Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7316

Pages:85

Published On:December 2025

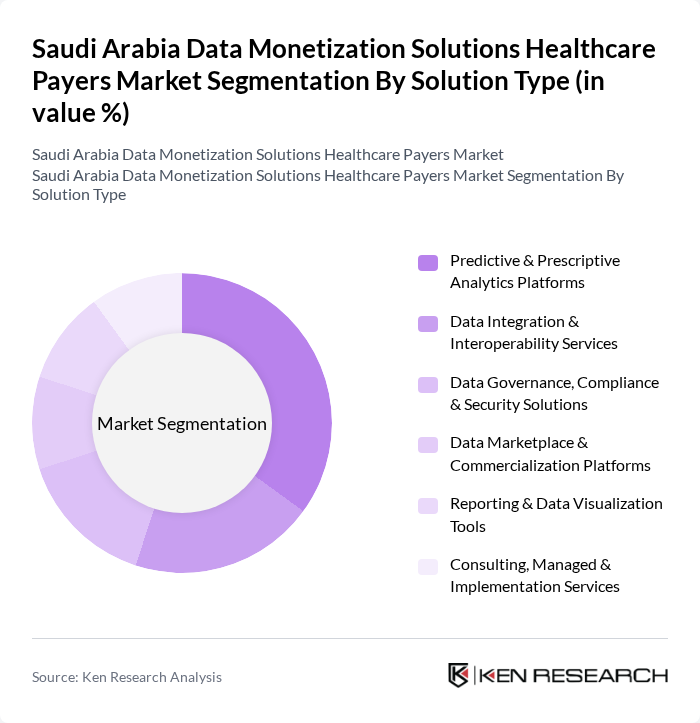

By Solution Type:The market is segmented into various solution types that cater to the diverse needs of healthcare payers. The subsegments include Predictive & Prescriptive Analytics Platforms, Data Integration & Interoperability Services, Data Governance, Compliance & Security Solutions, Data Marketplace & Commercialization Platforms, Reporting & Data Visualization Tools, and Consulting, Managed & Implementation Services. Among these, Predictive & Prescriptive Analytics Platforms are leading due to their ability to enhance decision-making and operational efficiency.

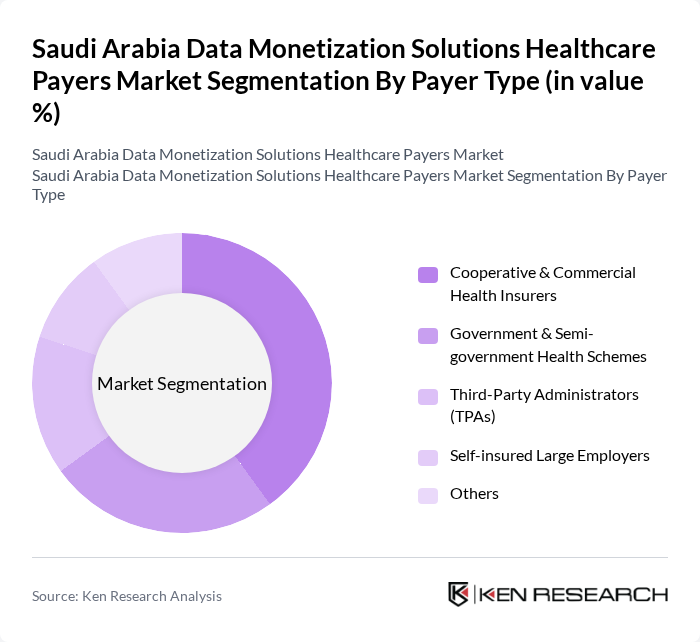

By Payer Type:The market is also segmented by payer types, which include Cooperative & Commercial Health Insurers, Government & Semi-government Health Schemes, Third-Party Administrators (TPAs), Self-insured Large Employers, and Others. Cooperative & Commercial Health Insurers dominate this segment due to their extensive customer base and the increasing demand for innovative healthcare solutions.

The Saudi Arabia Data Monetization Solutions Healthcare Payers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Council of Health Insurance (CHI) – Saudi Arabia, National Health Information Center (NHIC) – Saudi Health Council, Bupa Arabia for Cooperative Insurance, The Company for Cooperative Insurance (Tawuniya), Medgulf Cooperative Insurance & Reinsurance Co., Saudi Enaya Cooperative Insurance Co., Al Rajhi Company for Cooperative Insurance (Al Rajhi Takaful), AXA Cooperative Insurance Co. (GIG Saudi), United Cooperative Assurance Co. (UCA), Walaa Cooperative Insurance Co., Arabian Shield Cooperative Insurance Co., Malath Cooperative Insurance Co., Alinma Tokio Marine Co., IBM Saudi Arabia, Oracle Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian data monetization solutions healthcare payers market appears promising, driven by ongoing digital transformation initiatives and increasing investments in health IT infrastructure. As the government continues to promote interoperability among healthcare systems, payers will increasingly adopt innovative technologies. The focus on value-based care models will further enhance patient engagement and experience, leading to improved health outcomes. Additionally, the integration of AI and machine learning will revolutionize data utilization, paving the way for more efficient healthcare delivery.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Predictive & Prescriptive Analytics Platforms Data Integration & Interoperability Services Data Governance, Compliance & Security Solutions Data Marketplace & Commercialization Platforms Reporting & Data Visualization Tools Consulting, Managed & Implementation Services |

| By Payer Type | Cooperative & Commercial Health Insurers Government & Semi?government Health Schemes (e.g., NHIC, Council of Health Insurance) Third?Party Administrators (TPAs) Self?insured Large Employers Others |

| By Region | Central Region (including Riyadh) Western Region (including Jeddah, Makkah, Madinah) Eastern Region (including Dammam, Dhahran) Northern & Southern Regions |

| By Use Case / Application | Claims Analytics & Automation Fraud, Waste & Abuse (FWA) Detection Risk Scoring & Underwriting Analytics Member 360° & Population Health Management Provider Network Optimization & Contracting Analytics Product Design, Pricing & Revenue Optimization Others |

| By Data Source | Claims & Reimbursement Data Eligibility, Enrollment & Member Demographic Data Electronic Health Records & Clinical Data Pharmacy & Prescription Data Telehealth, Remote Monitoring & Wearable Data Consumer, Wellness & mHealth Application Data Others |

| By Deployment / Service Model | On?premise Solutions Software as a Service (SaaS) Platform as a Service (PaaS) & Data?as?a?Service (DaaS) Hybrid & Managed Services |

| By Policy & Commercial Model | Subscription?based Licensing Usage?based & Outcome?based Contracts Revenue?sharing & Data Partnership Models Government Incentives & Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Healthcare Payers | 100 | Policy Makers, Financial Analysts |

| Private Health Insurance Providers | 80 | Product Managers, Data Analysts |

| Healthcare IT Solution Providers | 70 | Technical Leads, Business Development Managers |

| Healthcare Data Analytics Firms | 60 | Data Scientists, Market Researchers |

| Regulatory Bodies in Healthcare | 50 | Regulatory Affairs Specialists, Compliance Officers |

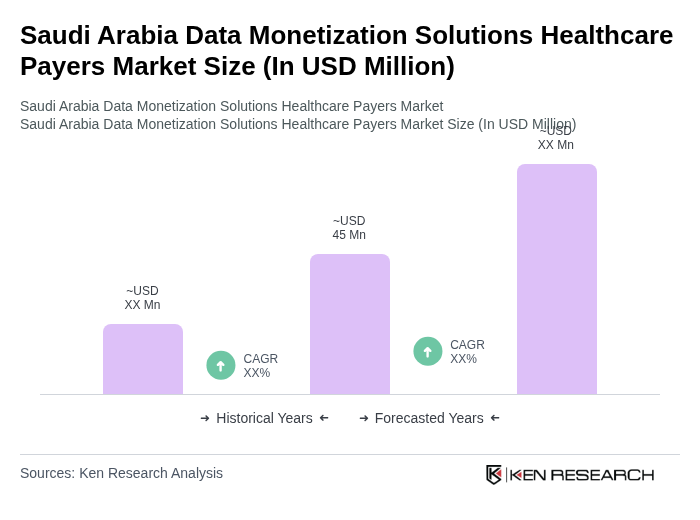

The Saudi Arabia Data Monetization Solutions Healthcare Payers Market is valued at approximately USD 45 million, reflecting a five-year historical analysis driven by digital health technology adoption and enhanced data analytics capabilities.