Region:Middle East

Author(s):Dev

Product Code:KRAD7738

Pages:83

Published On:December 2025

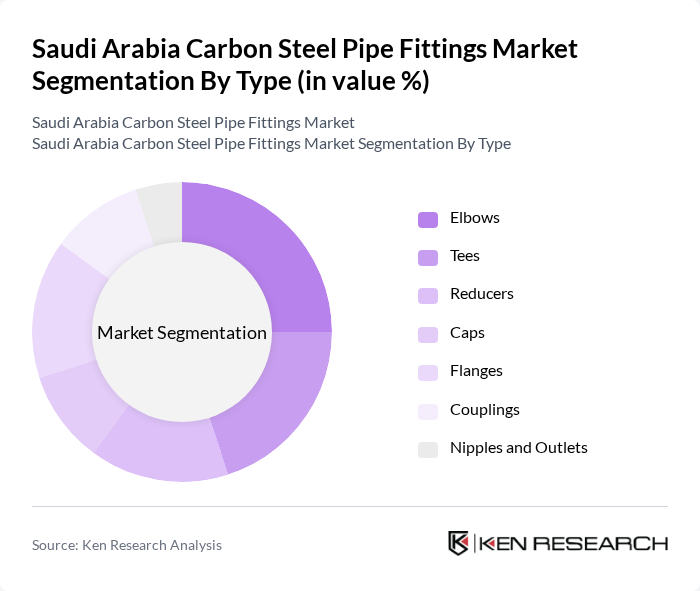

By Type:The market can be segmented into various types of carbon steel pipe fittings, including elbows, tees, reducers, caps, flanges, couplings, and nipples and outlets. Each type serves specific functions in piping systems, contributing to the overall efficiency and reliability of industrial operations.

The elbows segment is currently dominating the market due to their essential role in changing the direction of piping systems, which is crucial in various applications, especially in the oil and gas sector. The increasing complexity of piping layouts in industrial settings has led to a higher demand for elbows, as they facilitate efficient flow management. Additionally, the trend towards modular construction and prefabricated piping systems has further boosted the consumption of elbows, making them a key focus for manufacturers.

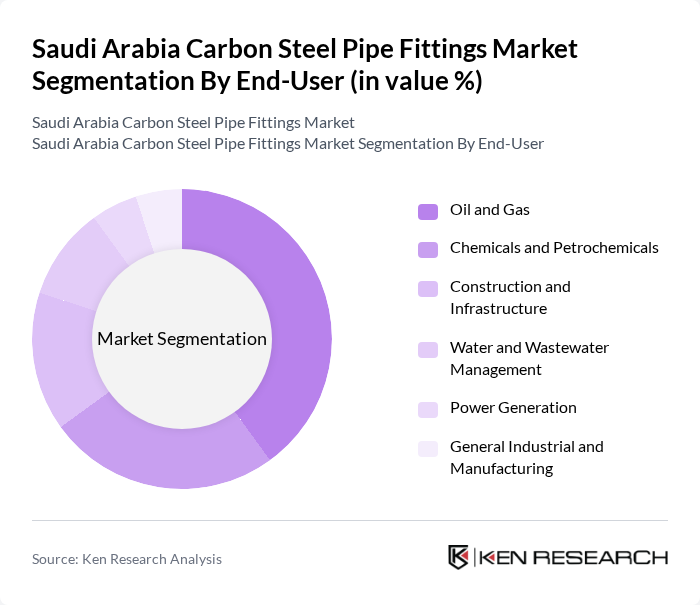

By End-User:The market is segmented based on end-users, including oil and gas, chemicals and petrochemicals, construction and infrastructure, water and wastewater management, power generation, and general industrial and manufacturing.

The oil and gas sector is the leading end-user of carbon steel pipe fittings, accounting for a significant portion of the market. This dominance is attributed to the extensive use of pipe fittings in exploration, production, and transportation processes within the industry. The ongoing expansion of oil and gas projects in Saudi Arabia, driven by both domestic and international investments, continues to fuel the demand for high-quality fittings that meet stringent safety and performance standards.

The Saudi Arabia Carbon Steel Pipe Fittings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Steel Pipe Company (Tenaris Saudi Steel Pipes), Arabian Pipes Company, National Pipe Company Ltd. (NPC), East Pipes Integrated Company for Industry, ArcelorMittal Jubail Tubular Products Company, Al-Jazira Pipe Industries & Plastic Factory, Rezayat Group – Rezayat Company Ltd. (Steel & Process Piping Division), Alim Steel Industries Co., Zamil Pipes (Zamil Steel Group), Pan Gulf Piping Systems Co. (Pan Gulf Holding), Tubi Arabia Ltd., United Special Technical Services (USTS Saudi), Saudi Steel Rolling Company, National Petroleum Construction Company Saudi (NPCC Saudi), Global Pipe Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the carbon steel pipe fittings market in Saudi Arabia appears promising, driven by ongoing infrastructure projects and a robust oil and gas sector. As the government continues to invest in industrial diversification and sustainable practices, the market is likely to witness increased demand for innovative and durable products. Additionally, the integration of advanced technologies in manufacturing processes will enhance efficiency and product quality, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Elbows Tees Reducers Caps Flanges Couplings Nipples and Outlets |

| By End-User | Oil and Gas Chemicals and Petrochemicals Construction and Infrastructure Water and Wastewater Management Power Generation General Industrial and Manufacturing |

| By Application | Process and Industrial Piping Transmission and Distribution Pipelines Fire Protection and HVAC Systems Plumbing and Building Services Others |

| By Material Grade | ASTM A234 WPB / WPC ASTM A105 / A105N ASTM A106 Grade B / C High-Yield and Low-Temperature Grades (e.g., ASTM A420) |

| By Size | Up to 2 Inches (Small Diameter) >2 to 12 Inches (Medium Diameter) >12 to 24 Inches (Large Diameter) Above 24 Inches (Extra-Large Diameter) |

| By Distribution Channel | Direct Sales to EPCs and End Users Authorized Distributors and Stockists Trading Companies and Project Merchants Online and E-Procurement Portals |

| By Region | Central Region (Riyadh and Surrounding Areas) Eastern Region (Jubail, Dammam, Khobar, SPARK) Western Region (Jeddah, Makkah, Madinah, Yanbu) Southern Region Northern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector | 110 | Procurement Managers, Project Engineers |

| Construction Industry | 90 | Site Managers, Construction Supervisors |

| Water Supply & Treatment | 70 | Water Resource Managers, Environmental Engineers |

| Manufacturing Sector | 60 | Operations Managers, Supply Chain Coordinators |

| Distribution & Retail | 80 | Sales Managers, Logistics Coordinators |

The Saudi Arabia Carbon Steel Pipe Fittings Market is valued at approximately USD 1.1 billion, driven by growth in the oil and gas sector, infrastructure investments, and increasing demand for durable fittings across various applications.