Region:Middle East

Author(s):Geetanshi

Product Code:KRAB5710

Pages:83

Published On:October 2025

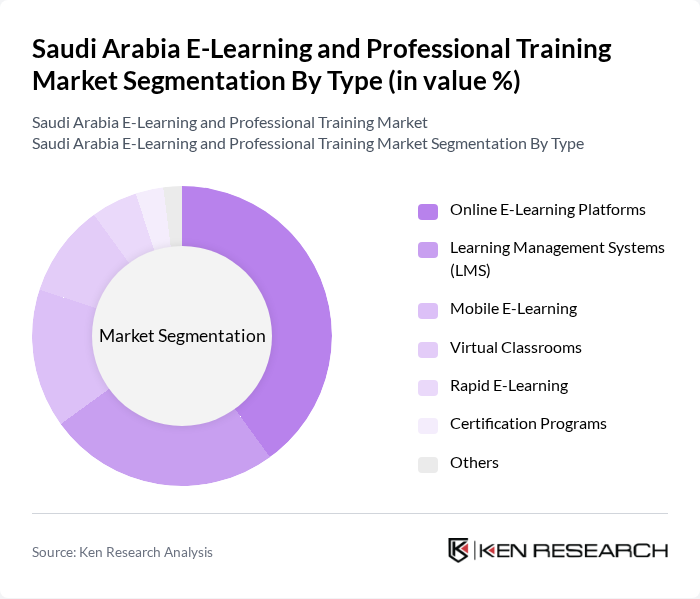

By Type:The market is segmented into Online E-Learning Platforms, Learning Management Systems (LMS), Mobile E-Learning, Virtual Classrooms, Rapid E-Learning, Certification Programs, and Others. Online E-Learning Platforms lead the segment due to their flexibility, accessibility, and ability to serve a wide range of learners. The increasing preference for self-paced learning, coupled with a diverse array of course offerings, has made this segment particularly prominent. LMS and mobile e-learning are also experiencing strong adoption, driven by corporate training needs and mobile-first strategies .

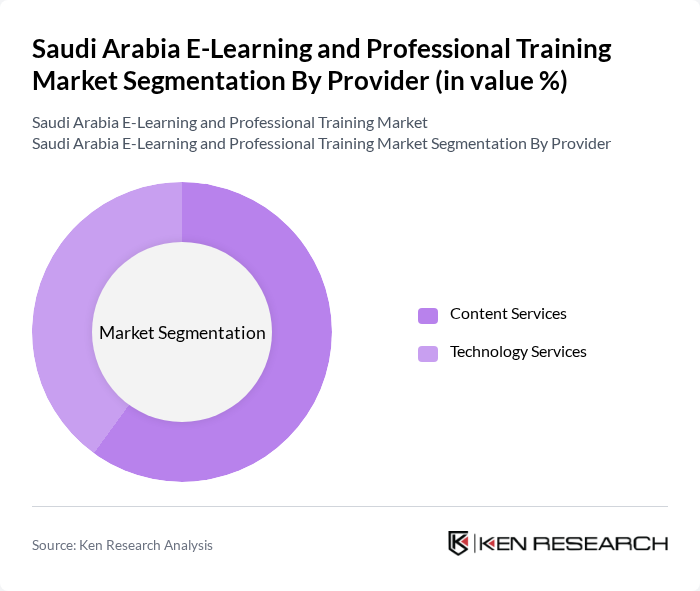

By Provider:The market is categorized into Content Services and Technology Services. Content Services dominate the market, driven by demand for tailored educational materials and resources that address specific needs of learners and organizations. The surge in high-quality, engaging content has led to significant investments in innovative learning materials, while Technology Services continue to expand, supporting platform development and integration .

The Saudi Arabia E-Learning and Professional Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rwaq, Tadarab, Tuwaiq Academy, Noon Academy, Classera, Madrasati (Ministry of Education Platform), Edraak, Nafham, Coursera, Udacity, FutureLearn, LinkedIn Learning, Skillshare, Khan Academy, Almentor, Maktabati, LearnSmart, Qasid Arabic Institute contribute to innovation, geographic expansion, and service delivery in this space.

The future of the e-learning and professional training market in Saudi Arabia appears promising, driven by technological advancements and increasing acceptance of digital education. As the government continues to invest in educational technology and infrastructure, the market is expected to witness significant growth. Additionally, the integration of artificial intelligence and personalized learning experiences will enhance the effectiveness of e-learning platforms, making them more appealing to both learners and educators, thereby fostering a more robust educational ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Online E-Learning Platforms Learning Management Systems (LMS) Mobile E-Learning Virtual Classrooms Rapid E-Learning Certification Programs Others |

| By Provider | Content Services Technology Services |

| By End-User | K-12 Schools Higher Education Vocational Training Corporates (SMEs & Large Enterprises) Government Agencies Individual/Home Users |

| By Application | Academic Learning Professional Development Compliance Training Skill Enhancement |

| By Content Type | Multimedia (Video, Audio, Interactive) Open Courseware Online Test & Assessment E-Books |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 E-Learning Programs | 100 | School Administrators, Curriculum Developers |

| Higher Education Online Courses | 80 | University Professors, Academic Deans |

| Corporate Training Solutions | 120 | HR Managers, Learning and Development Specialists |

| Professional Certification Programs | 70 | Certification Bodies, Training Providers |

| EdTech Startups and Innovations | 60 | Founders, Product Managers |

The Saudi Arabia E-Learning and Professional Training Market is valued at approximately USD 2.4 billion, reflecting significant growth driven by digital learning adoption, government initiatives like "Vision 2030," and increasing workforce demand for upskilling and reskilling.