Region:Middle East

Author(s):Shubham

Product Code:KRAA8873

Pages:88

Published On:November 2025

Training Dataset Healthcare Market.png)

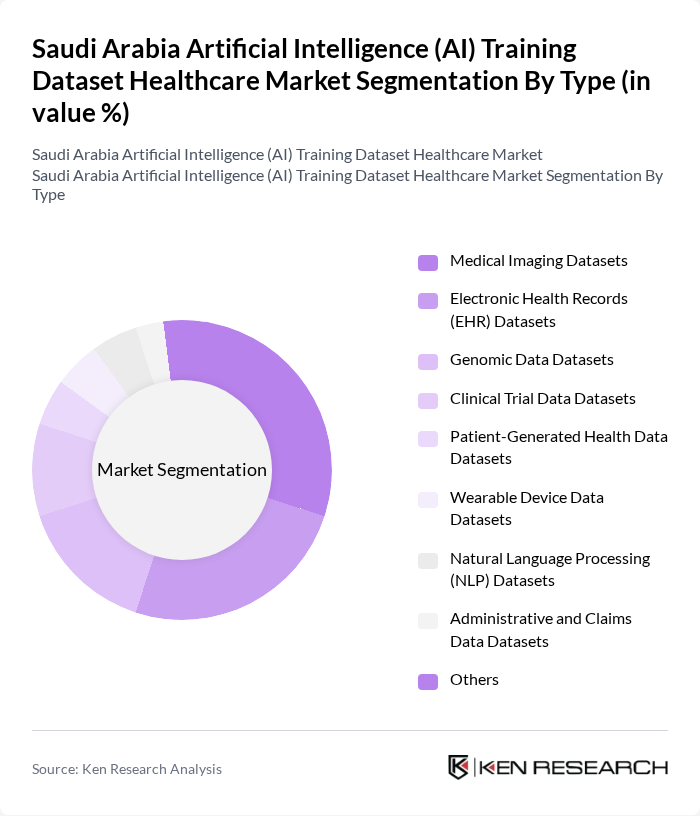

By Type:The market is segmented into various types of datasets that are crucial for training AI models in healthcare. The subsegments include Medical Imaging Datasets, Electronic Health Records (EHR) Datasets, Genomic Data Datasets, Clinical Trial Data Datasets, Patient-Generated Health Data Datasets, Wearable Device Data Datasets, Natural Language Processing (NLP) Datasets, Administrative and Claims Data Datasets, and Others. Among these, Medical Imaging Datasets are leading the market due to the increasing use of AI in diagnostic imaging, which enhances accuracy and efficiency in disease detection. The growing adoption of AI-powered radiology and pathology tools is driving demand for high-quality annotated imaging datasets, while EHR and genomic datasets are increasingly leveraged for predictive analytics and personalized medicine .

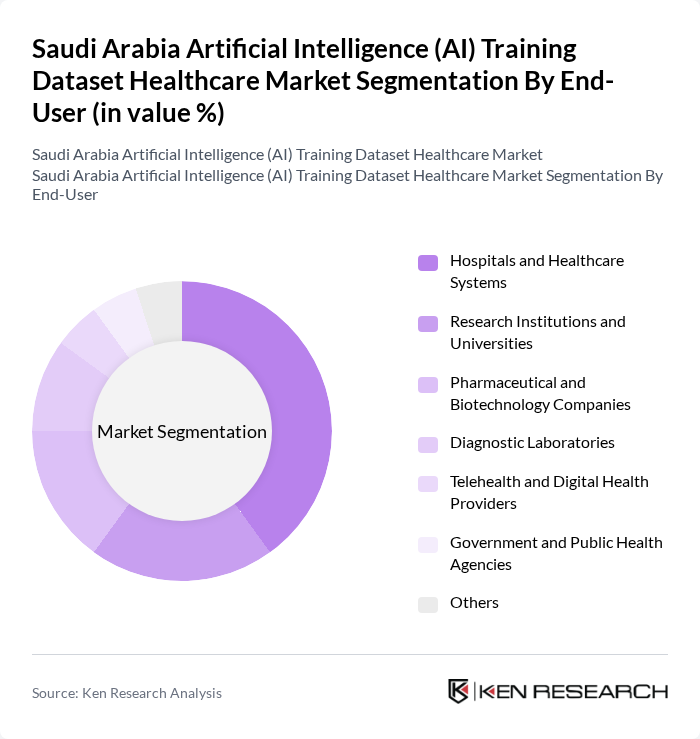

By End-User:The end-user segmentation includes Hospitals and Healthcare Systems, Research Institutions and Universities, Pharmaceutical and Biotechnology Companies, Diagnostic Laboratories, Telehealth and Digital Health Providers, Government and Public Health Agencies, and Others. Hospitals and Healthcare Systems dominate this segment as they are the primary users of AI training datasets for improving patient care, operational efficiency, and clinical decision-making. Research institutions and universities are also significant contributors, leveraging datasets for AI model development and validation, while pharmaceutical and biotechnology companies increasingly utilize clinical and genomic datasets for drug discovery and personalized therapeutics .

The Saudi Arabia Artificial Intelligence (AI) Training Dataset Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Watson Health, Siemens Healthineers, Philips Healthcare, GE Healthcare, Cerner Corporation (Oracle Health), Optum, Medtronic, NVIDIA Corporation, Microsoft Azure Health, Google Health, Amazon Web Services (AWS) Health, SAS Institute, Health Catalyst, Lean Business Services (Saudi Arabia), King Faisal Specialist Hospital & Research Centre (Saudi Arabia), Seha Virtual Hospital (Saudi Ministry of Health), Synyi AI, Tawuniya (Company for Cooperative Insurance, Saudi Arabia), Vezeeta, Babylon Health contribute to innovation, geographic expansion, and service delivery in this space. These organizations are actively engaged in partnerships with Saudi healthcare providers, supporting the deployment of AI-powered diagnostic, administrative, and patient management solutions across the Kingdom .

The future of the AI training dataset market in Saudi Arabia's healthcare sector appears promising, driven by ongoing government support and technological advancements. As healthcare providers increasingly adopt AI solutions, the demand for high-quality training datasets will rise. Furthermore, the integration of AI into clinical workflows is expected to enhance patient care and operational efficiency. The focus on ethical AI practices will also shape the market, ensuring that innovations align with regulatory standards and public trust.

| Segment | Sub-Segments |

|---|---|

| By Type | Medical Imaging Datasets Electronic Health Records (EHR) Datasets Genomic Data Datasets Clinical Trial Data Datasets Patient-Generated Health Data Datasets Wearable Device Data Datasets Natural Language Processing (NLP) Datasets Administrative and Claims Data Datasets Others |

| By End-User | Hospitals and Healthcare Systems Research Institutions and Universities Pharmaceutical and Biotechnology Companies Diagnostic Laboratories Telehealth and Digital Health Providers Government and Public Health Agencies Others |

| By Region | Central Region (including Riyadh) Eastern Region (including Dammam, Khobar) Western Region (including Jeddah, Makkah, Madinah) Southern Region |

| By Application | Disease Diagnosis and Risk Prediction Treatment Recommendations and Decision Support Patient Monitoring and Remote Care Drug Discovery and Development Population Health Management Others |

| By Data Source | Publicly Available Datasets Proprietary Datasets Collaborative and Consortium Datasets Synthetic Data Others |

| By Data Format | Structured Data Unstructured Data Semi-Structured Data Others |

| By Policy Support | Government Grants Tax Incentives Research Funding Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare AI Implementation | 100 | Healthcare IT Managers, Data Analysts |

| AI Training Dataset Usage | 80 | Clinical Researchers, AI Developers |

| Regulatory Compliance in AI | 60 | Compliance Officers, Legal Advisors |

| AI in Medical Imaging | 70 | Radiologists, Imaging Technologists |

| Patient Data Management | 90 | Healthcare Administrators, Data Privacy Officers |

The Saudi Arabia Artificial Intelligence (AI) Training Dataset Healthcare Market is valued at approximately USD 210 million, reflecting significant growth driven by the increasing adoption of AI technologies and the government's focus on digital transformation in healthcare.