Region:Global

Author(s):Dev

Product Code:KRAC8820

Pages:95

Published On:November 2025

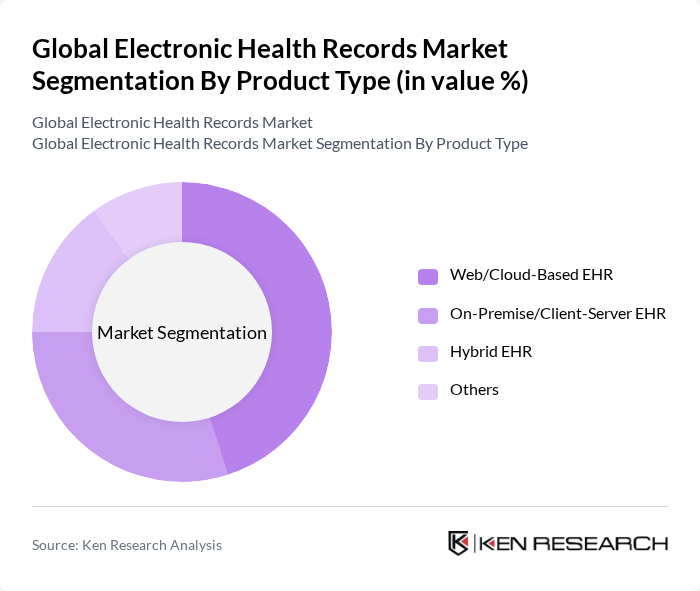

By Product Type:The product type segmentation includes Web/Cloud-Based EHR, On-Premise/Client-Server EHR, Hybrid EHR, and Others. Among these, Web/Cloud-Based EHR is the leading subsegment due to its flexibility, scalability, cost-effectiveness, and ease of remote access, making it a preferred choice for healthcare providers seeking to streamline operations, enhance patient care, and support telehealth initiatives .

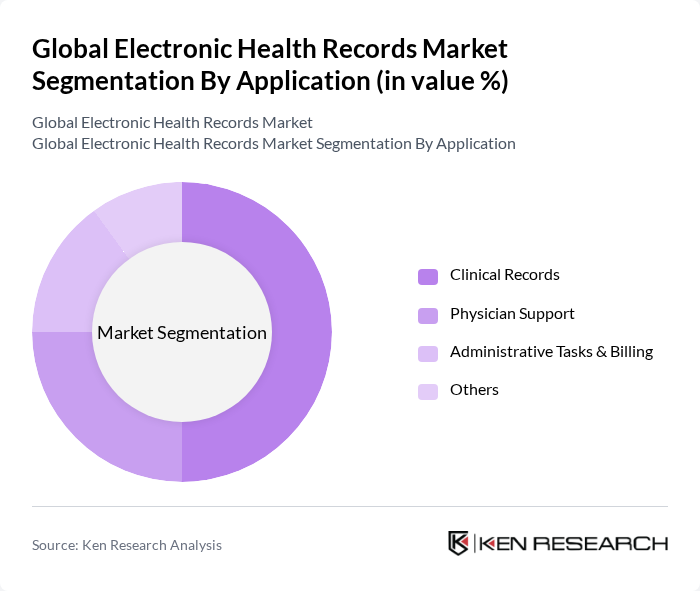

By Application:The application segmentation encompasses Clinical Records, Physician Support, Administrative Tasks & Billing, and Others. Clinical Records remains the dominant subsegment, driven by the increasing need for accurate patient data management, regulatory requirements for documentation, and the growing emphasis on quality care and patient safety in healthcare settings. The trend toward value-based care and population health management further elevates the importance of comprehensive clinical records .

The Global Electronic Health Records Market is characterized by a dynamic mix of regional and international players. Leading participants such as Epic Systems Corporation, Oracle Health (formerly Cerner Corporation), Allscripts Healthcare Solutions (now Veradigm Inc.), MEDITECH (Medical Information Technology, Inc.), athenahealth, Inc., NextGen Healthcare, Inc., eClinicalWorks, LLC, GE HealthCare Technologies Inc., McKesson Corporation, Siemens Healthineers AG, Philips Healthcare (Royal Philips NV), Oracle Health Sciences, IBM Watson Health (now Merative), Infor, Inc., Greenway Health, LLC contribute to innovation, geographic expansion, and service delivery in this space.

As the healthcare landscape evolves, the electronic health records market is poised for significant transformation. The increasing emphasis on value-based care will drive healthcare providers to adopt EHR systems that enhance patient outcomes. Additionally, the rise of telehealth services will necessitate more integrated EHR solutions, fostering collaboration among healthcare providers. Advancements in data analytics and patient engagement tools will further shape the market in future, creating a more patient-centric approach to healthcare delivery.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Web/Cloud-Based EHR On-Premise/Client-Server EHR Hybrid EHR Others |

| By Application | Clinical Records Physician Support Administrative Tasks & Billing Others |

| By Therapeutic Area | Cardiological Disorders Oncological Disorders Inflammatory Disorders Metabolic Disorders Neurological Disorders Respiratory Disorders Others |

| By End-User | Hospitals Ambulatory Care Centers Specialty Clinics Others |

| By Business Model | Licensed Software EHR Technology Resale Subscriptions Professional Services Others |

| By Functionality | Clinical Documentation & Charting Patient Demographics & Registration Medication Management Laboratory & Diagnostic Integration Radiology Information System Integration Clinical Decision Support Computerized Provider Order Entry (CPOE) Electronic Prescribing Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital EHR Implementation | 100 | IT Directors, Chief Information Officers |

| Ambulatory Care EHR Usage | 80 | Practice Managers, Physicians |

| Long-term Care Facility EHR Adoption | 60 | Facility Administrators, Nursing Directors |

| Telehealth Integration with EHR | 50 | Telehealth Coordinators, IT Specialists |

| Patient Engagement Tools in EHR | 40 | Patient Experience Officers, Health IT Analysts |

The Global Electronic Health Records Market is valued at approximately USD 30 billion, driven by the increasing adoption of digital health solutions and the demand for efficient healthcare management systems.