Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7168

Pages:90

Published On:December 2025

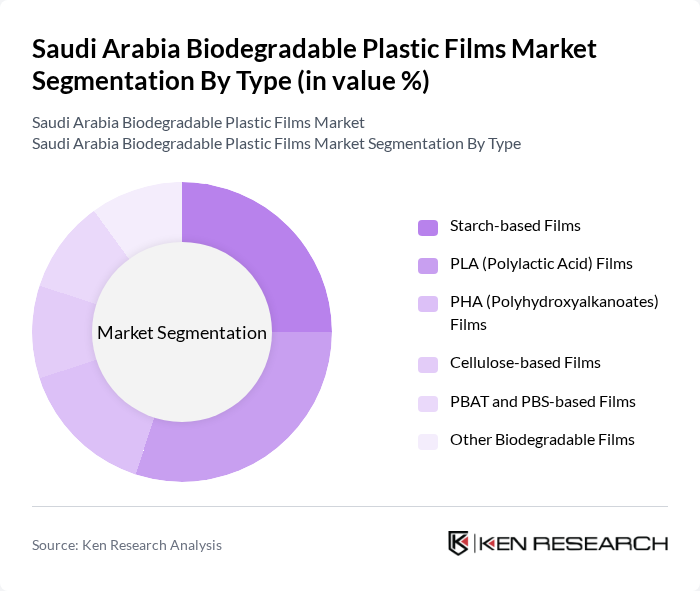

By Type:The biodegradable plastic films market can be segmented into various types, including starch-based films, PLA (Polylactic Acid) films, PHA (Polyhydroxyalkanoates) films, cellulose-based films, PBAT and PBS-based films, and other biodegradable films. Each type serves different applications and industries, with starch-based, PLA, and PBAT/PBS blends widely used in food packaging and bags, PHA gaining traction in specialty and high-performance compostable applications, and cellulose-based films used where clarity and barrier performance are required, collectively catering to the growing demand for sustainable packaging solutions in Saudi Arabia’s food, agriculture, and consumer goods sectors.

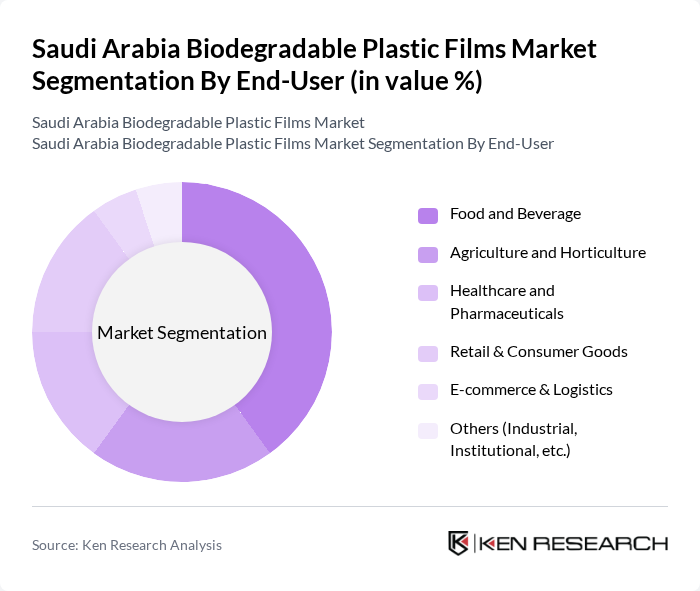

By End-User:The end-user segmentation of the biodegradable plastic films market includes food and beverage, agriculture and horticulture, healthcare and pharmaceuticals, retail & consumer goods, e-commerce & logistics, and others. The food and beverage segment increasingly uses compostable and biodegradable films for wraps, trays, and flexible packaging; agriculture and horticulture apply mulch films and crop protection films; healthcare and pharmaceuticals require controlled-disposal packaging formats; while retail, consumer goods, and e-commerce integrate biodegradable carrier bags, mailers, and protective films to align with sustainable packaging and national waste-reduction objectives.

The Saudi Arabia Biodegradable Plastic Films Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC (Saudi Basic Industries Corporation), Napco National, Takween Advanced Industries, Al Watania Plastic, Arabian Plastic Manufacturing Company (APM), Zamil Plastic Industries, Rowad International Geosynthetics Co. Ltd. (Rowad International), Green Planet for Plastic Recycling & Biopolymers, Saudi Top Plastic Factory (STP), Saudi Modern Packaging Company Ltd. (Printopack), Novamont S.p.A., BASF SE, NatureWorks LLC, TotalEnergies Corbion PLA, TIPA Corp. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the biodegradable plastic films market in Saudi Arabia appears promising, driven by a combination of regulatory support and shifting consumer preferences. As the government continues to enforce stricter regulations on plastic waste, the demand for biodegradable alternatives is expected to rise. Additionally, innovations in material science are likely to enhance the performance and reduce the costs of biodegradable films, making them more competitive against traditional plastics. This evolving landscape presents significant opportunities for growth and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Starch-based Films PLA (Polylactic Acid) Films PHA (Polyhydroxyalkanoates) Films Cellulose-based Films PBAT and PBS-based Films Other Biodegradable Films |

| By End-User | Food and Beverage Agriculture and Horticulture Healthcare and Pharmaceuticals Retail & Consumer Goods E-commerce & Logistics Others (Industrial, Institutional, etc.) |

| By Application | Flexible Packaging (Bags, Pouches & Wraps) Mulch and Agricultural Films Compostable Garbage & Shopping Bags Medical & Hygiene Films Other Specialty Applications |

| By Material Source | Bio-based (Renewable Resources) Fossil-based Biodegradable Polymers Blends and Composites |

| By Distribution Channel | Direct Sales (B2B) Distributors & Converters Online Channels Specialized Sustainability Retailers |

| By Region | Central Region (including Riyadh) Eastern Region (including Dammam, Al Khobar) Western Region (including Jeddah, Makkah, Madinah) Southern Region Northern Region |

| By Performance Attribute | Compostable and Home-compostable Films Industrially Compostable Films Biodegradable Films with Barrier Properties High-strength / High-clarity Films |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Applications | 100 | Farm Managers, Agricultural Product Distributors |

| Food Packaging Sector | 120 | Packaging Engineers, Food Product Managers |

| Consumer Goods Industry | 80 | Brand Managers, Product Development Specialists |

| Environmental Advocacy Groups | 60 | Sustainability Coordinators, Policy Analysts |

| Retail Sector Insights | 90 | Retail Managers, Supply Chain Analysts |

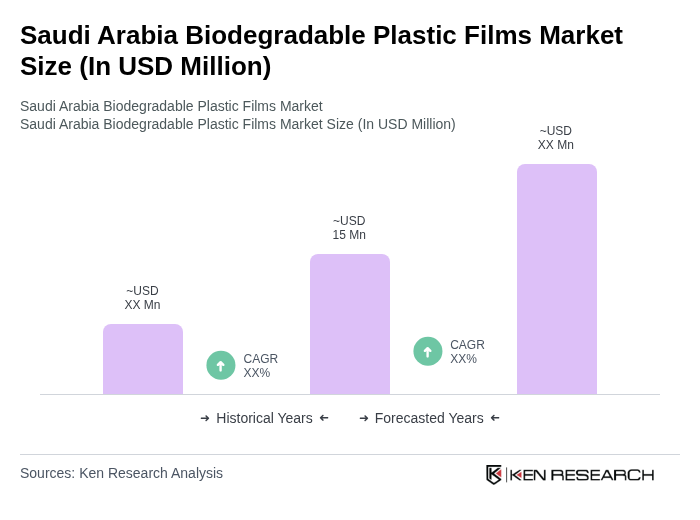

The Saudi Arabia Biodegradable Plastic Films Market is valued at approximately USD 15 million, reflecting a growing trend towards sustainable packaging solutions driven by environmental awareness and regulatory support.