Region:Middle East

Author(s):Rebecca

Product Code:KRAB8752

Pages:91

Published On:October 2025

Market.png)

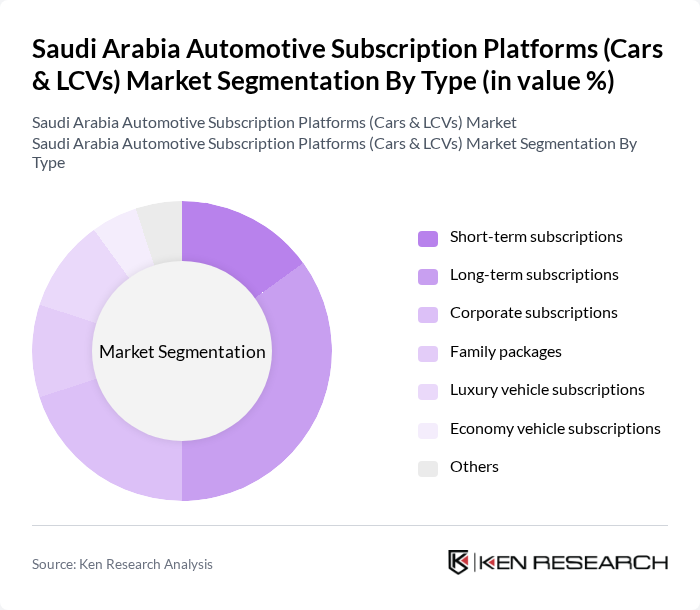

By Type:The market is segmented into various types of subscriptions, including short-term subscriptions, long-term subscriptions, corporate subscriptions, family packages, luxury vehicle subscriptions, economy vehicle subscriptions, and others. Among these, long-term subscriptions are gaining traction due to their cost-effectiveness and convenience for consumers who prefer extended vehicle usage without the commitment of ownership.

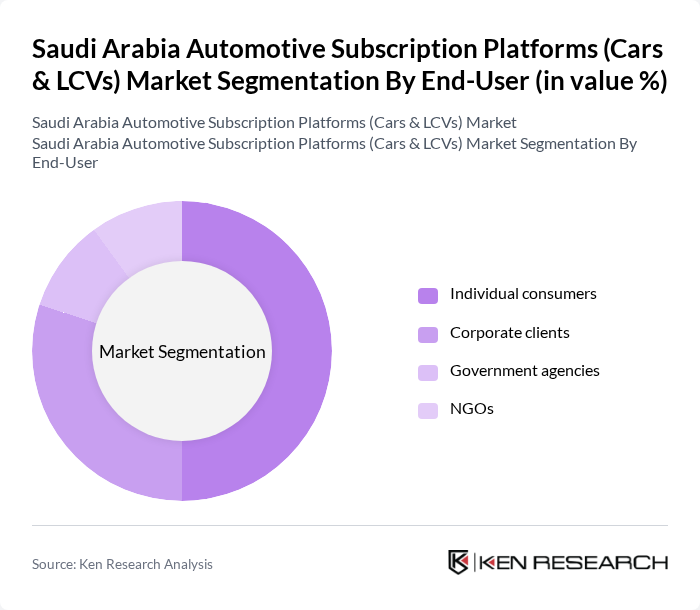

By End-User:The end-user segmentation includes individual consumers, corporate clients, government agencies, and NGOs. Individual consumers are the dominant segment, driven by the increasing preference for flexible mobility solutions and the convenience of subscription services that cater to personal transportation needs without the burdens of ownership.

The Saudi Arabia Automotive Subscription Platforms (Cars & LCVs) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Careem, Udrive, Thrifty Car Rental, Sixt Rent a Car, Enterprise Rent-A-Car, Al-Futtaim Automotive, Al-Muhaidib Group, Budget Rent a Car, Hertz, Al-Jazira Vehicles, Saudi Automotive Services Company (SASCO), Al-Mansour Automotive, Al-Faisaliah Group, Abdul Latif Jameel Motors, Al-Muhaidib Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of automotive subscription platforms in Saudi Arabia appears promising, driven by urbanization and evolving consumer preferences. In the future, the market is expected to see increased integration of technology, enhancing user experience and operational efficiency. Additionally, the rise of electric vehicles will likely influence subscription offerings, as consumers become more environmentally conscious. As the government continues to support innovative mobility solutions, the landscape for automotive subscriptions will evolve, presenting new opportunities for growth and collaboration.

| Segment | Sub-Segments |

|---|---|

| By Type | Short-term subscriptions Long-term subscriptions Corporate subscriptions Family packages Luxury vehicle subscriptions Economy vehicle subscriptions Others |

| By End-User | Individual consumers Corporate clients Government agencies NGOs |

| By Vehicle Category | Cars Light Commercial Vehicles (LCVs) |

| By Subscription Model | All-inclusive packages Pay-per-use models Mileage-based subscriptions |

| By Payment Structure | Monthly subscriptions Annual subscriptions One-time fees |

| By Distribution Channel | Online platforms Mobile applications Physical dealerships |

| By Customer Demographics | Age groups Income levels Urban vs rural consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Subscription Users | 150 | Current Subscribers, Potential Subscribers |

| Automotive Dealerships | 100 | Sales Managers, Business Development Executives |

| Fleet Management Companies | 80 | Fleet Managers, Operations Directors |

| Automotive Industry Experts | 50 | Market Analysts, Industry Consultants |

| Consumer Behavior Analysts | 70 | Research Analysts, Marketing Strategists |

The Saudi Arabia Automotive Subscription Platforms market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by urbanization, increased disposable income, and a shift towards flexible vehicle ownership options.