Region:Middle East

Author(s):Shubham

Product Code:KRAD4737

Pages:90

Published On:December 2025

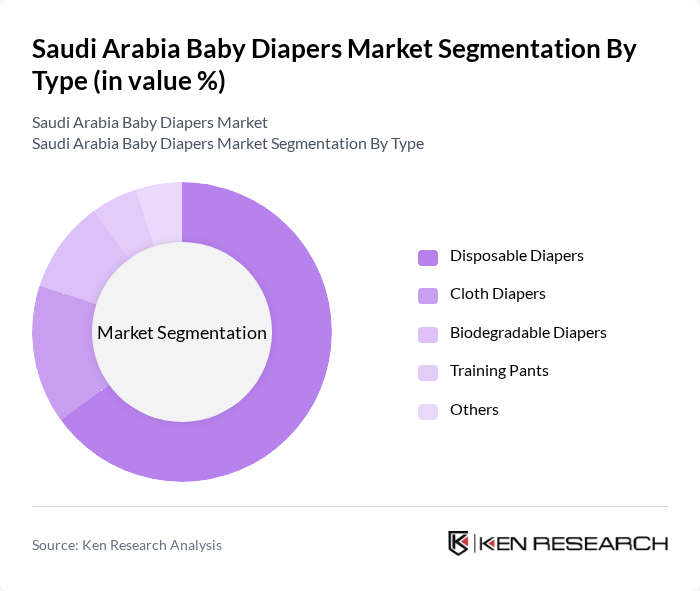

By Type:The market is segmented into various types of diapers, including Disposable Diapers, Cloth Diapers, Biodegradable Diapers, Training Pants, and Others. Among these, Disposable Diapers dominate the market due to their convenience and ease of use, making them the preferred choice for many parents. The trend towards eco-friendly products has also led to a gradual increase in the demand for Biodegradable Diapers.

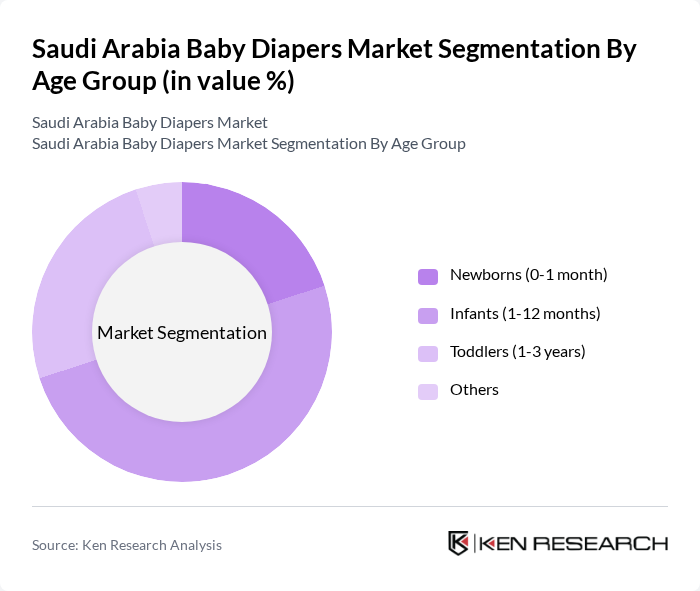

By Age Group:The market is categorized based on age groups, including Newborns (0-1 month), Infants (1-12 months), Toddlers (1-3 years), and Others. The Infants segment holds the largest share, driven by the high number of infants in the population and the continuous need for diapers during this growth phase. Parents are increasingly investing in high-quality diapers for their infants to ensure comfort and skin health.

The Saudi Arabia Baby Diapers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble, Kimberly-Clark, Unicharm, Nestlé, Johnson & Johnson, Al-Hokair Group, Al-Muhaidib Group, Al-Faisaliah Group, Al-Nahdi Medical Company, Al-Jazeera Group, Al-Mansour Group, Al-Othaim Group, Al-Sadhan Group, Al-Rajhi Group, Al-Futtaim Group contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia baby diapers market is poised for significant evolution, driven by demographic shifts and changing consumer preferences. As birth rates rise and disposable incomes increase, the demand for high-quality and eco-friendly products is expected to grow. Innovations in product design, such as biodegradable materials and customizable options, will likely attract environmentally conscious consumers. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products, enhancing market dynamics and competition.

| Segment | Sub-Segments |

|---|---|

| By Type | Disposable Diapers Cloth Diapers Biodegradable Diapers Training Pants Others |

| By Age Group | Newborns (0-1 month) Infants (1-12 months) Toddlers (1-3 years) Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Pharmacies Convenience Stores Others |

| By Material Type | Cotton Synthetic Materials Biodegradable Materials Others |

| By Brand Type | National Brands Private Labels Premium Brands Others |

| By Pricing Strategy | Economy Mid-Range Premium Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Parents with Infants | 150 | Parents aged 25-40, Middle to Upper Class |

| Retail Store Managers | 120 | Managers from baby product retail chains |

| Pediatric Healthcare Professionals | 80 | Pediatricians, Nurses, Childcare Specialists |

| Diaper Manufacturers | 60 | Product Managers, Marketing Executives |

| Consumer Behavior Analysts | 50 | Market Researchers, Data Analysts |

The Saudi Arabia Baby Diapers Market is valued at approximately USD 1.2 billion, driven by increasing birth rates, rising disposable incomes, and heightened hygiene awareness among parents. This growth reflects a significant demand for convenient and comfortable baby care products.