Region:Middle East

Author(s):Shubham

Product Code:KRAD5418

Pages:99

Published On:December 2025

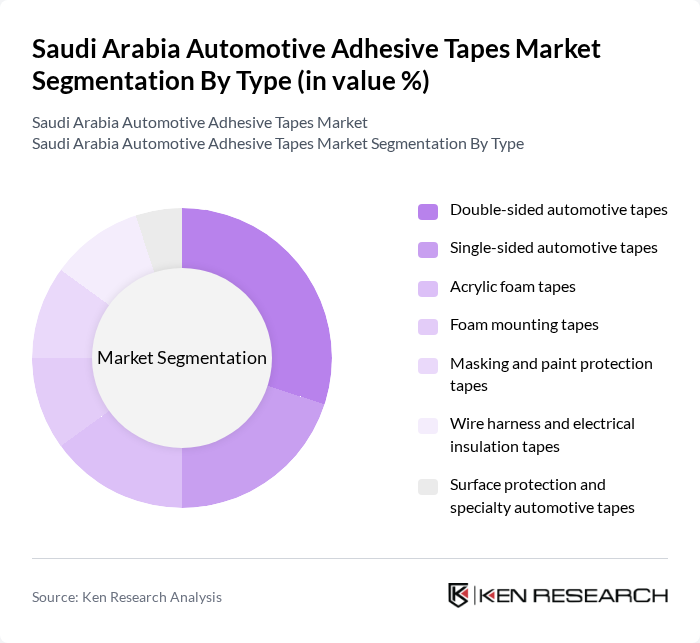

By Type:The market is segmented into various types of automotive adhesive tapes, including double-sided automotive tapes, single-sided automotive tapes, acrylic foam tapes, foam mounting tapes, masking and paint protection tapes, wire harness and electrical insulation tapes, and surface protection and specialty automotive tapes. This segmentation is consistent with global automotive adhesive tape classifications, where key families include double-sided bonding tapes, acrylic foam attachment tapes, foam mounting tapes, masking tapes, and wire harnessing/electrical tapes for interior, exterior, and under-the-hood applications. Among these, double-sided automotive tapes are leading the market due to their versatility in replacing rivets and screws, their strong bonding capabilities on metals, plastics, and composites, and their essential role in trim attachment, emblem mounting, interior panels, and EV battery module assembly.

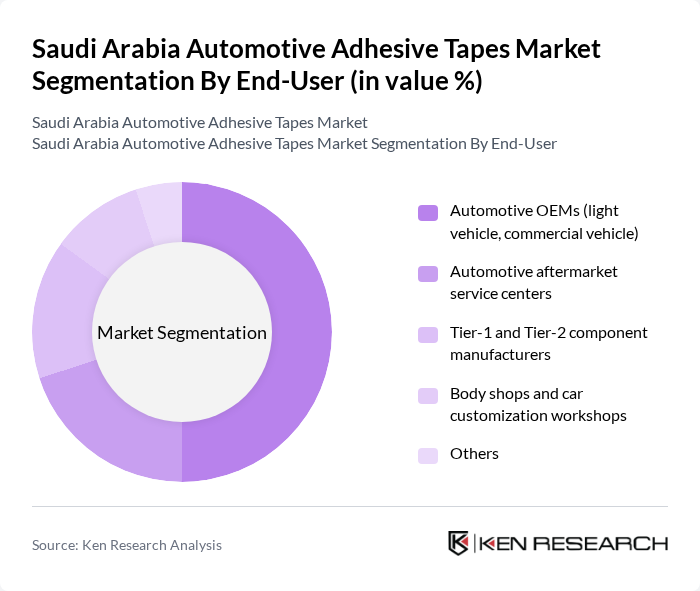

By End-User:The end-user segmentation includes automotive OEMs (light vehicle and commercial vehicle), automotive aftermarket service centers, Tier-1 and Tier-2 component manufacturers, body shops and car customization workshops, and others. This structure aligns with the way adhesive tape demand is split globally between OEM assembly, Tier suppliers, and aftermarket/repair applications. The automotive OEMs segment is the largest due to the increasing localization of vehicle assembly in Saudi Arabia, government-backed investments in new plants and EV manufacturing, and the growing need for high-performance adhesive solutions in body-in-white, interior trim, exterior attachment, battery systems, and safety-related applications.

The Saudi Arabia Automotive Adhesive Tapes Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Henkel AG & Co. KGaA, Avery Dennison Corporation, tesa SE, Nitto Denko Corporation, Sika AG, Saint-Gobain S.A., Lohmann GmbH & Co. KG, Bostik SA (an Arkema company), Shurtape Technologies, LLC, Intertape Polymer Group Inc., Scapa Group Ltd (a SWM International company), ORAFOL Europe GmbH, Lintec Corporation, NAR Industrial Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space, particularly through the development of high-performance acrylic foam tapes, double-sided bonding tapes, and specialty products tailored for automotive and electric vehicle applications in demanding climatic conditions.

The future of the automotive adhesive tapes market in Saudi Arabia appears promising, driven by the expansion of electric vehicle production and increasing investments in automotive research and development. As the market adapts to evolving consumer preferences and regulatory landscapes, manufacturers are likely to focus on developing innovative, eco-friendly adhesive solutions. Additionally, the growth of e-commerce and logistics sectors will further enhance the demand for adhesive tapes, creating new avenues for market expansion and technological advancements.

| Segment | Sub-Segments |

|---|---|

| By Type | Double-sided automotive tapes Single-sided automotive tapes Acrylic foam tapes Foam mounting tapes Masking and paint protection tapes Wire harness and electrical insulation tapes Surface protection and specialty automotive tapes |

| By End-User | Automotive OEMs (light vehicle, commercial vehicle) Automotive aftermarket service centers Tier-1 and Tier-2 component manufacturers Body shops and car customization workshops Others |

| By Application | Interior trim and component mounting Exterior trim, emblems, and body attachments Wire harnessing and electrical insulation NVH, sealing, and structural bonding Battery, EV, and thermal management applications |

| By Adhesive Type | Acrylic pressure-sensitive adhesives Rubber-based pressure-sensitive adhesives Silicone-based pressure-sensitive adhesives High-temperature and specialty adhesive systems |

| By Thickness | Thin-gauge automotive tapes (< 0.2 mm) Medium-gauge automotive tapes (0.2–0.8 mm) Thick-gauge and foam tapes (> 0.8 mm) Others |

| By Region | Central Region (Riyadh and surrounding) Eastern Region (Dammam, Jubail, Khobar) Western Region (Jeddah, Makkah, Madinah) Southern and Northern Regions |

| By Distribution Channel | Direct sales to OEMs and Tier suppliers Industrial distributors and traders Online B2B platforms Retail hardware and auto parts stores Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 100 | Production Managers, Quality Assurance Engineers |

| Adhesive Tape Suppliers | 80 | Sales Directors, Product Development Managers |

| Automotive Aftermarket | 70 | Retail Managers, Procurement Specialists |

| Research & Development Departments | 60 | R&D Engineers, Material Scientists |

| Industry Experts and Consultants | 50 | Market Analysts, Industry Advisors |

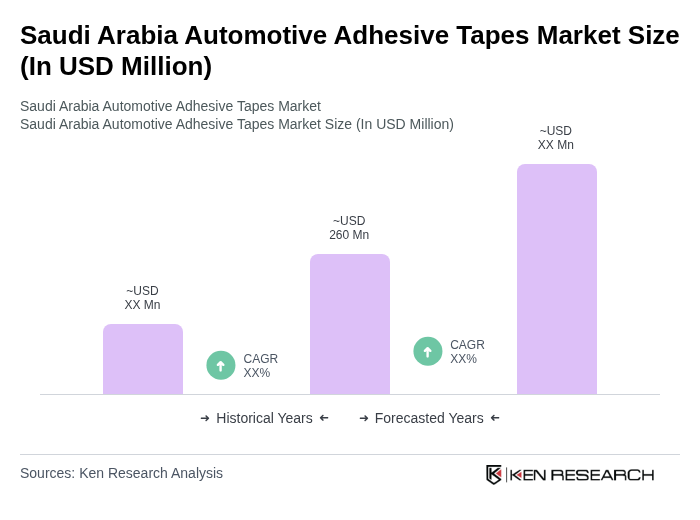

The Saudi Arabia Automotive Adhesive Tapes Market is valued at approximately USD 260 million, reflecting a significant segment of the broader adhesive tape and specialty tapes markets, which are valued at around USD 656 million and USD 660 million, respectively.