Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1015

Pages:87

Published On:October 2025

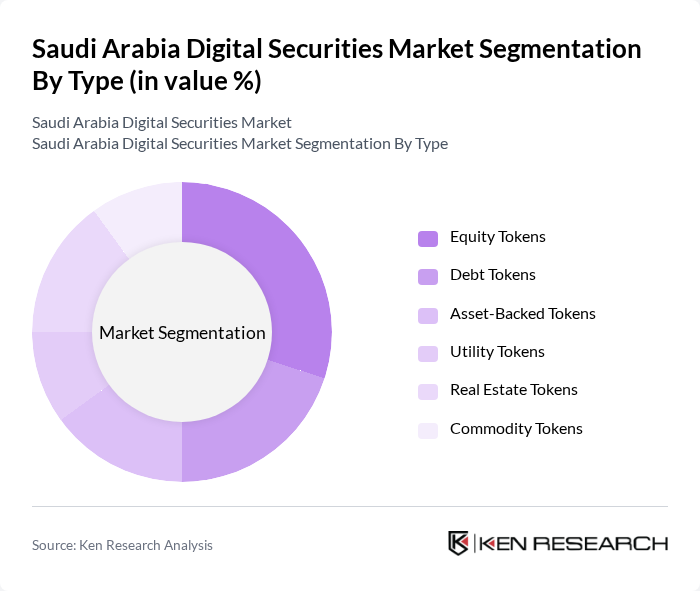

By Type:The digital securities market can be segmented into various types, including equity tokens, debt tokens, asset-backed tokens, utility tokens, real estate tokens, and commodity tokens. Each of these subsegments caters to different investor needs and preferences, with equity tokens gaining significant traction due to their potential for high returns and liquidity. Asset-backed and real estate tokens are also experiencing increased adoption, driven by demand for fractional ownership and diversification opportunities .

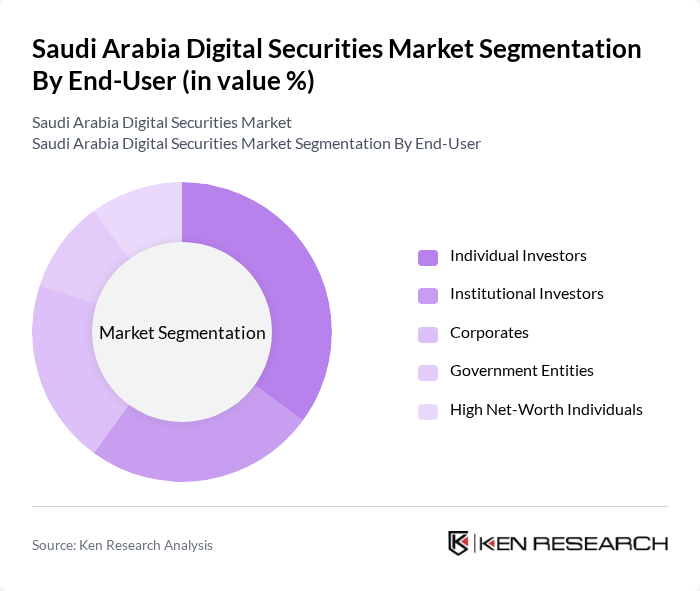

By End-User:The end-user segmentation includes individual investors, institutional investors, corporates, government entities, and high net-worth individuals. Individual investors are increasingly participating in the digital securities market, driven by the accessibility and potential for diversification that digital assets offer. Institutional investors and corporates are expanding their involvement through digital asset management platforms and tokenized investment products, reflecting broader market maturity .

The Saudi Arabia Digital Securities Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Tadawul Group (Saudi Stock Exchange), Saudi Central Bank (SAMA), Alinma Investment, SNB Capital (formerly NCB Capital), Riyad Capital, Samba Capital & Investment Management, Al Rajhi Capital, Arab National Bank (ANB), Banque Saudi Fransi, Emirates NBD Securities, Alkhabeer Capital, Aljazira Capital, BMG Financial Group, Amlak International, Mulkia Investment, HSBC Saudi Arabia, Maan Financial Services, Al-Etihad Cooperative Insurance, Al-Bilad Investment contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia digital securities market appears promising, driven by technological advancements and increasing regulatory support. The integration of artificial intelligence in trading platforms is expected to enhance decision-making processes, while the rise of decentralized finance (DeFi) will create new avenues for investment. As institutional investors continue to enter the market, the overall landscape will evolve, fostering innovation and attracting a broader range of participants, ultimately leading to a more dynamic market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Tokens Debt Tokens Asset-Backed Tokens Utility Tokens Real Estate Tokens Commodity Tokens |

| By End-User | Individual Investors Institutional Investors Corporates Government Entities High Net-Worth Individuals |

| By Investment Size | Small Investments (Below SAR 100,000) Medium Investments (SAR 100,000–1,000,000) Large Investments (Above SAR 1,000,000) |

| By Trading Platform | Centralized Exchanges Decentralized Exchanges Over-the-Counter (OTC) Markets Digital Brokerage Platforms |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| By Geographic Focus | Domestic Market Regional Markets (GCC) International Markets |

| By Asset Class | Equities Bonds Mutual Funds ETFs Derivatives |

| By Others | Niche Digital Securities Emerging Market Segments Unclassified Digital Securities |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Institutional Investors in Digital Securities | 100 | Portfolio Managers, Investment Analysts |

| Regulatory Bodies and Compliance Officers | 40 | Regulators, Compliance Managers |

| Fintech Companies Offering Digital Securities Solutions | 60 | Product Managers, Business Development Executives |

| Retail Investors Engaged in Digital Asset Trading | 110 | Individual Investors, Financial Advisors |

| Technology Providers in Blockchain and Digital Securities | 50 | CTOs, Software Developers |

The Saudi Arabia Digital Securities Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by blockchain adoption, regulatory advancements, and increased interest in digital asset investments among both retail and institutional investors.