Region:Middle East

Author(s):Rebecca

Product Code:KRAB7774

Pages:81

Published On:October 2025

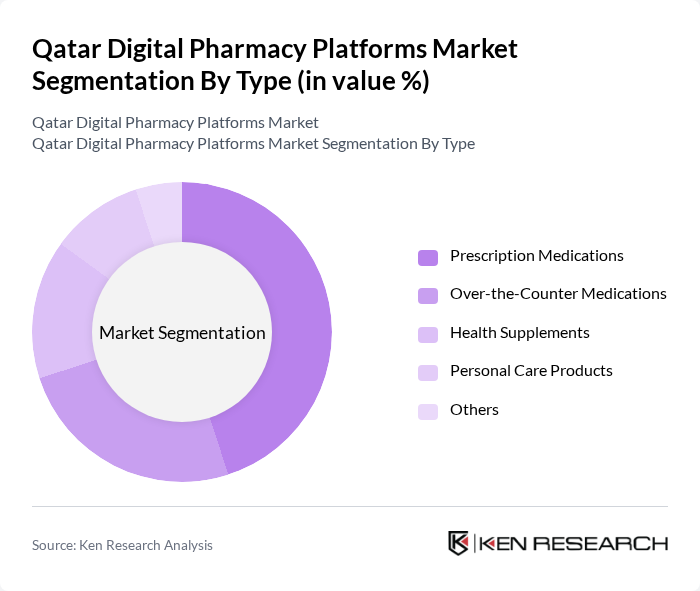

By Type:The market is segmented into various types, including Prescription Medications, Over-the-Counter Medications, Health Supplements, Personal Care Products, and Others. Among these, Prescription Medications are currently dominating the market due to the increasing prevalence of chronic diseases and the growing trend of telemedicine, which facilitates online consultations and prescriptions. The convenience of obtaining medications through digital platforms is driving consumer preference towards this sub-segment.

By End-User:The end-user segmentation includes Individual Consumers, Healthcare Institutions, and Corporate Clients. Individual Consumers are the leading segment, driven by the increasing trend of self-medication and the convenience of online shopping. The rise in health awareness and the need for easy access to medications have significantly contributed to the growth of this segment, making it the most prominent in the market.

The Qatar Digital Pharmacy Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Pharmacy, Al-Dawaa Pharmacies, Aster Pharmacy, Dhaman Pharmacy, United Pharmacies, Al-Mana Group, Al-Hekma Pharmacy, Al-Sadd Pharmacy, Al-Wakrah Pharmacy, Qatar Medical Supplies, Doha Pharmacy, Gulf Pharmacy, Al-Faisal Pharmacy, Al-Mansoori Pharmacy, Qatar Health Pharmacy contribute to innovation, geographic expansion, and service delivery in this space.

The future of digital pharmacy platforms in Qatar appears promising, driven by technological advancements and increasing consumer acceptance. As telehealth services expand, digital pharmacies are likely to integrate more comprehensive health management solutions. The focus on patient-centric services will enhance user experience, while government support for digital health initiatives will further stimulate market growth. Continuous innovation in mobile applications and e-prescription systems will also play a pivotal role in shaping the future landscape of this sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Medications Over-the-Counter Medications Health Supplements Personal Care Products Others |

| By End-User | Individual Consumers Healthcare Institutions Corporate Clients |

| By Sales Channel | Direct-to-Consumer B2B Partnerships Online Marketplaces |

| By Distribution Mode | Home Delivery Click-and-Collect |

| By Product Category | Chronic Disease Management Acute Care Products Preventive Care Products |

| By Customer Demographics | Age Group Gender Income Level |

| By Policy Support | Subsidies for Digital Health Initiatives Tax Incentives for E-Pharmacies Regulatory Support for Innovation |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Usage of Digital Pharmacy Platforms | 150 | Regular Users, Occasional Users, Non-Users |

| Pharmacy Owner Insights | 100 | Independent Pharmacy Owners, Chain Pharmacy Managers |

| Healthcare Professional Perspectives | 80 | Doctors, Pharmacists, Healthcare Administrators |

| Technology Providers in Digital Health | 60 | IT Managers, Software Developers, Digital Health Consultants |

| Regulatory Insights from Health Authorities | 50 | Regulatory Affairs Specialists, Policy Makers |

The Qatar Digital Pharmacy Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital health solutions and consumer demand for convenience in accessing pharmacy services.