Region:Middle East

Author(s):Shubham

Product Code:KRAD5515

Pages:89

Published On:December 2025

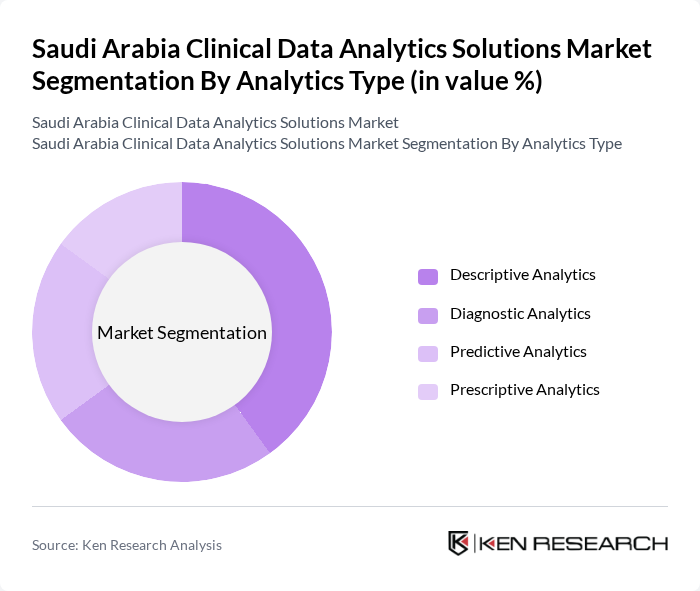

By Analytics Type:The analytics type segmentation includes Descriptive Analytics, Diagnostic Analytics, Predictive Analytics, and Prescriptive Analytics. Among these, Descriptive Analytics is currently the leading sub-segment, as it provides essential insights into historical data, helping healthcare providers understand patient trends and outcomes; this aligns with broader healthcare analytics data indicating that descriptive analytics holds the largest share in Saudi Arabia. The increasing focus on data visualization, performance dashboards, and regulatory reporting tools in hospitals and health systems has further propelled the demand for this segment.

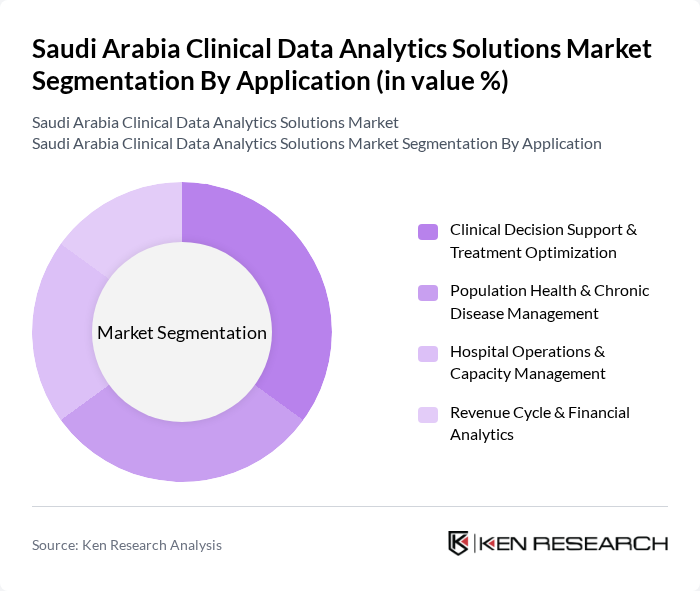

By Application:The application segmentation encompasses Clinical Decision Support & Treatment Optimization, Population Health & Chronic Disease Management, Hospital Operations & Capacity Management, and Revenue Cycle & Financial Analytics. Clinical Decision Support & Treatment Optimization is the dominant application, driven by the need for improved patient outcomes, the push toward value-based and quality-linked reimbursement programs, and the integration of evidence-based practices in clinical settings. The increasing complexity of patient care, growth in chronic disease burden, and expansion of AI-enabled decision support and predictive risk scoring tools necessitate robust decision support systems, making this application critical for healthcare providers.

The Saudi Arabia Clinical Data Analytics Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oracle Health (including Cerner solutions), InterSystems Corporation, IBM (including IBM Watson Health solutions and related analytics offerings), Microsoft (Azure Health Data & Analytics), SAS Institute Inc., IQVIA, Epic Systems Corporation, Philips Healthcare, GE HealthCare Technologies Inc., Siemens Healthineers, Optum (UnitedHealth Group), Health Catalyst, Lean Business Services (Ministry of Health digital & analytics arm, Saudi Arabia), Saudi Company for Exchanging Digital Information (Tabadul), Elm Company contribute to innovation, geographic expansion, and service delivery in this space, particularly through electronic health record platforms, health information exchange solutions, population health analytics, and AI-enabled clinical decision support deployments across leading Saudi providers.

The future of the clinical data analytics solutions market in Saudi Arabia appears promising, driven by ongoing investments in digital health and a growing emphasis on personalized medicine. As healthcare providers increasingly adopt cloud-based solutions and predictive analytics, the market is expected to witness significant advancements. Furthermore, the integration of artificial intelligence and machine learning technologies will enhance data processing capabilities, enabling healthcare organizations to deliver more efficient and tailored patient care solutions in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Analytics Type | Descriptive Analytics Diagnostic Analytics Predictive Analytics Prescriptive Analytics |

| By Application | Clinical Decision Support & Treatment Optimization Population Health & Chronic Disease Management Hospital Operations & Capacity Management Revenue Cycle & Financial Analytics |

| By End-User | Public Hospitals & Health Systems (Ministry of Health, governmental) Private Hospitals & Clinic Chains Research & Academic Institutions Payers, Regulators & Government Programs |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Data Source | Electronic Health Records (EHR) & EMR Data Claims & Financial Data Operational & Administrative Data Medical Imaging, Devices & Remote Monitoring Data |

| By Region | Central Region (including Riyadh) Western Region (including Makkah & Madinah) Eastern Region Northern & Southern Regions |

| By Customer Size | Large Health Systems & Government Networks Mid-Sized Hospitals & Specialized Centers Small Clinics & Ambulatory Care Providers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Data Management | 100 | IT Directors, Data Analysts |

| Clinical Research Institutions | 80 | Research Coordinators, Data Scientists |

| Healthcare IT Solutions Providers | 70 | Product Managers, Sales Executives |

| Government Health Agencies | 60 | Policy Makers, Health Informatics Specialists |

| Private Clinics and Practices | 90 | Practice Managers, Healthcare Providers |

The Saudi Arabia Clinical Data Analytics Solutions Market is valued at approximately USD 50 million, reflecting a significant growth trajectory driven by the adoption of digital health technologies and government initiatives aimed at enhancing healthcare outcomes.