Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7002

Pages:91

Published On:October 2025

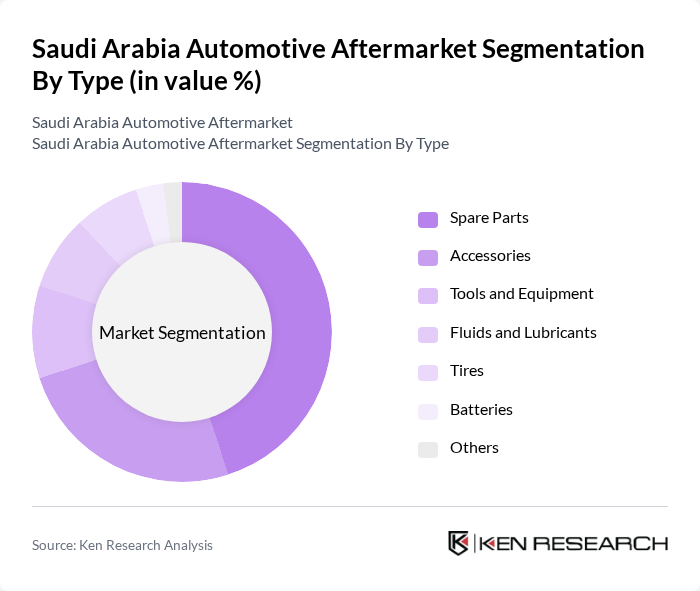

By Type:The automotive aftermarket in Saudi Arabia can be segmented into various types, including Spare Parts, Accessories, Tools and Equipment, Fluids and Lubricants, Tires, Batteries, and Others. Among these, Spare Parts dominate the market due to the high demand for vehicle maintenance and repair. Consumers are increasingly opting for quality spare parts to ensure the longevity and performance of their vehicles. Accessories also see significant demand as vehicle owners look to personalize their cars, while Tools and Equipment are essential for automotive workshops and DIY enthusiasts.

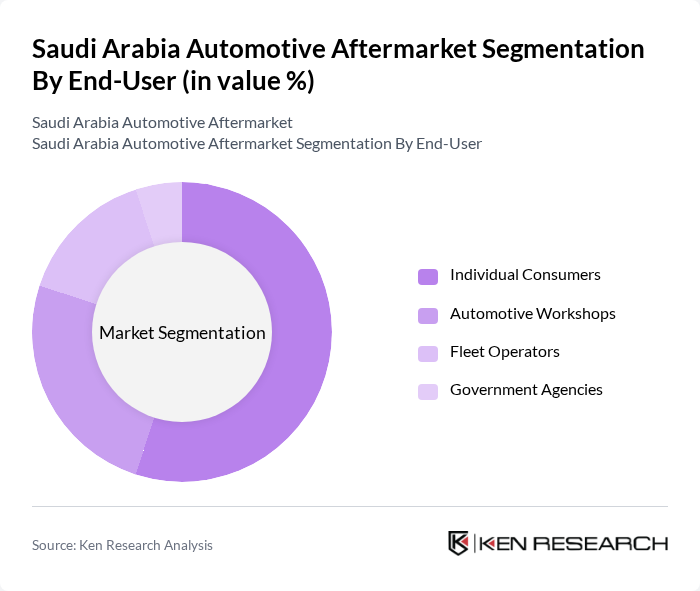

By End-User:The end-user segmentation of the automotive aftermarket includes Individual Consumers, Automotive Workshops, Fleet Operators, and Government Agencies. Individual Consumers represent the largest segment, driven by the increasing number of vehicle owners who seek to maintain and enhance their vehicles. Automotive Workshops also play a crucial role, as they require a steady supply of parts and tools to service their clients. Fleet Operators and Government Agencies contribute to the market by maintaining their vehicle fleets, ensuring that they are equipped with the necessary parts and services.

The Saudi Arabia Automotive Aftermarket market is characterized by a dynamic mix of regional and international players. Leading participants such as Abdul Latif Jameel Co., Al-Futtaim Group, Al-Jomaih Automotive, Al-Muhaidib Group, Al-Tamimi Group, Al-Watania Group, Gulf Auto, National Automotive, United Motors, Zahran Group, Al-Mansour Automotive, Al-Muhaidib Automotive, Al-Suwaidi Group, Al-Hokair Group, Al-Faisaliah Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian automotive aftermarket appears promising, driven by technological advancements and changing consumer behaviors. The increasing integration of smart technologies in vehicles is expected to create new service demands, while the shift towards e-commerce will enhance accessibility for consumers. Additionally, sustainability initiatives will likely shape product offerings, as consumers become more environmentally conscious. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Spare Parts Accessories Tools and Equipment Fluids and Lubricants Tires Batteries Others |

| By End-User | Individual Consumers Automotive Workshops Fleet Operators Government Agencies |

| By Sales Channel | Online Retail Offline Retail Direct Sales Distributors |

| By Distribution Mode | Direct Distribution Indirect Distribution E-Commerce Platforms |

| By Price Range | Budget Mid-Range Premium |

| By Brand | OEM Brands Aftermarket Brands Private Labels |

| By Product Lifecycle | New Products Refurbished Products End-of-Life Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Parts Retailers | 150 | Store Managers, Sales Executives |

| Service and Repair Shops | 100 | Workshop Owners, Service Managers |

| Automotive Accessory Suppliers | 80 | Product Managers, Marketing Directors |

| End Consumers of Automotive Services | 200 | Car Owners, Fleet Managers |

| Automotive Industry Experts | 50 | Consultants, Analysts |

The Saudi Arabia automotive aftermarket is valued at approximately USD 5 billion, driven by increasing vehicle ownership, rising disposable incomes, and a growing trend towards vehicle customization and maintenance.