Region:Middle East

Author(s):Dev

Product Code:KRAA8194

Pages:87

Published On:November 2025

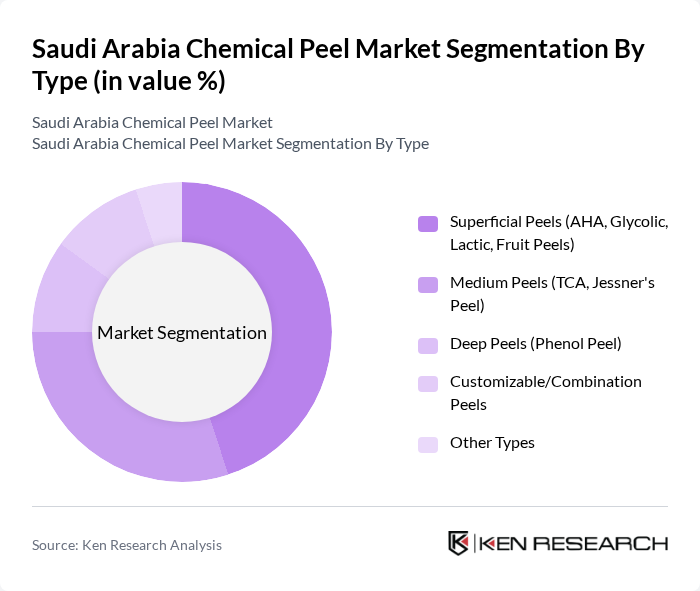

By Type:The market is segmented into various types of chemical peels, including superficial peels, medium peels, deep peels, customizable/combination peels, and other types. Superficial peels, which include AHA, glycolic, lactic, and fruit peels, are particularly popular due to their minimal downtime and effectiveness in treating mild skin issues. Medium peels, such as TCA and Jessner's peel, are also gaining traction for their ability to address more significant skin concerns. The demand for customizable and combination peels is on the rise as consumers seek tailored solutions for their unique skin types and conditions. Fruit and lactic peels are especially favored for their safety and compatibility with sensitive skin, while glycolic peels remain a leading choice for superficial exfoliation .

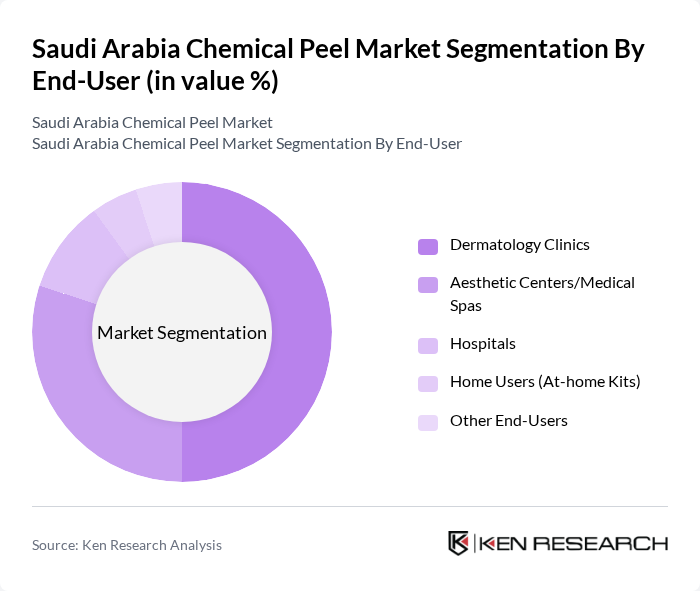

By End-User:The end-user segmentation includes dermatology clinics, aesthetic centers/medical spas, hospitals, home users (at-home kits), and other end-users. Dermatology clinics are the leading segment, as they provide professional treatments and have access to advanced technologies. Aesthetic centers and medical spas are also significant players, catering to a growing clientele seeking non-invasive cosmetic procedures. The trend of at-home skincare solutions is gaining momentum, particularly among younger consumers who prefer convenience and affordability. While dermatology clinics account for the majority of procedures, the rise of at-home peel kits and subscription-based skincare services is expanding the market's reach .

The Saudi Arabia Chemical Peel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Merz Pharmaceuticals, Galderma, SkinMedica (Allergan/AbbVie), Obagi Medical Products, PCA Skin, NeoStrata (Johnson & Johnson), Reviva Labs, Dermalogica, Jan Marini Skin Research, Image Skincare, Epionce, Alastin Skincare (Galderma), Biopelle (Ferndale Pharma Group), Environ Skin Care, Dr. Dennis Gross Skincare, Sesderma, Medica Group (Saudi Arabia), Nahdi Medical Company (Saudi Arabia), Jamjoom Pharma (Saudi Arabia), Al-Dawaa Pharmacies (Saudi Arabia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia chemical peel market appears promising, driven by increasing consumer interest in aesthetic treatments and advancements in product formulations. As the beauty and wellness industry continues to expand, the market is likely to witness a surge in innovative treatments tailored to individual skin types. Additionally, the integration of technology in aesthetic practices will enhance treatment experiences, making chemical peels more accessible and appealing to a broader audience, thus fostering sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Superficial Peels (AHA, Glycolic, Lactic, Fruit Peels) Medium Peels (TCA, Jessner's Peel) Deep Peels (Phenol Peel) Customizable/Combination Peels Other Types |

| By End-User | Dermatology Clinics Aesthetic Centers/Medical Spas Hospitals Home Users (At-home Kits) Other End-Users |

| By Skin Type | Oily Skin Dry Skin Combination Skin Sensitive Skin Other Skin Types |

| By Age Group | 25 Years 35 Years 45 Years 55 Years Years and Above |

| By Gender | Male Female Other Genders |

| By Distribution Channel | Online Sales Offline Sales (Pharmacies, Clinics, Beauty Retailers) Other Channels |

| By Geographic Region | Central Region Eastern Region Western Region Southern Region Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dermatology Clinics | 60 | Dermatologists, Clinic Managers |

| Beauty Salons and Spas | 50 | Beauty Therapists, Salon Owners |

| Consumer Feedback on Chemical Peels | 100 | Recent Clients, Skincare Enthusiasts |

| Healthcare Professionals | 40 | Plastic Surgeons, Aesthetic Practitioners |

| Market Experts and Analysts | 40 | Industry Analysts, Market Researchers |

The Saudi Arabia Chemical Peel Market is valued at approximately USD 10 million, reflecting a growing interest in skincare and aesthetic treatments among consumers, driven by increased awareness and the prevalence of skin-related issues.