Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3081

Pages:87

Published On:October 2025

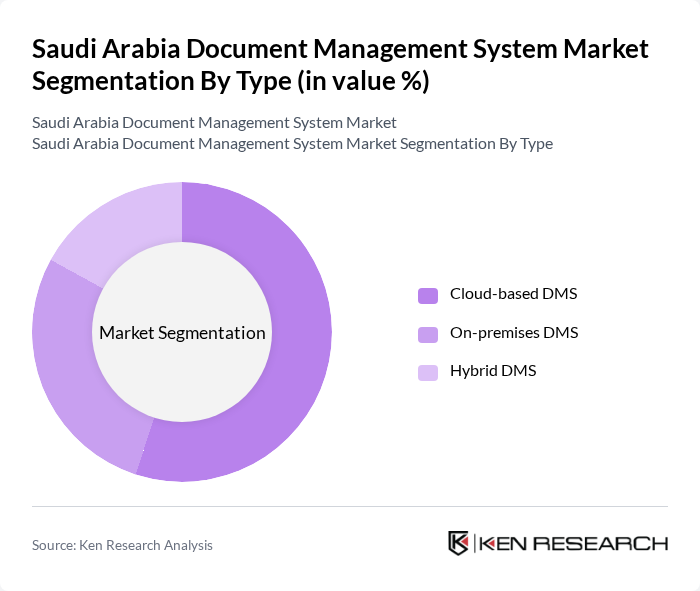

By Type:The market is segmented into three types: Cloud-based DMS, On-premises DMS, and Hybrid DMS. Each type serves different organizational needs based on their infrastructure and operational requirements.

TheCloud-based DMSsegment is leading the market due to its flexibility, scalability, and cost-effectiveness. Organizations are increasingly opting for cloud solutions to facilitate remote work, enhance collaboration, and support hybrid working models. TheOn-premises DMSsegment remains significant, particularly among large enterprises and government entities with stringent data residency and security requirements.Hybrid DMSis gaining traction as it combines the benefits of both cloud and on-premises solutions, catering to organizations with complex compliance or integration needs.

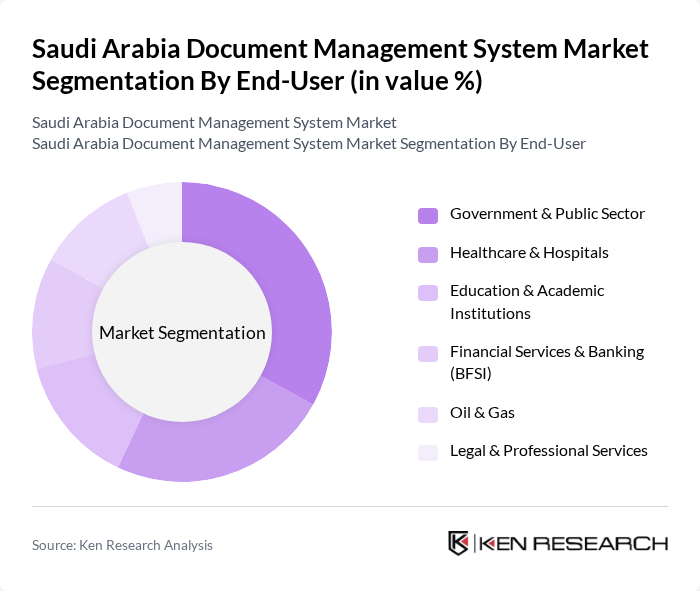

By End-User:The market is segmented into Government & Public Sector, Healthcare & Hospitals, Education & Academic Institutions, Financial Services & Banking (BFSI), Oil & Gas, and Legal & Professional Services. Each end-user segment has unique requirements and compliance standards.

TheGovernment & Public Sectorsegment is the largest end-user, driven by the need for transparency, compliance, and efficiency in public administration. TheHealthcaresector follows closely, as hospitals and clinics require robust document management for patient records and regulatory compliance. TheEducationsector is also adopting DMS solutions to streamline administrative processes and support digital learning environments.

The Saudi Arabia Document Management System Market is characterized by a dynamic mix of regional and international players. Leading participants such as OpenText Corporation, M-Files Corporation, DocuWare GmbH, Hyland Software, Inc., IBM Corporation, Microsoft Corporation (SharePoint, OneDrive), Laserfiche, Alfresco Software, Inc., Box, Inc., Zoho Corporation, Everteam (Everteam Software SAS), Xerox Holdings Corporation, Kyocera Document Solutions, Canon Middle East, Diyar United Company, Raqmiyat LLC, Newgen Software Technologies Ltd., DocuSign, Inc., Dropbox, Inc., SAP SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Document Management System market in Saudi Arabia appears promising, driven by ongoing digital transformation initiatives and increasing regulatory compliance demands. As organizations continue to embrace remote work, the need for efficient document management solutions will grow. Additionally, advancements in artificial intelligence and machine learning are expected to enhance DMS capabilities, making them more attractive to businesses. Overall, the market is poised for significant growth as companies recognize the value of streamlined document management in achieving operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-based DMS On-premises DMS Hybrid DMS |

| By End-User | Government & Public Sector Healthcare & Hospitals Education & Academic Institutions Financial Services & Banking (BFSI) Oil & Gas Legal & Professional Services |

| By Industry | Manufacturing Retail & E-commerce Telecommunications & IT Transportation and Logistics Construction & Real Estate |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Document Type | Text Documents Images Videos Audio Files Scanned Records |

| By Sales Channel | Direct Sales Online Sales Resellers & System Integrators |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Sector Document Management | 60 | IT Directors, Document Control Managers |

| Healthcare Document Solutions | 50 | Healthcare Administrators, IT Managers |

| Financial Services Document Management | 45 | Compliance Officers, Operations Managers |

| Education Sector Digitalization | 40 | IT Coordinators, Administrative Heads |

| Corporate Document Management Systems | 55 | Chief Information Officers, Project Managers |

The Saudi Arabia Document Management System market is valued at approximately USD 55 million, reflecting a growing demand for efficient document handling and compliance driven by digital transformation initiatives across various sectors.