Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7335

Pages:99

Published On:October 2025

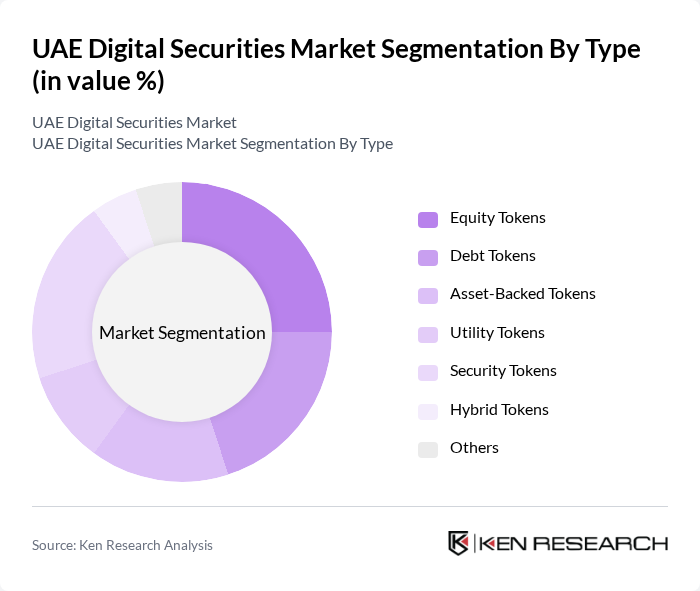

By Type:The market is segmented into various types of digital securities, including equity tokens, debt tokens, asset-backed tokens, utility tokens, security tokens, hybrid tokens, and others. Each type serves different investment needs and preferences, catering to a diverse range of investors.

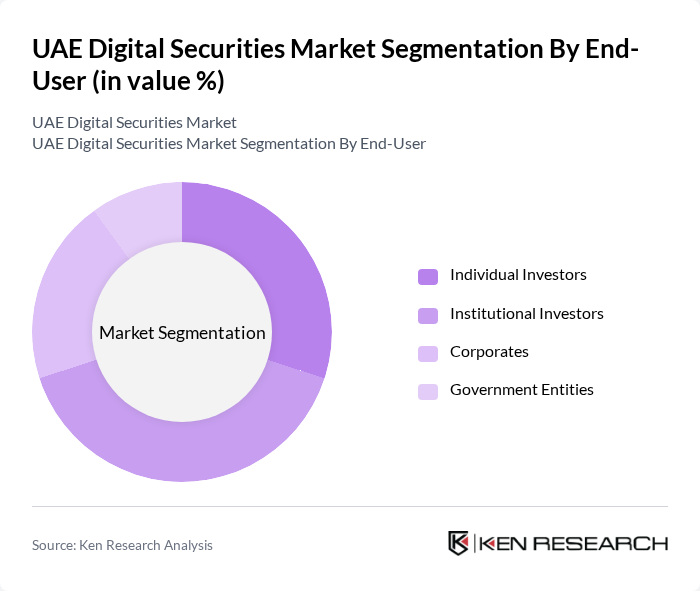

By End-User:The end-user segmentation includes individual investors, institutional investors, corporates, and government entities. Each group has distinct motivations and investment strategies, influencing their participation in the digital securities market.

The UAE Digital Securities Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Global Market, Dubai Financial Market, Emirates NBD, DGCX (Dubai Gold and Commodities Exchange), ADX (Abu Dhabi Securities Exchange), FTX Trading Ltd., Binance, BitOasis, Rain Financial, eToro, Crypto.com, CEX.IO, Huobi Global, OKEx, Kraken contribute to innovation, geographic expansion, and service delivery in this space.

The UAE digital securities market is poised for transformative growth, driven by technological advancements and increasing investor interest. In the future, the integration of artificial intelligence in trading platforms is expected to enhance decision-making processes, while the rise of decentralized finance (DeFi) will offer innovative investment avenues. Additionally, the focus on environmental, social, and governance (ESG) criteria will attract socially conscious investors, further diversifying the market landscape and promoting sustainable investment practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Tokens Debt Tokens Asset-Backed Tokens Utility Tokens Security Tokens Hybrid Tokens Others |

| By End-User | Individual Investors Institutional Investors Corporates Government Entities |

| By Investment Size | Small Investments Medium Investments Large Investments |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| By Market Maturity | Emerging Market Growth Market Established Market |

| By Geographic Focus | Domestic Market International Market |

| By User Experience Level | Novice Users Intermediate Users Advanced Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Institutional Investors in Digital Securities | 100 | Portfolio Managers, Investment Analysts |

| Regulatory Bodies and Compliance Officers | 50 | Regulators, Compliance Managers |

| Fintech Companies Offering Digital Securities | 80 | Founders, Product Managers |

| Retail Investors in Digital Assets | 120 | Individual Investors, Financial Advisors |

| Technology Providers for Blockchain Solutions | 70 | CTOs, Software Developers |

The UAE Digital Securities Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by blockchain technology adoption, regulatory advancements, and increased investor interest in digital assets.