Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4177

Pages:94

Published On:December 2025

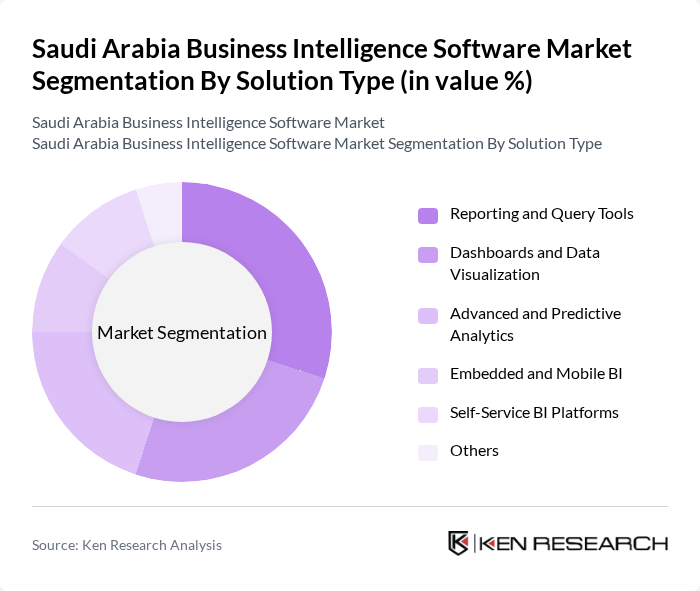

By Solution Type:The market is segmented into various solution types, including Reporting and Query Tools, Dashboards and Data Visualization, Advanced and Predictive Analytics, Embedded and Mobile BI, Self-Service BI Platforms, and Others. Among these, Reporting and Query Tools, together with Dashboards and Data Visualization, are gaining strong traction due to their ability to provide near real-time insights, standardized KPI monitoring, and intuitive interactive exploration for both technical and business users. The increasing complexity and volume of data generated from core enterprise systems, IoT, and customer channels, combined with the push toward AI-powered analytics, are driving organizations to invest in advanced and predictive analytics capabilities as well as self-service BI platforms that allow business users to build their own reports, dashboards, and models while operating within governed data frameworks.

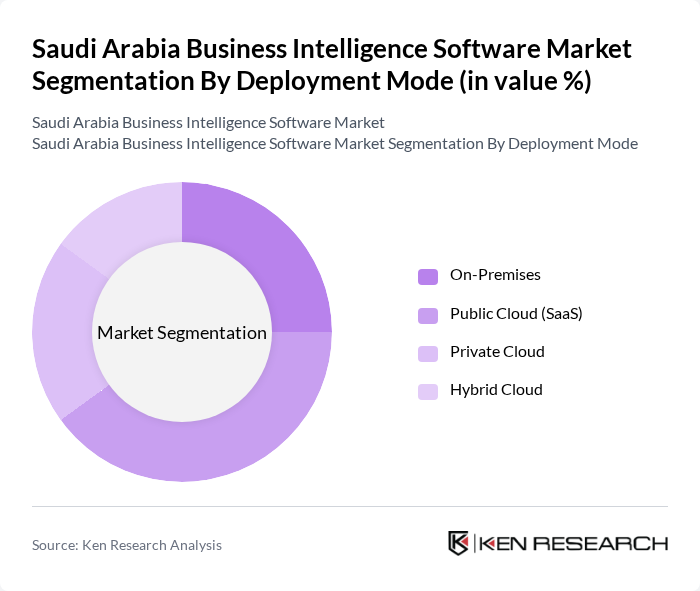

By Deployment Mode:The deployment modes for BI solutions include On-Premises, Public Cloud (SaaS), Private Cloud, and Hybrid Cloud. The Public Cloud (SaaS) segment is witnessing significant growth due to its cost-effectiveness, scalability, and alignment with national cloud-first and digital government strategies, making it an attractive option for small and medium-sized enterprises (SMEs) as well as large enterprises seeking faster time to value. Organizations are increasingly opting for cloud-based solutions to reduce infrastructure costs, enable rapid experimentation with AI and advanced analytics services, and enhance collaboration by providing secure, role-based access to BI content from any location and device, while hybrid and private cloud deployments remain important for workloads with stricter data residency and security requirements.

The Saudi Arabia Business Intelligence Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Microsoft Corporation (Power BI), Oracle Corporation, IBM Corporation, Salesforce, Inc. (Tableau and CRM Analytics), QlikTech International AB, SAS Institute Inc., MicroStrategy Incorporated, Informatica LLC, Google LLC (Looker and Looker Studio), Zoho Corporation (Zoho Analytics), TIBCO Software Inc., Sisense Ltd., Domo, Inc., Dirayaah Smart Technologies, Olivo Technologies contribute to innovation, geographic expansion, and service delivery in this space, with a strong emphasis on cloud-native BI, AI-augmented analytics, and industry-specific solutions for financial services, government, energy, and healthcare.

The future of the Saudi Arabia business intelligence software market appears promising, driven by ongoing digital transformation and government support. As organizations increasingly prioritize data-driven strategies, the demand for advanced analytics tools is expected to rise. Furthermore, the integration of artificial intelligence and machine learning into BI solutions will enhance data processing capabilities, enabling businesses to derive actionable insights more efficiently. This trend is likely to foster innovation and competitiveness across various sectors, positioning Saudi Arabia as a regional leader in business intelligence adoption.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Reporting and Query Tools Dashboards and Data Visualization Advanced and Predictive Analytics Embedded and Mobile BI Self-Service BI Platforms Others |

| By Deployment Mode | On-Premises Public Cloud (SaaS) Private Cloud Hybrid Cloud |

| By Organization Size | Large Enterprises Small and Medium-Sized Enterprises (SMEs) |

| By Application Area | Finance and Performance Management Sales and Marketing Analytics Operations and Supply Chain Analytics Customer and Citizen Experience Analytics Risk, Compliance, and Fraud Analytics Human Capital and Workforce Analytics Others |

| By Industry Vertical | Banking, Financial Services and Insurance (BFSI) Government and Public Sector Healthcare and Life Sciences Retail and E-Commerce Telecommunications and IT Oil, Gas and Petrochemicals Manufacturing and Industrial Transportation and Logistics Energy and Utilities Others |

| By Geographic Region | Central Region (including Riyadh) Eastern Region (including Dammam and Dhahran) Western Region (including Jeddah and Makkah) Southern and Northern Regions |

| By Pricing and Licensing Model | Subscription-Based (Per User / Per Month) Usage-Based / Consumption-Based Perpetual License Freemium and Open-Source Supported Enterprise-Wide Agreements |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Sector | 120 | Chief Data Officers, Business Intelligence Managers |

| Healthcare Analytics | 90 | Healthcare IT Directors, Data Analysts |

| Retail Business Intelligence | 100 | Retail Operations Managers, Marketing Analysts |

| Manufacturing Data Solutions | 80 | Production Managers, Supply Chain Analysts |

| Telecommunications Insights | 70 | Network Operations Managers, Business Analysts |

The Saudi Arabia Business Intelligence Software Market is valued at approximately USD 65 million, reflecting a focused yet rapidly expanding niche driven by digital transformation and analytics adoption across various sectors.