Region:Asia

Author(s):Shubham

Product Code:KRAA8525

Pages:94

Published On:November 2025

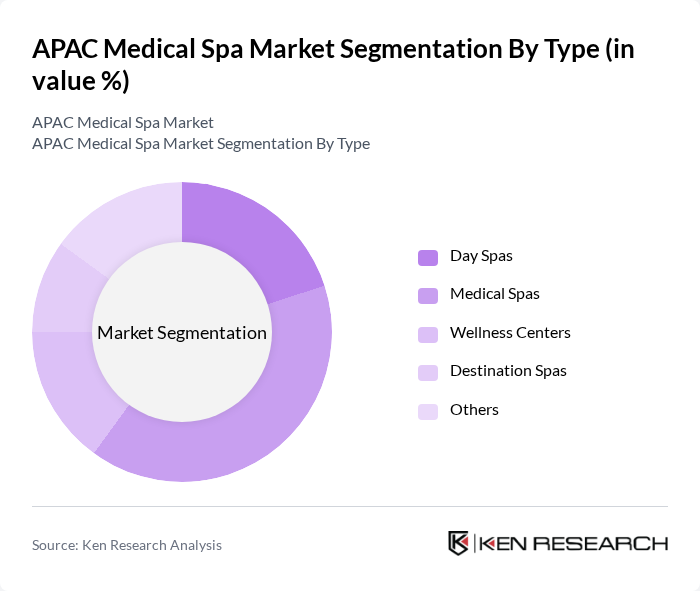

By Type:The market is segmented into Day Spas, Medical Spas, Wellness Centers, Destination Spas, and Others. Medical Spas are currently the leading segment, driven by the growing preference for non-invasive procedures, medical-grade aesthetic treatments, and hybrid wellness models. The increasing adoption of advanced technologies and the expansion of medical tourism have further contributed to the dominance of this segment.

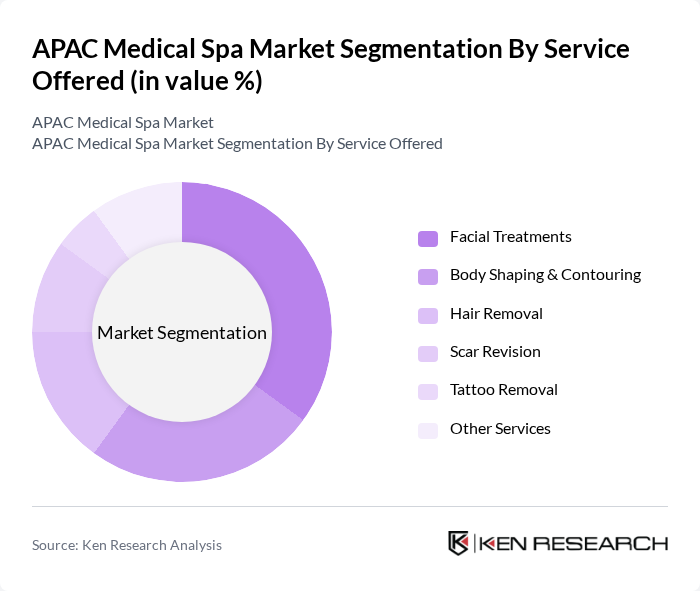

By Service Offered:The services offered in the market include Facial Treatments, Body Shaping & Contouring, Hair Removal, Scar Revision, Tattoo Removal, and Other Services. Facial Treatments are the most sought-after service, accounting for the largest share of revenue, driven by increasing demand for skincare solutions, anti-aging treatments, and preventative care. The influence of social media and the desire for aesthetic enhancement have led to a significant uptick in consumers opting for these services.

The APAC Medical Spa Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Aivee Clinic, Spa Esprit Group, Oracle Medical Group, Dermaster Thailand, Kaya Skin Clinic, The DRx Clinic, Renewme Skin Clinic, The Spa at Mandarin Oriental, Mendis Aesthetics, The Spa at Four Seasons, Chiva-Som International Health Resort, The Spa at The Oberoi, Ananda in the Himalayas, The Spa at The St. Regis, Banyan Tree Spa contribute to innovation, geographic expansion, and service delivery in this space.

The APAC medical spa market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As personalized skincare treatments gain traction, businesses are expected to invest in innovative solutions that cater to individual needs. Additionally, the integration of teleconsultation services will enhance accessibility, allowing consumers to engage with professionals remotely. This shift towards convenience and customization will likely redefine service delivery, positioning the market for sustained expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Day Spas Medical Spas Wellness Centers Destination Spas Others |

| By Service Offered | Facial Treatments Body Shaping & Contouring Hair Removal Scar Revision Tattoo Removal Other Services |

| By Customer Demographics | Age Group (18-30, 31-45, 46-60, 60+) Gender (Male, Female) Income Level (Low, Middle, High) Others |

| By Geographic Presence | China Japan India South Korea Singapore Malaysia Thailand Rest of Asia Pacific |

| By Treatment Type | Injectables (Botox, Fillers) Laser Treatments Chemical Peels Microdermabrasion Others |

| By Pricing Model | Package Deals Pay-Per-Service Membership Plans Others |

| By Marketing Channel | Online Marketing Social Media Promotions Traditional Advertising Referral Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Spa Client Satisfaction | 120 | Regular Clients, New Clients |

| Service Provider Insights | 80 | Medical Spa Owners, Aesthetic Practitioners |

| Market Trends in Aesthetic Treatments | 60 | Industry Analysts, Market Researchers |

| Consumer Behavior in Wellness Spending | 100 | Health and Wellness Enthusiasts, Spa Visitors |

| Regulatory Impact Assessment | 40 | Regulatory Officials, Compliance Officers |

The APAC Medical Spa Market is valued at approximately USD 24.2 billion, driven by increasing consumer demand for wellness and aesthetic treatments, rising disposable incomes, and a growing awareness of self-care among consumers in the region.