Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0036

Pages:83

Published On:August 2025

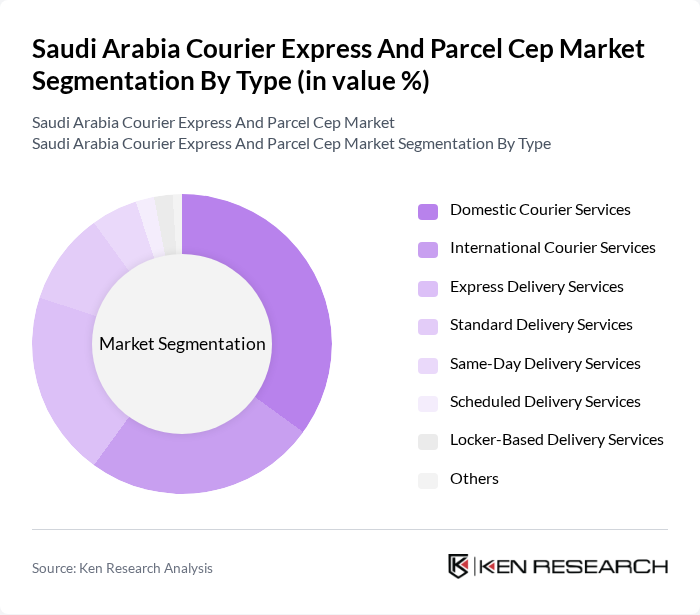

By Type:The market is segmented into various types of courier services, including Domestic Courier Services, International Courier Services, Express Delivery Services, Standard Delivery Services, Same-Day Delivery Services, Scheduled Delivery Services, Locker-Based Delivery Services, and Others. Among these,Domestic Courier Servicesare witnessing significant growth due to the increasing demand for local deliveries, driven by the booming e-commerce sector and the need for rapid last-mile fulfillment .

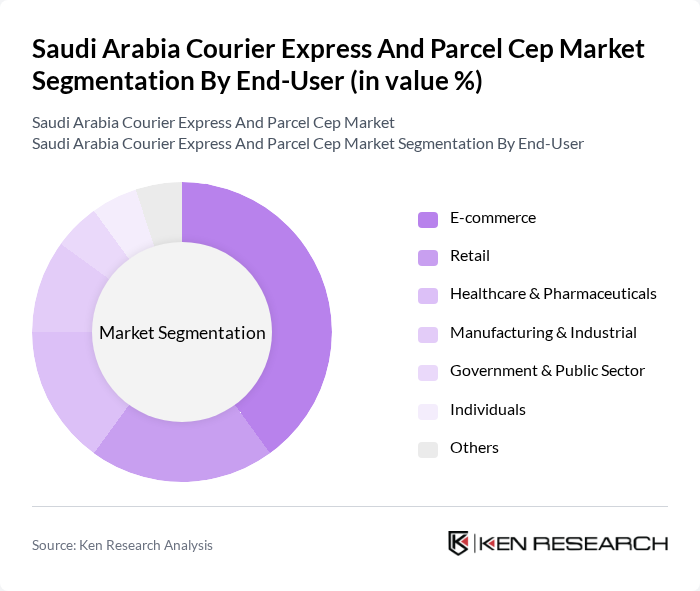

By End-User:The end-user segmentation includes E-commerce, Retail, Healthcare & Pharmaceuticals, Manufacturing & Industrial, Government & Public Sector, Individuals, and Others. TheE-commerce sectoris the leading end-user, driven by the surge in online shopping and the need for efficient delivery solutions to meet customer expectations. Healthcare and pharmaceuticals are also showing notable growth due to increased demand for time-sensitive and temperature-controlled deliveries .

The Saudi Arabia Courier Express And Parcel Cep Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Post (SPL), Aramex, DHL Express, FedEx, UPS, Naqel Express, SMSA Express, Zajil Express, Barq Express, J&T Express, OMINIC, Al-Faris Cargo, Al-Muqarrar Logistics, Al-Hokair Logistics, Al-Jazira Express contribute to innovation, geographic expansion, and service delivery in this space.

The future of the courier express and parcel market in Saudi Arabia appears promising, driven by the ongoing digital transformation and increasing consumer expectations for rapid delivery. As e-commerce continues to expand, companies are likely to invest in advanced logistics technologies and sustainable practices. Furthermore, the integration of AI and automation will enhance operational efficiency, allowing businesses to meet the growing demand for fast and reliable delivery services while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Domestic Courier Services International Courier Services Express Delivery Services Standard Delivery Services Same-Day Delivery Services Scheduled Delivery Services Locker-Based Delivery Services Others |

| By End-User | E-commerce Retail Healthcare & Pharmaceuticals Manufacturing & Industrial Government & Public Sector Individuals Others |

| By Delivery Speed | Same-Day Delivery Next-Day Delivery Standard Delivery (2-3 Days) Scheduled Delivery Others |

| By Pricing Model | Flat Rate Pricing Variable Pricing (Distance/Weight-Based) Subscription-Based Pricing Others |

| By Packaging Type | Standard Packaging Custom Packaging Eco-Friendly Packaging Temperature-Controlled Packaging Others |

| By Distribution Channel | Online Platforms Retail Outlets Direct Sales Third-Party Aggregators Others |

| By Service Type | B2B Services B2C Services C2C Services Reverse Logistics/Returns Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Domestic Courier Services | 120 | Operations Managers, Logistics Coordinators |

| International Parcel Delivery | 60 | Export Managers, Compliance Officers |

| E-commerce Fulfillment Solutions | 70 | eCommerce Directors, Supply Chain Analysts |

| Last-Mile Delivery Innovations | 40 | Technology Officers, Delivery Operations Managers |

| Corporate Logistics Solutions | 50 | Procurement Managers, Business Development Executives |

The Saudi Arabia Courier Express and Parcel (CEP) market is valued at approximately USD 4.2 billion, driven by the rapid growth of e-commerce and increasing consumer demand for fast and reliable delivery services.