Region:Middle East

Author(s):Dev

Product Code:KRAD0373

Pages:90

Published On:August 2025

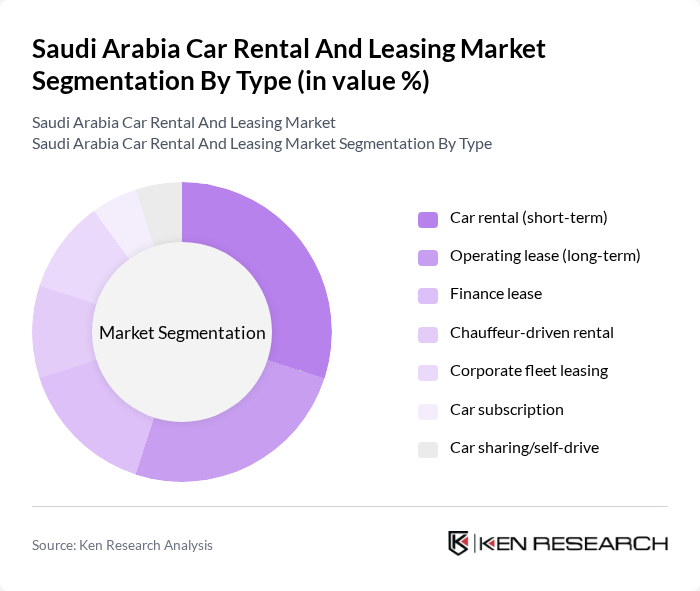

By Type:The market is segmented into various types, including car rental (short-term), operating lease (long-term), finance lease, chauffeur-driven rental, corporate fleet leasing, car subscription, and car sharing/self-drive. Each of these segments caters to different consumer needs and preferences, with short-term rentals being popular among tourists and business travelers, while long-term leases are favored by corporations for fleet management. Adoption of telematics, contactless rentals, and subscription-based models is expanding service options and improving utilization across segments.

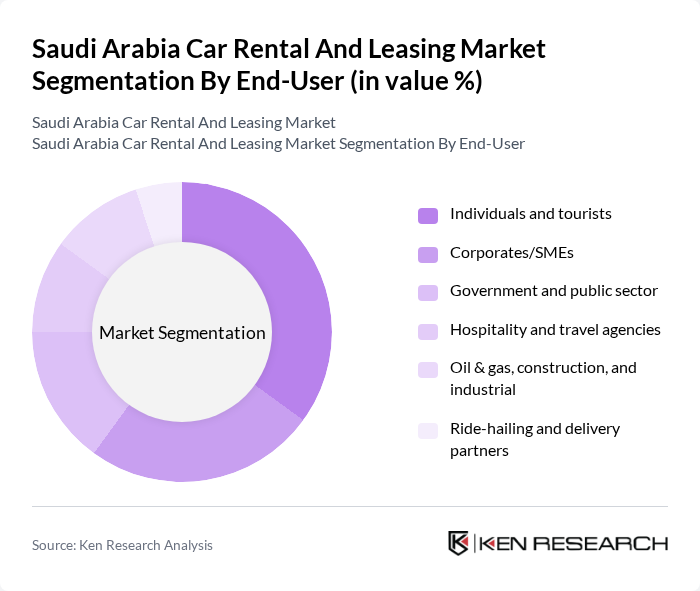

By End-User:The end-user segmentation includes individuals and tourists, corporates/SMEs, government and public sector, hospitality and travel agencies, oil & gas, construction, and industrial sectors, as well as ride-hailing and delivery partners. The individual and tourist segment is significant due to the influx of visitors, while corporates and SMEs rely on rental services for business travel and fleet management. Growing pilgrimage and leisure travel, alongside corporate demand in major cities, underpin these end-user patterns.

The Saudi Arabia Car Rental And Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Budget Saudi Arabia (United International Transportation Co. – Budget Saudi), Theeb Rent a Car (Theeb Rent a Car Co.), Lumi Rental Company, Hanco (Al Tala’a International Transportation Co.), Yelo – Al Wefaq Rent a Car, Key Car Rental, Hertz Saudi Arabia (franchise – Arabian Hala Company), Avis Saudi Arabia (AVIS Saudi – United Saudi Company), Europcar Saudi Arabia (franchise partner), Sixt Saudi Arabia (franchise partner), Thrifty Car Rental Saudi Arabia (franchise partner), National Car Rental Saudi Arabia (franchise partner), Al Jazira Vehicle Agencies Co., Al Watania for Car Rental, Udrive Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space. Operators are increasingly leveraging telematics, AI-driven fleet management, and digital booking channels, while selectively adding EVs and hybrids to meet sustainability targets and corporate client requirements.

The future of the car rental and leasing market in Saudi Arabia appears promising, driven by technological advancements and changing consumer preferences. The increasing adoption of digital platforms for bookings is expected to streamline operations and enhance customer experiences. Additionally, the shift towards sustainable transportation solutions, including electric vehicle rentals, will likely gain traction as environmental awareness grows among consumers, positioning the market for significant transformation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Car rental (short-term) Operating lease (long-term) Finance lease Chauffeur-driven rental Corporate fleet leasing Car subscription Car sharing/self-drive |

| By End-User | Individuals and tourists Corporates/SMEs Government and public sector Hospitality and travel agencies Oil & gas, construction, and industrial Ride-hailing and delivery partners |

| By Vehicle Class | Hatchback Sedan (economy and standard) SUV/MUV Premium and luxury Light commercial vehicles (LCV/van/pickup) Specialty vehicles (4x4, buses, refrigerated) |

| By Rental Duration | Daily Weekly Monthly –48 month leases |

| By Payment/Booking Mode | Online (app/website) Offline (counter/agency) Corporate contracts Subscription/auto-debit plans |

| By Propulsion | Internal combustion engine (ICE) Hybrid Battery electric vehicle (BEV) Plug-in hybrid (PHEV) |

| By Geography (Key Cities/Regions) | Riyadh Jeddah and Makkah Dammam/Khobar/Dhahran (Eastern Province) Madinah NEOM and Red Sea/Giga-project corridors Others |

| By Fleet Management Type | In-house fleet management Outsourced fleet management Hybrid fleet management Telematics-enabled fleet |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Car Leasing | 150 | Fleet Managers, Procurement Officers |

| Tourist Car Rentals | 100 | Travel Agency Owners, Tour Operators |

| Local Consumer Rentals | 120 | Individual Renters, Families |

| Long-term Leasing Clients | 80 | Business Executives, HR Managers |

| Luxury Car Rentals | 70 | Luxury Service Providers, High-net-worth Individuals |

The Saudi Arabia car rental and leasing market is valued at approximately USD 2.6 billion, driven by factors such as increasing urbanization, tourism growth, and corporate sector expansion, which have heightened demand for rental services.