Region:Middle East

Author(s):Dev

Product Code:KRAB6718

Pages:81

Published On:October 2025

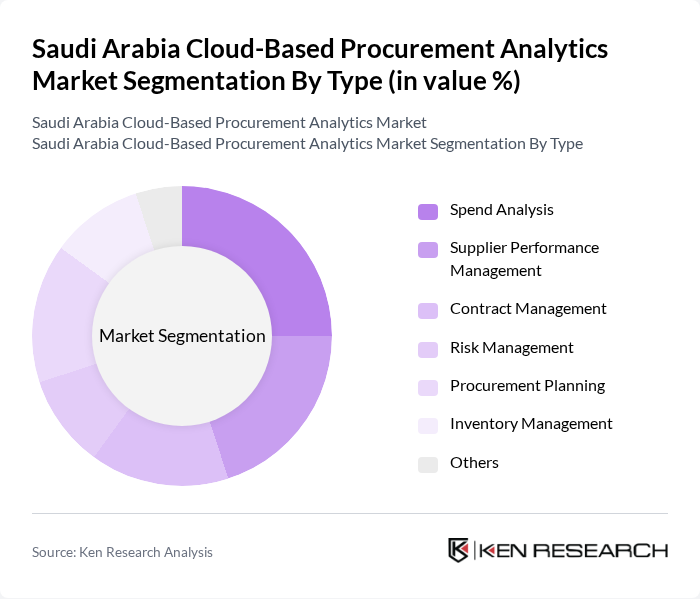

By Type:The market is segmented into various types, including Spend Analysis, Supplier Performance Management, Contract Management, Risk Management, Procurement Planning, Inventory Management, and Others. Each of these sub-segments plays a crucial role in enhancing procurement efficiency and decision-making.

The Spend Analysis sub-segment is currently dominating the market due to its critical role in helping organizations identify and manage their spending patterns effectively. Companies are increasingly focusing on optimizing their procurement processes, and spend analysis tools provide valuable insights into cost-saving opportunities. The growing emphasis on data-driven decision-making and the need for enhanced visibility into procurement activities are driving the demand for spend analysis solutions, making it the leading sub-segment in the market.

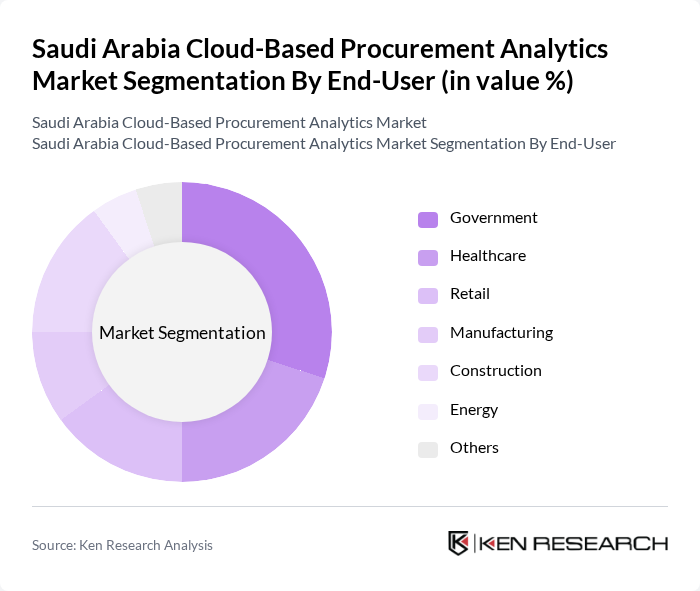

By End-User:The market is segmented by end-users, including Government, Healthcare, Retail, Manufacturing, Construction, Energy, and Others. Each end-user category has unique requirements and challenges that cloud-based procurement analytics solutions can address.

The Government sector is the leading end-user of cloud-based procurement analytics solutions, driven by the need for transparency and efficiency in public procurement processes. The implementation of regulations mandating digital procurement systems has further accelerated the adoption of these solutions. Additionally, the healthcare sector is also witnessing significant growth due to the increasing need for efficient supply chain management and cost control in healthcare services.

The Saudi Arabia Cloud-Based Procurement Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Coupa Software Incorporated, Jaggaer, Ivalua, GEP Worldwide, Zycus, SynerTrade, Tradeshift, Basware, Proactis, SpendHQ, Determine, Inc., Ariba, an SAP Company, Xeeva contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia cloud-based procurement analytics market appears promising, driven by ongoing digital transformation initiatives and increasing investments in IT infrastructure. As organizations prioritize real-time analytics and data-driven decision-making, the integration of AI and machine learning technologies is expected to enhance procurement processes significantly. Furthermore, the growing emphasis on sustainability in supply chains will likely shape procurement strategies, encouraging the adoption of innovative cloud solutions that align with environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Spend Analysis Supplier Performance Management Contract Management Risk Management Procurement Planning Inventory Management Others |

| By End-User | Government Healthcare Retail Manufacturing Construction Energy Others |

| By Industry Vertical | Public Sector Financial Services Telecommunications Transportation and Logistics Education Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Functionality | Spend Visibility Supplier Collaboration Analytics and Reporting Compliance Management |

| By Sales Channel | Direct Sales Online Sales Resellers |

| By Pricing Model | Subscription-Based Pay-Per-Use License Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Large Enterprises in Retail | 100 | Chief Procurement Officers, IT Directors |

| Manufacturing Sector Procurement | 80 | Supply Chain Managers, Operations Executives |

| Public Sector Procurement Initiatives | 60 | Government Procurement Officers, Policy Makers |

| Healthcare Industry Procurement | 70 | Procurement Managers, IT Specialists |

| SMEs Adopting Cloud Solutions | 90 | Business Owners, Financial Managers |

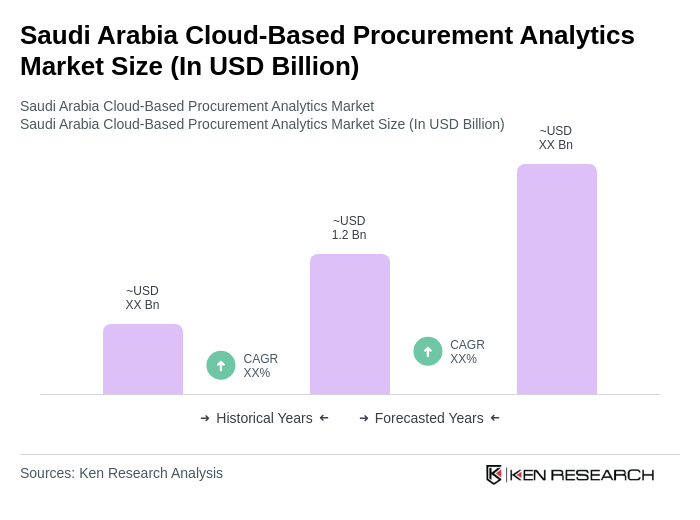

The Saudi Arabia Cloud-Based Procurement Analytics Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by digital transformation initiatives across various sectors, enhancing operational efficiency and decision-making processes.