Region:Middle East

Author(s):Shubham

Product Code:KRAD0683

Pages:82

Published On:August 2025

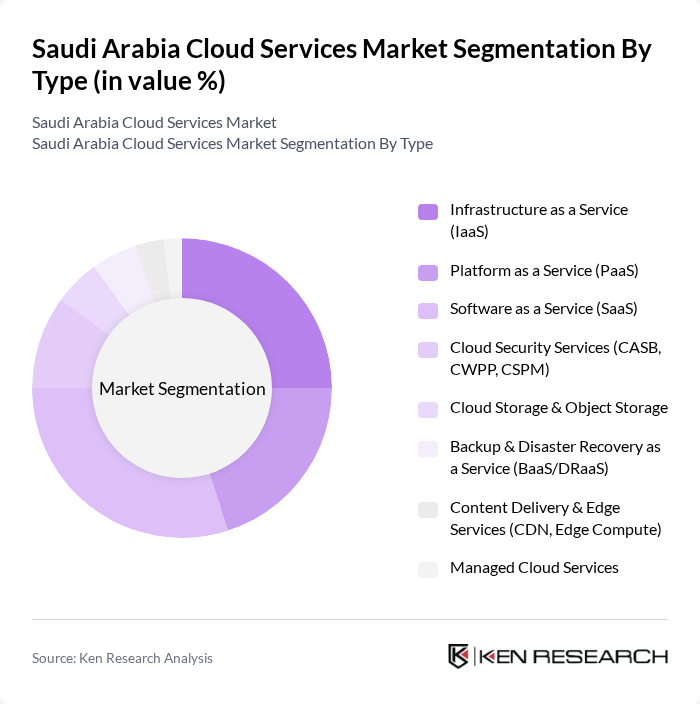

By Type:The cloud services market can be segmented into various types, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS), Cloud Security Services, Cloud Storage & Object Storage, Backup & Disaster Recovery as a Service (BaaS/DRaaS), Content Delivery & Edge Services, and Managed Cloud Services. Each of these segments plays a crucial role in meeting the diverse needs of businesses and organizations.

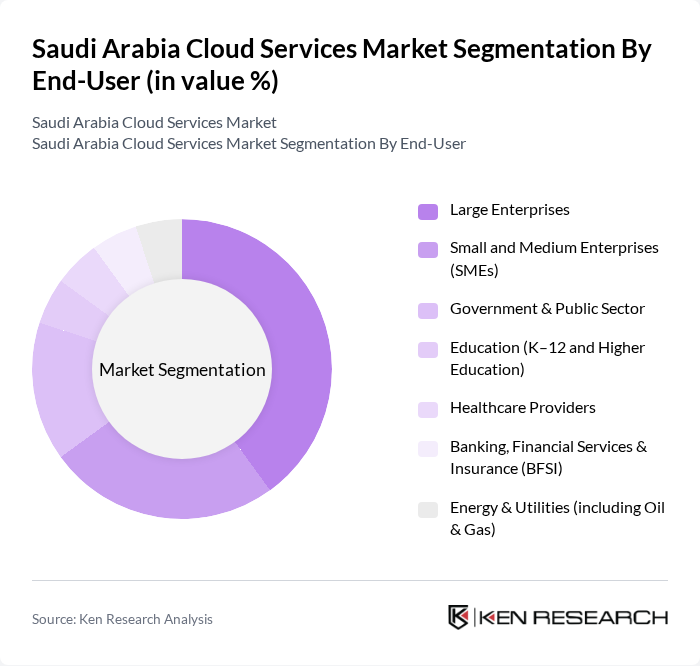

By End-User:The end-user segmentation of the cloud services market includes Large Enterprises, Small and Medium Enterprises (SMEs), Government & Public Sector, Education (K–12 and Higher Education), Healthcare Providers, Banking, Financial Services & Insurance (BFSI), and Energy & Utilities (including Oil & Gas). Each segment has unique requirements and drives demand for specific cloud solutions.

The Saudi Arabia Cloud Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (Google Cloud), Oracle Cloud Infrastructure (OCI), IBM Cloud, Alibaba Cloud, stc Cloud (Saudi Telecom Company), Mobily Business Cloud (Etihad Etisalat), Zain KSA Cloud, Huawei Cloud, SAP Cloud (SAP Saudi Arabia), Oracle–NEOM Cloud Services Company, Google Cloud Region Riyadh (Saudi Aramco partnership), Site (Sahara Net) Cloud & Managed Services, Ebttikar Technology Company (Cloud & Managed Services) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia cloud services market appears promising, driven by ongoing digital transformation and government initiatives. As businesses increasingly recognize the benefits of cloud solutions, the market is expected to witness a surge in adoption rates. The integration of advanced technologies such as AI and machine learning will further enhance cloud capabilities, enabling organizations to optimize operations and improve customer experiences. Additionally, the focus on sustainability will shape cloud service offerings, aligning with global environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Cloud Security Services (CASB, CWPP, CSPM) Cloud Storage & Object Storage Backup & Disaster Recovery as a Service (BaaS/DRaaS) Content Delivery & Edge Services (CDN, Edge Compute) Managed Cloud Services |

| By End-User | Large Enterprises Small and Medium Enterprises (SMEs) Government & Public Sector Education (K–12 and Higher Education) Healthcare Providers Banking, Financial Services & Insurance (BFSI) Energy & Utilities (including Oil & Gas) |

| By Industry Vertical | IT & Telecommunications Retail & E-commerce Manufacturing Energy, Utilities & Oil and Gas Transportation & Logistics Media & Entertainment Public Sector & Smart Cities (e.g., NEOM, Red Sea, Diriyah) |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Community Cloud (Regulated Industries) |

| By Service Model | Managed Services (Monitoring, Optimization, SOC) Professional Services (Migration, Integration) Consulting & Advisory Support & Maintenance |

| By Pricing Model | Subscription-Based (Reserved/Committed Use) Pay-As-You-Go (On-Demand) Tiered Pricing Spot/Premptible Instances Enterprise Agreements & Savings Plans |

| By Geographic Presence | Central Region (Riyadh, Qassim) Eastern Region (Dammam, Dhahran, Khobar) Western Region (Jeddah, Makkah, Madinah) Southern Region (Asir, Jizan, Najran) Northern Region (Tabuk, Al-Jawf, Hail) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 120 | IT Managers, CTOs, CIOs |

| SME Cloud Utilization | 100 | Business Owners, IT Consultants |

| Public Sector Cloud Services | 80 | Government IT Officials, Project Managers |

| Cloud Security Solutions | 70 | Security Officers, Compliance Managers |

| Cloud Service Provider Insights | 90 | Sales Directors, Product Managers |

The Saudi Arabia Cloud Services Market is valued at approximately USD 4 billion, driven by digital transformation across various sectors, including government, healthcare, and financial services, alongside the expansion of local cloud regions and data centers.