Region:Middle East

Author(s):Dev

Product Code:KRAD0351

Pages:91

Published On:August 2025

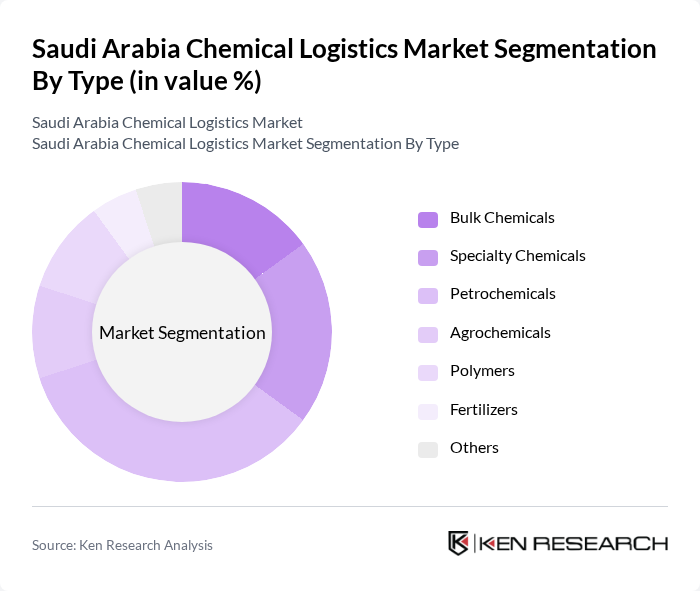

By Type:The market is segmented into Bulk Chemicals, Specialty Chemicals, Petrochemicals, Agrochemicals, Polymers, Fertilizers, and Others. Among these, Petrochemicals dominate the market due to the country's vast oil reserves and the significant role of petrochemical products in various industries. The demand for Petrochemicals is driven by their extensive use in manufacturing plastics, chemicals, and synthetic fibers, making them essential for economic growth. Specialty chemicals are also experiencing notable growth, supported by a shift toward higher-value, function-specific products and the establishment of new manufacturing facilities .

By End-User:The end-user segmentation includes the Oil and Gas Industry, Pharmaceutical Industry, Cosmetic Industry, Specialty Chemicals Industry, Agriculture, Construction, and Other End Users. The Oil and Gas Industry is the leading segment, driven by the high demand for chemicals in exploration, production, and refining processes. The sector's growth is closely tied to the country's oil production capabilities, making it a significant contributor to the chemical logistics market. Pharmaceutical and specialty chemical end-users are also expanding, supported by increased investments in manufacturing and compliance with international standards .

The Saudi Arabia Chemical Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahri (The National Shipping Company of Saudi Arabia), SABIC Logistics (SABIC - Saudi Basic Industries Corporation), Saudi Aramco (Saudi Arabian Oil Company), Almajdouie Logistics, Agility Logistics, Globe Express Services, Kuehne + Nagel Saudi Arabia, DB Schenker Saudi Arabia, Al-Jabri Logistics, Gulf Agency Company (GAC) Saudi Arabia, Al-Futtaim Logistics Saudi Arabia, BDP International Saudi Arabia, Rhenus Logistics Saudi Arabia, DHL Global Forwarding Saudi Arabia, and Sadara Chemical Company contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Saudi Arabia chemical logistics market appears promising, driven by ongoing investments in infrastructure and technology. As the government continues to support economic diversification, the logistics sector is expected to adapt to new demands, including increased automation and digital solutions. Furthermore, the focus on sustainability will likely lead to innovative practices in chemical transportation, enhancing efficiency and reducing environmental impact, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Bulk Chemicals Specialty Chemicals Petrochemicals Agrochemicals Polymers Fertilizers Others |

| By End-User | Oil and Gas Industry Pharmaceutical Industry Cosmetic Industry Specialty Chemicals Industry Agriculture Construction Other End Users |

| By Distribution Mode | Road Transport Rail Transport Sea Freight Air Freight Pipeline Transport Others |

| By Packaging Type | Drums IBCs (Intermediate Bulk Containers) Tankers Bags Others |

| By Service Type | Transportation Warehousing, Distribution, and Inventory Management Customs Clearance Value-added Services Others |

| By Compliance Type | Hazardous Materials Compliance Environmental Compliance Safety Compliance Quality Compliance Others |

| By Market Channel | Direct Sales Distributors Online Platforms Retail Outlets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chemical Manufacturing Logistics | 100 | Logistics Managers, Operations Directors |

| Hazardous Material Transportation | 60 | Safety Compliance Officers, Transport Coordinators |

| Specialty Chemicals Distribution | 50 | Supply Chain Analysts, Product Managers |

| Bulk Chemicals Supply Chain | 70 | Procurement Managers, Warehouse Supervisors |

| Regulatory Compliance in Logistics | 40 | Regulatory Affairs Specialists, Quality Assurance Managers |

The Saudi Arabia Chemical Logistics Market is valued at approximately USD 10.6 billion, driven by the increasing demand for chemical products across various industries, including oil and gas, pharmaceuticals, and agriculture.