Region:Middle East

Author(s):Geetanshi

Product Code:KRAB5240

Pages:96

Published On:October 2025

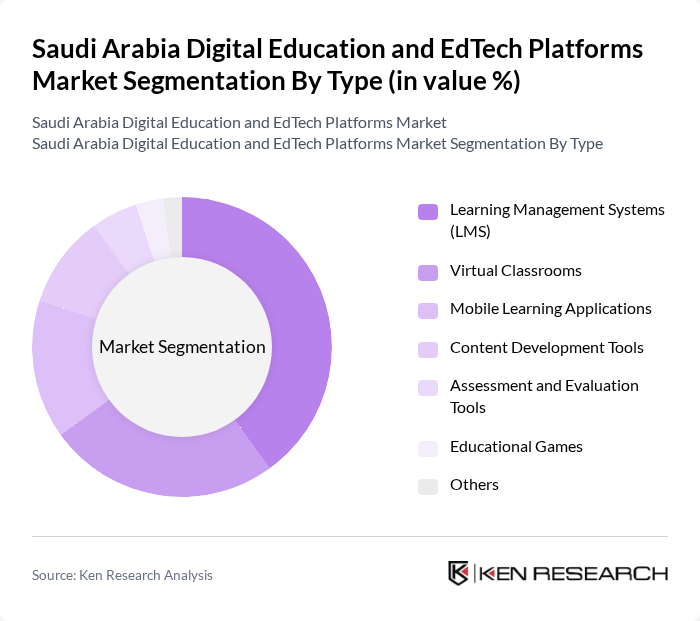

By Type:The market is segmented into various types of digital education solutions, each catering to different learning needs and preferences. The dominant sub-segment is Learning Management Systems (LMS), which facilitate the administration, documentation, tracking, and reporting of educational courses. The increasing demand for online learning and the need for efficient management of educational content have propelled the growth of LMS in the region. Other notable segments include Virtual Classrooms and Mobile Learning Applications, which are gaining traction due to the rise in remote learning and mobile device usage. Content Development Tools and Assessment & Evaluation Tools are also seeing increased adoption as institutions seek to enhance engagement and measure learning outcomes more effectively .

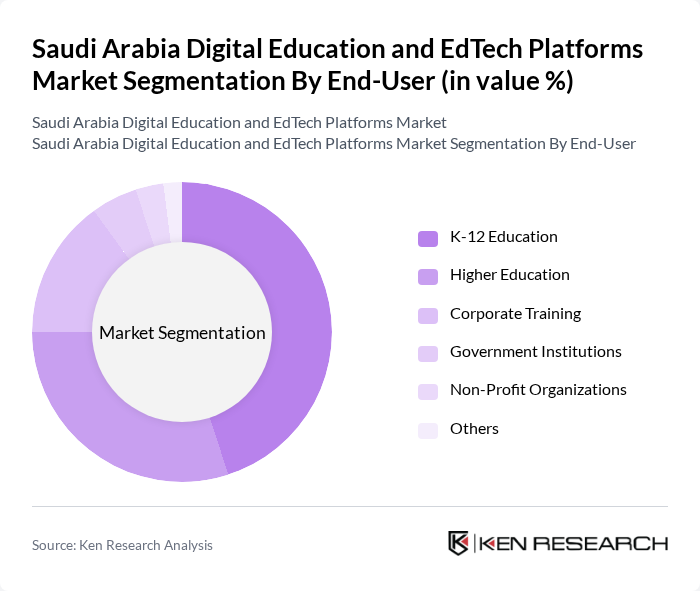

By End-User:The market is segmented by end-users, including K-12 Education, Higher Education, Corporate Training, Government Institutions, and Non-Profit Organizations. The K-12 Education segment is the largest, driven by the increasing integration of technology in schools and the demand for interactive learning tools. Higher Education is also significant, as universities adopt digital platforms to enhance learning experiences. Corporate Training is growing rapidly as companies seek to upskill employees through online courses and training programs. Government institutions and non-profit organizations are increasingly leveraging EdTech platforms to deliver scalable, accessible educational content and professional development .

The Saudi Arabia Digital Education and EdTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Madrasati, Noon Academy, Rwaq, Edraak, Qiyas (National Center for Assessment), Future Academy, Almentor, Maktabati, Aanaab, Coursera, Udacity, Tadarab, Khan Academy, Skill Academy, Saudi Digital Academy contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital education and EdTech platforms market in Saudi Arabia appears promising, driven by ongoing government support and increasing investments in technology. As digital literacy initiatives gain traction, more individuals will be equipped to engage with online learning. Furthermore, the rise of mobile learning and partnerships with educational institutions will enhance content accessibility, fostering a more inclusive educational landscape. The integration of advanced technologies like AI will also personalize learning experiences, making education more effective and engaging for diverse learners.

| Segment | Sub-Segments |

|---|---|

| By Type | Learning Management Systems (LMS) Virtual Classrooms Mobile Learning Applications Content Development Tools Assessment and Evaluation Tools Educational Games Others |

| By End-User | K-12 Education Higher Education Corporate Training Government Institutions Non-Profit Organizations Others |

| By Application | Academic Learning Professional Development Skill Development Compliance Training Certification Programs Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Licensing Others |

| By Content Type | Video-Based Content Text-Based Content Interactive Content Assessments and Quizzes Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 Education Administrators | 100 | School Principals, Curriculum Coordinators |

| Higher Education Institutions | 70 | University Deans, IT Directors |

| EdTech Platform Developers | 50 | Product Managers, Software Engineers |

| Students and Parents | 90 | High School Students, Parents of K-12 Students |

| Vocational Training Providers | 40 | Training Coordinators, Program Directors |

The Saudi Arabia Digital Education and EdTech Platforms Market is valued at approximately USD 2.3 billion, reflecting significant growth driven by the adoption of digital learning solutions and government initiatives aimed at modernizing educational infrastructure.