Region:Asia

Author(s):Rebecca

Product Code:KRAA2115

Pages:82

Published On:August 2025

Market.png)

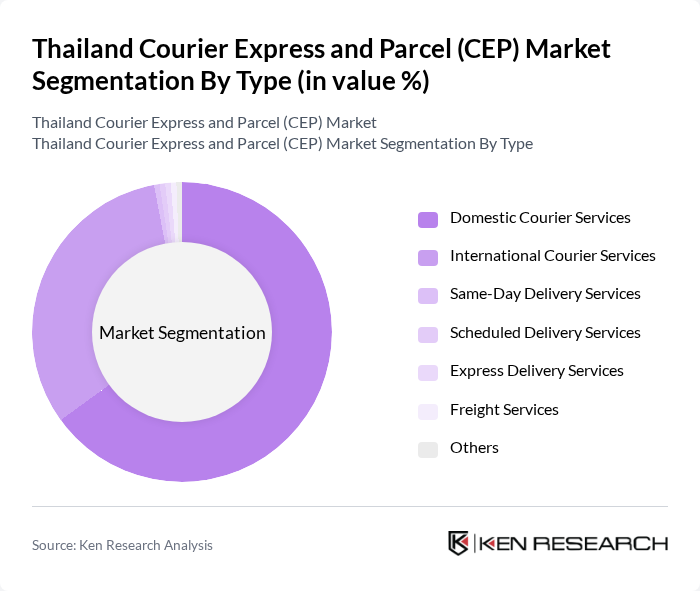

By Type:The market is segmented into various types of courier services, including Domestic Courier Services, International Courier Services, Same-Day Delivery Services, Scheduled Delivery Services, Express Delivery Services, Freight Services, and Others. Each of these segments caters to different consumer needs and preferences, with specific operational requirements and service levels.

The Domestic Courier Services segment is currently the leading sub-segment, accounting for approximately two-thirds of the market. This dominance is driven by the increasing demand for local deliveries, particularly from e-commerce businesses. Consumers prefer domestic services for their speed and reliability, which are crucial for online shopping. The rise in online retail has significantly influenced consumer behavior, leading to a surge in demand for domestic courier solutions that can provide timely deliveries. This trend is expected to continue as more businesses shift to online platforms .

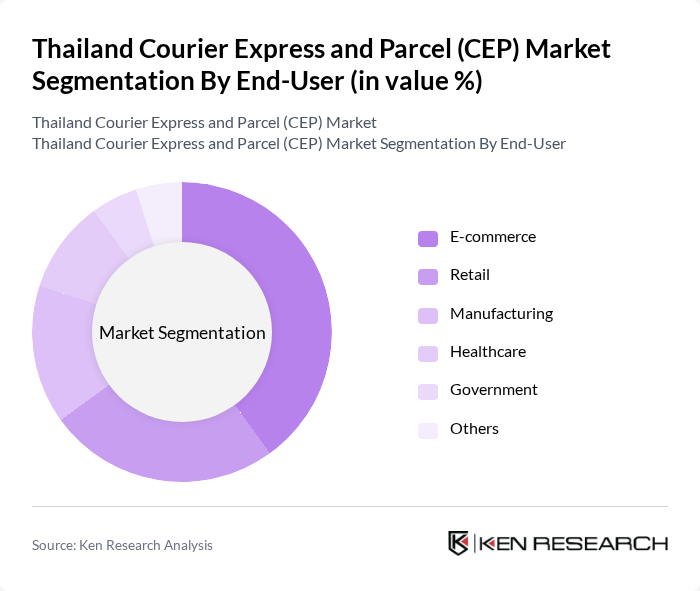

By End-User:The market is segmented by end-user into E-commerce, Retail, Manufacturing, Healthcare, Government, and Others. Each end-user category has unique logistics requirements, influencing the types of courier services utilized.

The E-commerce segment is the dominant end-user category, accounting for a significant portion of the market. The rapid growth of online shopping has necessitated efficient logistics solutions, with e-commerce businesses relying heavily on courier services for timely deliveries. This trend is further fueled by changing consumer preferences for convenience and speed, making e-commerce a critical driver of growth in the courier market .

The Thailand Courier Express and Parcel (CEP) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thailand Post, Kerry Express, DHL Express Thailand, FedEx Thailand, TNT Express Thailand, J&T Express Thailand, GrabExpress, Lalamove, Ninja Van Thailand, SCG Logistics, Flash Express, SF Express Thailand, Qxpress, LINE MAN, Best Express Thailand contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Thailand CEP market appears promising, driven by ongoing digital transformation and evolving consumer expectations. As logistics companies increasingly adopt AI and automation, operational efficiencies are expected to improve significantly. Furthermore, the demand for same-day delivery services is likely to rise, compelling businesses to innovate their delivery models. Companies that can adapt to these trends will be well-positioned to capture market share and enhance customer loyalty in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Domestic Courier Services International Courier Services Same-Day Delivery Services Scheduled Delivery Services Express Delivery Services Freight Services Others |

| By End-User | E-commerce Retail Manufacturing Healthcare Government Others |

| By Delivery Speed | Standard Delivery Express Delivery Same-Day Delivery Next-Day Delivery Others |

| By Service Type | Door-to-Door Services Drop-off Services Pickup Services Logistics Management Services Others |

| By Packaging Type | Standard Packaging Custom Packaging Temperature-Controlled Packaging Others |

| By Payment Method | Prepaid Postpaid Cash on Delivery Others |

| By Distribution Channel | Online Platforms Retail Outlets Direct Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Courier Services | 100 | Logistics Coordinators, Urban Delivery Managers |

| Rural Parcel Delivery | 60 | Operations Supervisors, Regional Managers |

| Same-Day Delivery Services | 40 | Customer Service Managers, Sales Directors |

| International Shipping Solutions | 50 | Export Managers, Compliance Officers |

| Last-Mile Delivery Innovations | 50 | Technology Officers, Logistics Analysts |

The Thailand Courier Express and Parcel (CEP) Market is valued at approximately USD 2.8 billion, driven by the rapid growth of e-commerce, increasing consumer demand for fast delivery services, and the rise of digital payment solutions.