Region:Middle East

Author(s):Shubham

Product Code:KRAC4956

Pages:93

Published On:October 2025

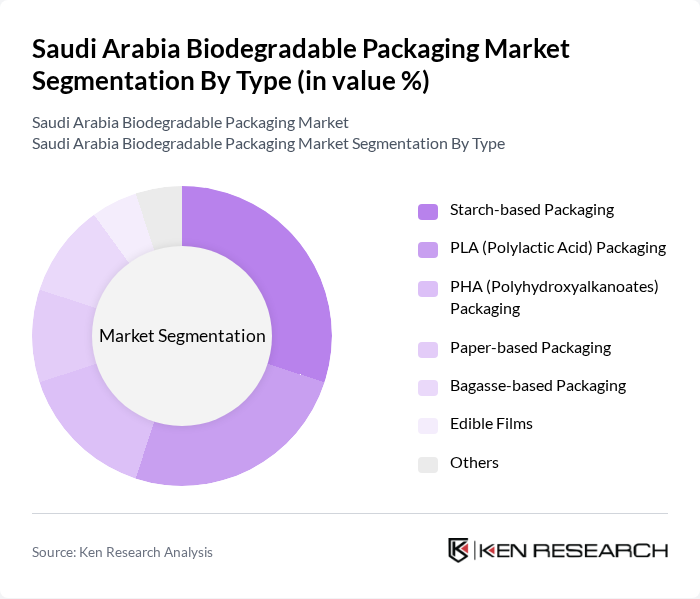

By Type:The biodegradable packaging market is segmented into various types, including starch-based packaging, PLA (Polylactic Acid) packaging, PHA (Polyhydroxyalkanoates) packaging, paper-based packaging, bagasse-based packaging, edible films, and others. Among these, starch-based packaging and PLA packaging are leading the market due to their widespread application in food packaging and consumer goods. The increasing consumer preference for sustainable and compostable materials is driving the growth of these segments .

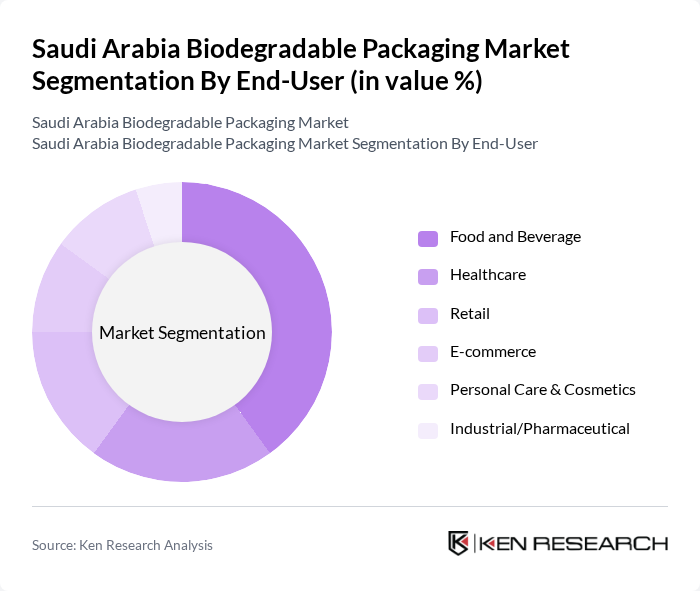

By End-User:The end-user segmentation includes food and beverage, healthcare, retail, e-commerce, personal care & cosmetics, and industrial/pharmaceutical sectors. The food and beverage sector is the largest consumer of biodegradable packaging, driven by the increasing demand for sustainable packaging solutions among consumers and regulatory pressures. The healthcare sector is also witnessing growth due to the rising need for eco-friendly medical packaging .

The Saudi Arabia Biodegradable Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Napco National, Takween Advanced Industries, Obeikan Paper Industries, Saudi Paper Manufacturing Co., Al Bayader International, Huhtamaki Oyj, Mondi Group, BioBag International AS, TIPA Corp., Novamont S.p.A., BASF SE, NatureWorks LLC, Eco-Products, Inc., Smurfit Kappa Group, DS Smith Plc, Amcor plc, Sealed Air Corporation, Green Dot Bioplastics, Biome Bioplastics, WestRock Company contribute to innovation, geographic expansion, and service delivery in this space .

The future of the biodegradable packaging market in Saudi Arabia appears promising, driven by a combination of regulatory support and shifting consumer preferences. As the government continues to enforce stricter regulations on plastic usage, manufacturers are likely to invest more in research and development of innovative biodegradable materials. Additionally, the increasing popularity of e-commerce is expected to further boost demand for sustainable packaging solutions, creating a robust market environment for biodegradable products in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Starch-based Packaging PLA (Polylactic Acid) Packaging PHA (Polyhydroxyalkanoates) Packaging Paper-based Packaging Bagasse-based Packaging Edible Films Others |

| By End-User | Food and Beverage Healthcare Retail E-commerce Personal Care & Cosmetics Industrial/Pharmaceutical |

| By Application | Food Packaging Cosmetic Packaging Industrial Packaging Pharmaceutical Packaging Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales (B2B) Others |

| By Material | Bioplastics Paper Composites Bagasse Others |

| By Region | Central Region Eastern Region Western Region Southern Region Northern Region |

| By Price Range | Low Price Mid Price Premium Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Packaging | 100 | Packaging Managers, Product Development Heads |

| Retail Sector Insights | 80 | Supply Chain Managers, Sustainability Coordinators |

| E-commerce Packaging Solutions | 60 | Logistics Directors, Operations Managers |

| Industrial Packaging Applications | 50 | Procurement Managers, Operations Supervisors |

| Consumer Awareness & Preferences | 90 | General Consumers, Eco-conscious Shoppers |

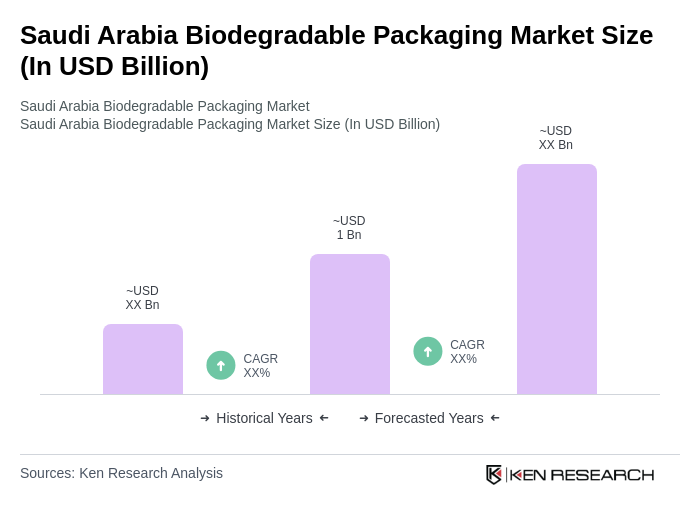

The Saudi Arabia Biodegradable Packaging Market is valued at approximately USD 1 billion, reflecting significant growth driven by environmental awareness, government initiatives, and consumer preferences for eco-friendly products across various sectors, including food and beverage, healthcare, and retail.