Region:Middle East

Author(s):Dev

Product Code:KRAB7798

Pages:93

Published On:October 2025

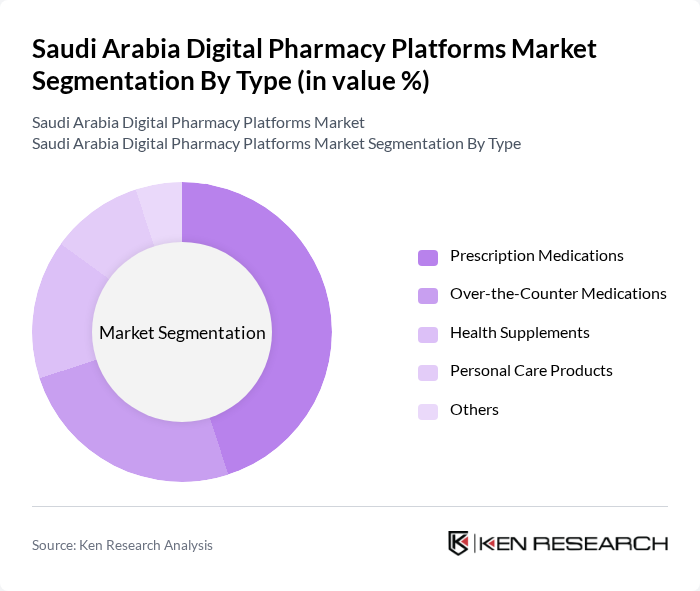

By Type:The market is segmented into various types, including Prescription Medications, Over-the-Counter Medications, Health Supplements, Personal Care Products, and Others. Among these, Prescription Medications are currently dominating the market due to the increasing prevalence of chronic diseases and the growing need for regular medication management. The convenience of ordering prescriptions online has significantly influenced consumer behavior, leading to a higher adoption rate of digital platforms for these products.

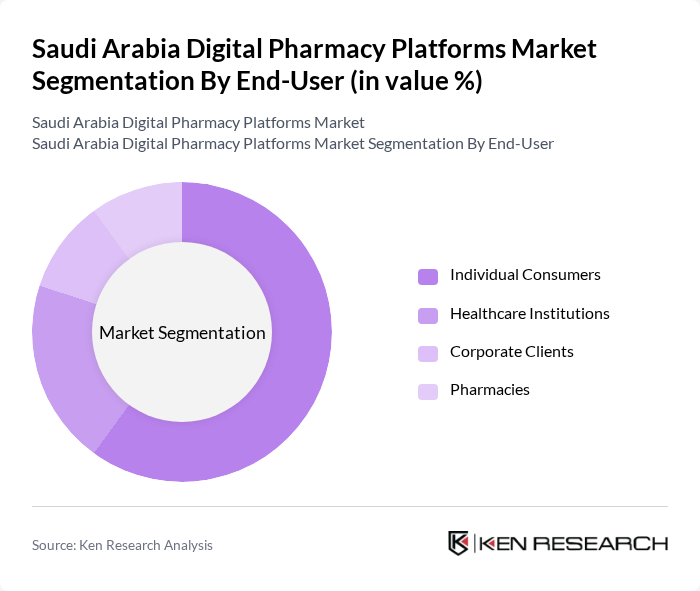

By End-User:The end-user segmentation includes Individual Consumers, Healthcare Institutions, Corporate Clients, and Pharmacies. Individual Consumers are the leading segment, driven by the growing trend of self-medication and the increasing reliance on online platforms for health-related purchases. The convenience of home delivery and the ability to compare prices and products online have made digital pharmacies particularly appealing to this demographic.

The Saudi Arabia Digital Pharmacy Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Nahdi Medical Company, United Pharmacies, White Pharmacy, Al-Dawaa Pharmacies, Tabby Pharmacy, Seha Online, Medisafe, Healthigo, Jarir Pharmacy, Al-Muhaidib Group, Al-Faisaliah Group, Al-Muhaidib Medical, Al-Hokair Group, Al-Jazeera Pharmaceutical, Al-Mansour Pharmacy contribute to innovation, geographic expansion, and service delivery in this space.

The future of digital pharmacy platforms in Saudi Arabia appears promising, driven by technological advancements and changing consumer behaviors. The integration of artificial intelligence and machine learning is expected to enhance personalized medicine, improving patient outcomes. Additionally, the expansion of telehealth services will likely create synergies with digital pharmacies, offering comprehensive healthcare solutions. As consumer awareness grows, the market is poised for significant transformation, with increased investment and innovation shaping its trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Medications Over-the-Counter Medications Health Supplements Personal Care Products Others |

| By End-User | Individual Consumers Healthcare Institutions Corporate Clients Pharmacies |

| By Sales Channel | Direct-to-Consumer B2B Sales Online Marketplaces Others |

| By Distribution Mode | Home Delivery Click-and-Collect Pharmacy Pickup Others |

| By Price Range | Budget Mid-Range Premium |

| By Customer Demographics | Age Group Gender Income Level |

| By Product Category | Chronic Disease Management Acute Care Preventive Care Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Pharmacy User Experience | 150 | Regular Users, Occasional Users |

| Healthcare Professional Insights | 100 | Pharmacists, Doctors, Healthcare Administrators |

| Market Trends and Adoption Rates | 80 | Industry Analysts, Market Researchers |

| Regulatory Compliance Feedback | 60 | Regulatory Affairs Specialists, Compliance Officers |

| Consumer Preferences and Behavior | 120 | General Consumers, Health-Conscious Individuals |

The Saudi Arabia Digital Pharmacy Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital health solutions and consumer demand for convenience, particularly accelerated during the pandemic.