advancements in biotechnology and increasing healthcare investments. As the government continues to support pharmaceutical manufacturing, local companies are likely to enhance their capabilities. Additionally, the growing focus on personalized medicine will further stimulate demand for ADCs, encouraging manufacturers to innovate and expand their product offerings to meet evolving market needs.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Antibody Production (Upstream Processing) Conjugation & Bioconjugation Services Linker & Payload Synthesis Fill–Finish & Packaging Analytical & QC Services Other ADC-related Services |

| By Stage | Preclinical & Early Development Manufacturing Clinical Trial Manufacturing Commercial-Scale Manufacturing |

| By Therapeutic Area | Oncology Hematology Autoimmune & Inflammatory Diseases Other Therapeutic Areas |

| By Customer Type | Global Pharma & Biopharma Companies Regional / Local Pharma Companies Biotechnology & Start-up Firms Academic & Research Institutions |

| By Ownership | Government / State-Owned Facilities Private Domestic CDMOs Multinational CDMOs Operating in Saudi Arabia |

| By Scale of Operation | Pilot-Scale Facilities Small & Medium-Scale Facilities Large-Scale / Commercial Facilities |

| By Region | Riyadh & Central Region Eastern Province (including Dammam, Jubail) Western Region (Jeddah, Makkah, Madinah) Southern & Northern Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturing Insights | 120 | Production Managers, Quality Assurance Leads |

| Contract Manufacturing Organizations | 90 | Business Development Managers, Operations Directors |

| Regulatory Compliance and Quality Control | 60 | Regulatory Affairs Specialists, Compliance Officers |

| Market Access and Pricing Strategies | 50 | Market Access Managers, Pricing Analysts |

| Clinical Development and Research | 80 | Clinical Research Coordinators, Medical Affairs Managers |

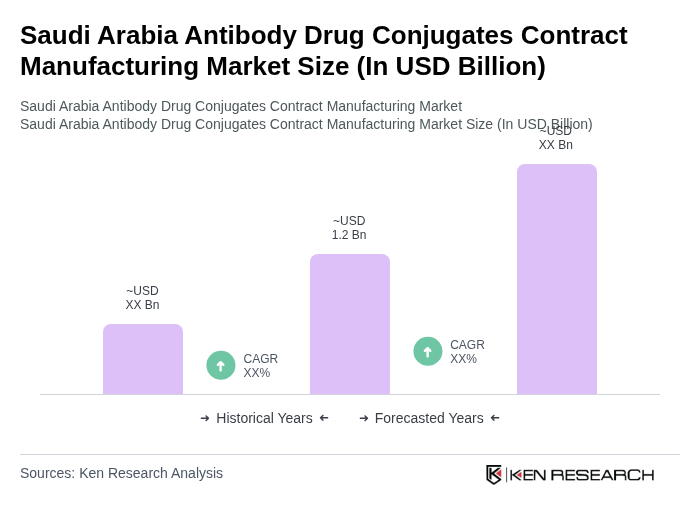

The Saudi Arabia Antibody Drug Conjugates Contract Manufacturing Market is valued at well below USD 1.2 billion, driven by the increasing prevalence of cancer and autoimmune diseases, along with advancements in biopharmaceutical technologies and a focus on personalized medicine.