Saudi Arabia Cloud-Based AI-Powered Financial Analytics Platforms Market Overview

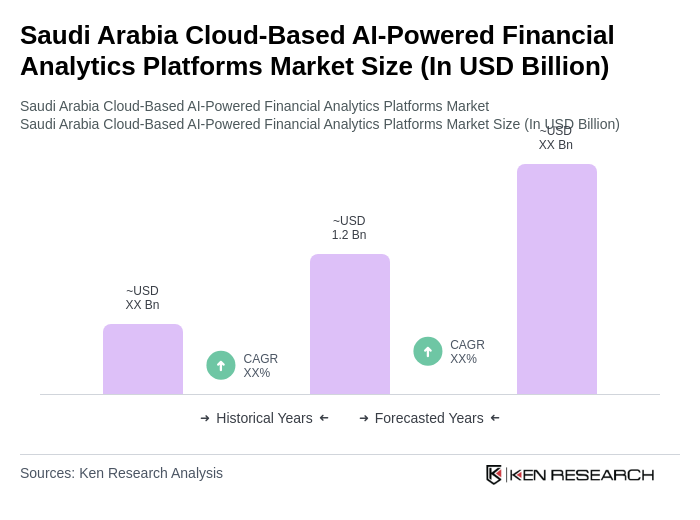

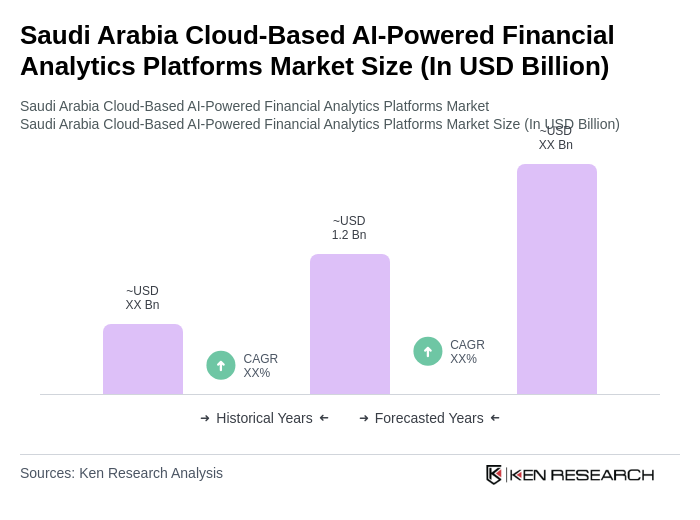

- The Saudi Arabia Cloud-Based AI-Powered Financial Analytics Platforms Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of cloud computing, the need for real-time data analytics, and the rising demand for enhanced financial decision-making capabilities among businesses. The integration of AI technologies has further accelerated the market's expansion, enabling organizations to leverage data for strategic insights.

- Key cities such as Riyadh, Jeddah, and Dammam dominate the market due to their status as financial hubs and centers of economic activity. Riyadh, being the capital, hosts numerous financial institutions and tech companies, while Jeddah serves as a commercial gateway. Dammam's strategic location enhances its role in logistics and trade, making these cities pivotal in driving the growth of cloud-based financial analytics solutions.

- In 2023, the Saudi Arabian government implemented the Financial Technology Development Program, aimed at fostering innovation in the financial sector. This initiative includes regulatory support for fintech companies and encourages the adoption of advanced technologies, including AI-powered analytics. The program is designed to enhance the efficiency and transparency of financial services, ultimately benefiting consumers and businesses alike.

Saudi Arabia Cloud-Based AI-Powered Financial Analytics Platforms Market Segmentation

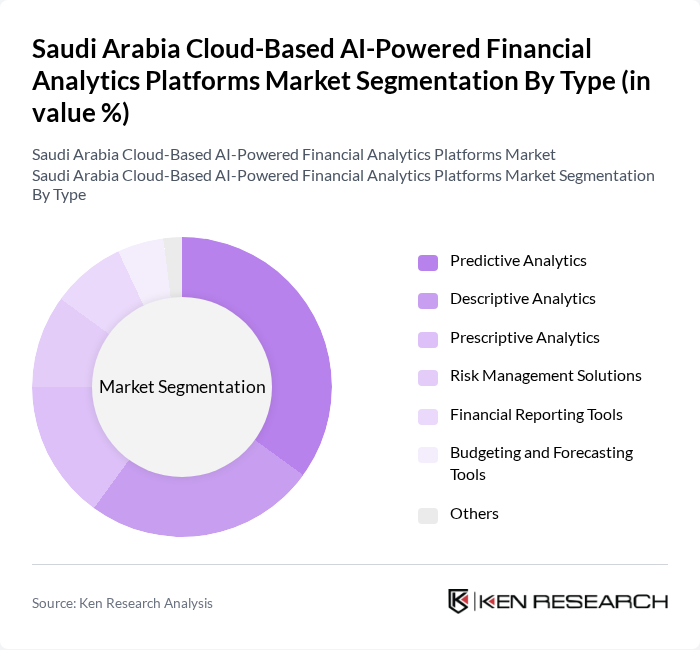

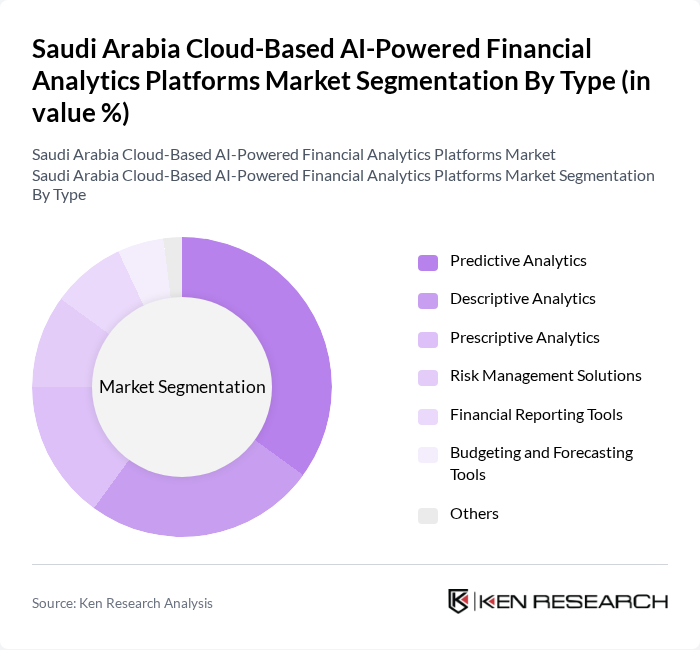

By Type:The market is segmented into various types, including Predictive Analytics, Descriptive Analytics, Prescriptive Analytics, Risk Management Solutions, Financial Reporting Tools, Budgeting and Forecasting Tools, and Others. Among these, Predictive Analytics is currently the leading sub-segment, driven by its ability to forecast trends and enhance decision-making processes. Organizations are increasingly relying on predictive models to anticipate market changes and customer behavior, making this segment crucial for strategic planning.

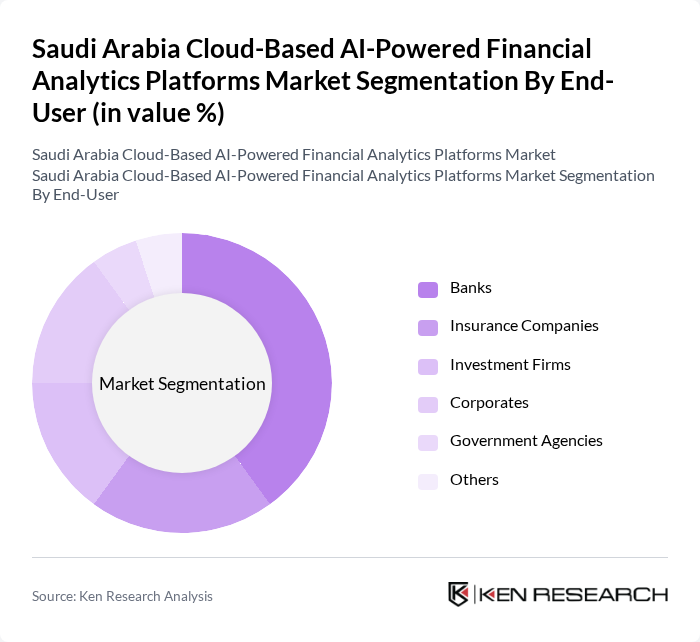

By End-User:The end-user segmentation includes Banks, Insurance Companies, Investment Firms, Corporates, Government Agencies, and Others. The banking sector is the dominant end-user, as financial institutions increasingly adopt AI-powered analytics to enhance risk assessment, customer service, and operational efficiency. The need for compliance with regulatory standards and the drive for improved customer insights further propel the demand for these solutions in the banking industry.

Saudi Arabia Cloud-Based AI-Powered Financial Analytics Platforms Market Competitive Landscape

The Saudi Arabia Cloud-Based AI-Powered Financial Analytics Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Microsoft Corporation, SAS Institute Inc., Tableau Software, LLC, QlikTech International AB, MicroStrategy Incorporated, TIBCO Software Inc., FICO, Alteryx, Inc., Domo, Inc., Sisense Inc., ThoughtSpot, Inc., Zoho Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Cloud-Based AI-Powered Financial Analytics Platforms Market Industry Analysis

Growth Drivers

- Increasing Demand for Data-Driven Decision Making:The financial sector in Saudi Arabia is witnessing a surge in demand for data-driven decision-making tools, with the market for analytics expected to reach approximately SAR 1.5 billion in future. This growth is fueled by the need for enhanced insights to drive profitability and efficiency. The Saudi Vision 2030 initiative emphasizes digital transformation, further propelling the adoption of AI-powered analytics solutions across financial institutions, which are increasingly relying on data to inform strategic decisions.

- Rise in Cloud Adoption Among Financial Institutions:As of future, around 70% of financial institutions in Saudi Arabia are projected to adopt cloud technologies, up from 50% in the past. This shift is driven by the need for scalable, flexible, and cost-effective solutions that cloud-based platforms offer. The increasing reliance on cloud infrastructure allows financial organizations to enhance their operational capabilities, streamline processes, and improve customer service, thereby fostering a conducive environment for AI-powered financial analytics platforms.

- Enhanced Regulatory Compliance Requirements:The implementation of stringent regulatory frameworks in Saudi Arabia, such as the Financial Sector Development Program, has necessitated advanced compliance solutions. In future, compliance-related expenditures in the financial sector are expected to exceed SAR 2 billion. This regulatory landscape compels financial institutions to adopt AI-powered analytics platforms that can efficiently manage compliance data, monitor transactions, and ensure adherence to evolving regulations, thus driving market growth.

Market Challenges

- Data Privacy and Security Concerns:Data privacy remains a significant challenge for the adoption of cloud-based AI solutions in Saudi Arabia. With over 60% of financial institutions expressing concerns about data breaches and compliance with local data protection laws, the reluctance to fully embrace cloud technologies hampers market growth. The need for robust security measures and assurance of data integrity is critical for building trust among financial institutions and their clients.

- High Initial Investment Costs:The financial analytics market faces challenges due to the high initial investment required for implementing AI-powered solutions. In future, the average cost for deploying such platforms is estimated to be around SAR 1 million per institution. This financial barrier can deter smaller financial entities from investing in advanced analytics, limiting the overall market growth and adoption rates across the sector.

Saudi Arabia Cloud-Based AI-Powered Financial Analytics Platforms Market Future Outlook

The future of the cloud-based AI-powered financial analytics market in Saudi Arabia appears promising, driven by ongoing digital transformation initiatives and increasing investments in technology. As financial institutions prioritize real-time analytics and user-friendly interfaces, the demand for innovative solutions will likely rise. Furthermore, the collaboration between fintech startups and established financial entities is expected to foster a dynamic ecosystem, enhancing the overall market landscape and encouraging the development of tailored solutions for diverse customer needs.

Market Opportunities

- Expansion of Fintech Startups:The burgeoning fintech sector in Saudi Arabia presents significant opportunities for AI-powered analytics platforms. With over 200 fintech startups projected to emerge in future, these companies are increasingly seeking advanced analytics solutions to enhance their offerings, thereby driving demand for cloud-based platforms tailored to their unique needs.

- Increasing Investment in Digital Transformation:The Saudi government is expected to invest approximately SAR 10 billion in digital transformation initiatives in future. This investment will likely stimulate the adoption of AI-powered financial analytics platforms, as organizations seek to leverage technology to improve operational efficiency and customer engagement, creating a favorable environment for market growth.