Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5992

Pages:90

Published On:December 2025

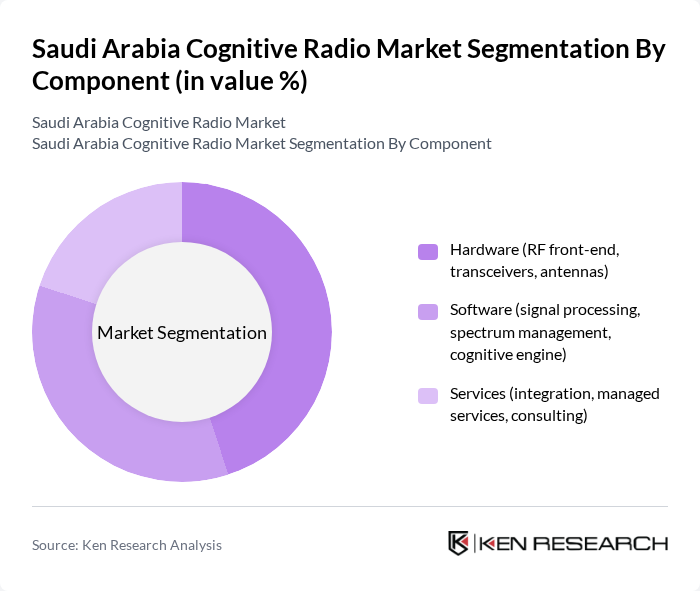

By Component:The segmentation by component includes Hardware (RF front-end, transceivers, antennas), Software (signal processing, spectrum management, cognitive engine), and Services (integration, managed services, consulting). Each of these components plays a crucial role in the overall functionality and effectiveness of cognitive radio systems, with hardware and software closely tied to 5G base stations, small cells, and mission?critical communication networks being rolled out in Saudi Arabia.

The hardware segment, particularly RF front-end and transceivers, dominates the market due to the increasing need for robust communication infrastructure and dense 5G and private network deployments. As cognitive radio technology evolves, the demand for advanced hardware components that can support dynamic spectrum access, multi?band operation, and efficient signal processing is on the rise. This trend is driven by the growing adoption of IoT devices, smart city platforms, and industry 4.0 applications, and the need for reliable, interference?aware communication in sectors including telecommunications, public safety, defense, and utilities in Saudi Arabia.

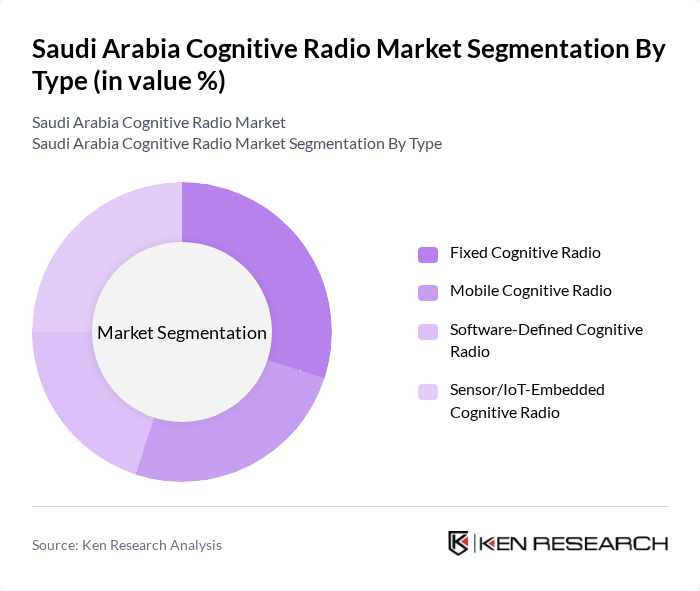

By Type:The segmentation by type includes Fixed Cognitive Radio, Mobile Cognitive Radio, Software-Defined Cognitive Radio, and Sensor/IoT-Embedded Cognitive Radio. Each type serves different applications and user needs, contributing to the overall growth of the market, from fixed base?station?class radios in 5G and microwave backhaul, to mobile and SDR platforms used in defense, public safety, and industrial wireless networks.

The fixed cognitive radio segment leads the market due to its widespread application in telecommunications infrastructure, including macro and small?cell sites, microwave links, and fixed wireless access systems that benefit from dynamic spectrum allocation and interference management. Fixed systems are essential for providing stable and reliable communication links, especially in urban areas where demand for bandwidth is high and spectrum is heavily utilized. The increasing deployment of smart city initiatives, critical communications networks, and large?scale IoT and sensor networks in Saudi Arabia further drives the need for fixed cognitive radio solutions, making it a critical component of the overall market.

The Saudi Arabia Cognitive Radio Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Telecom Company (stc), Etihad Etisalat Company (Mobily), Mobile Telecommunications Company Saudi Arabia (Zain KSA), Huawei Technologies Co., Ltd., Nokia Corporation, Telefonaktiebolaget LM Ericsson, Cisco Systems, Inc., Qualcomm Technologies, Inc., L3Harris Technologies, Inc., Thales Group, Motorola Solutions, Inc., NEC Corporation, CommScope Holding Company, Inc., Rohde & Schwarz GmbH & Co. KG, Keysight Technologies, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cognitive radio market in Saudi Arabia appears promising, driven by technological advancements and government support. As the nation progresses towards its Vision 2030 goals, the integration of cognitive radio systems into smart city projects and IoT applications will likely accelerate. Additionally, the expansion of 5G networks will create new opportunities for cognitive radio technologies, enhancing communication capabilities and fostering innovation across various sectors, including healthcare, transportation, and public safety.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (RF front-end, transceivers, antennas) Software (signal processing, spectrum management, cognitive engine) Services (integration, managed services, consulting) |

| By Type | Fixed Cognitive Radio Mobile Cognitive Radio Software-Defined Cognitive Radio Sensor/IoT?Embedded Cognitive Radio |

| By Application | Spectrum Sensing & Dynamic Spectrum Access Cognitive Routing & Interference Management Public Protection & Disaster Relief (PPDR) Communications Smart Grid & Critical Infrastructure Communication Location Tracking & Asset Monitoring Others |

| By End-User | Telecommunications & Mobile Network Operators Defense and Military Public Safety & Emergency Services Transportation & Smart Mobility (aviation, rail, ports, logistics) Utilities, Oil & Gas, and Industrial IoT Others |

| By Frequency Band | VHF Band UHF Band SHF / Microwave Band mmWave and Other Bands |

| By Deployment Mode | On-Premises (private networks, mission?critical) Cloud-Based (virtualized RAN, centralized control) Hybrid Edge?Deployed Cognitive Radio |

| By Region | Central Region (Riyadh and surroundings) Eastern Region (Dammam, Dhahran, oil & gas corridor) Western Region (Jeddah, Makkah, Madinah, Red Sea projects) Southern & Northern Regions |

| By Policy & Regulatory Support | CITC / CST Spectrum Frameworks and Sandbox Programs Government Subsidies & Tax Incentives Research Grants & Pilot Programs (universities, R&D centers) Public–Private Partnerships and Localization Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Operators | 100 | Network Engineers, Operations Managers |

| Government Regulatory Bodies | 50 | Policy Makers, Regulatory Analysts |

| Technology Providers | 80 | Product Managers, R&D Directors |

| End-Users in Public Safety | 70 | Emergency Services Coordinators, Communication Officers |

| Academic and Research Institutions | 60 | Researchers, Professors in Telecommunications |

The Saudi Arabia Cognitive Radio Market is valued at approximately USD 180 million, reflecting a significant growth trajectory driven by the increasing demand for efficient spectrum management and the rise of IoT applications.