Region:Asia

Author(s):Dev

Product Code:KRAA5134

Pages:97

Published On:September 2025

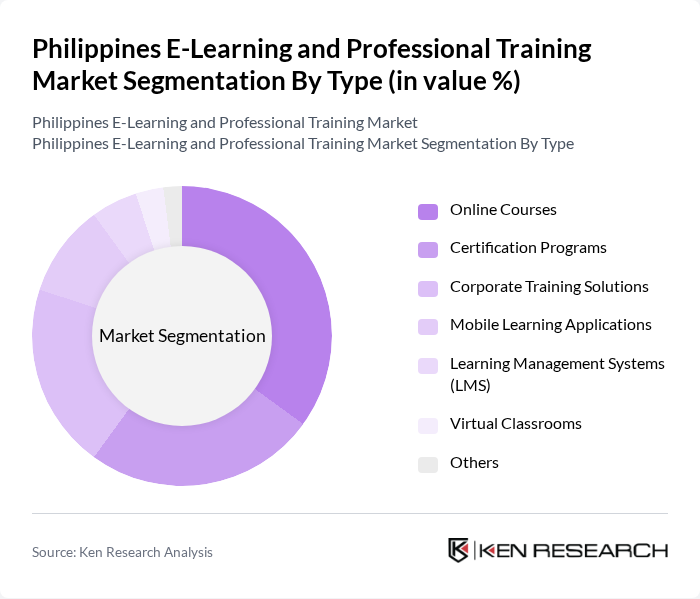

By Type:The market can be segmented into various types, including Online Courses, Certification Programs, Corporate Training Solutions, Mobile Learning Applications, Learning Management Systems (LMS), Virtual Classrooms, and Others. Among these, Online Courses have gained significant traction due to their flexibility and accessibility, allowing learners to study at their own pace. Certification Programs are also popular as they provide recognized qualifications that enhance employability. The demand for Corporate Training Solutions is rising as companies seek to upskill their workforce in a rapidly changing job market.

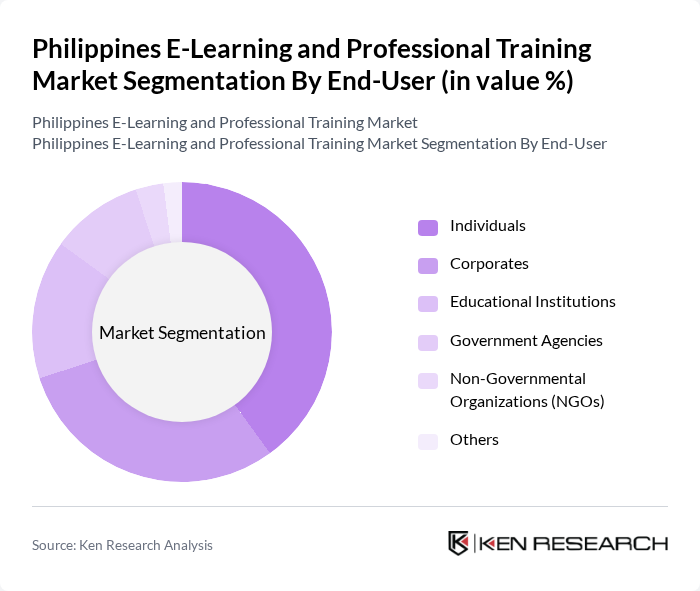

By End-User:The end-user segmentation includes Individuals, Corporates, Educational Institutions, Government Agencies, Non-Governmental Organizations (NGOs), and Others. Individuals are the largest segment, driven by the need for personal development and skill enhancement. Corporates are increasingly investing in training programs to improve employee performance and retention. Educational Institutions are also adopting e-learning solutions to complement traditional teaching methods, while Government Agencies and NGOs are focusing on capacity building and community education.

The Philippines E-Learning and Professional Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coursera, Udemy, LinkedIn Learning, Skillshare, edX, Pluralsight, Khan Academy, TESDA, Google Career Certificates, FutureLearn, Simplilearn, Alison, LearnDash, Teachable, Edureka contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines' e-learning and professional training market is poised for significant transformation, driven by technological advancements and changing workforce needs. As organizations increasingly adopt hybrid learning models, the integration of artificial intelligence and personalized learning experiences will become more prevalent. Additionally, the focus on soft skills development will gain momentum, aligning educational offerings with industry demands. These trends indicate a robust future for the market, fostering innovation and accessibility in education across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Certification Programs Corporate Training Solutions Mobile Learning Applications Learning Management Systems (LMS) Virtual Classrooms Others |

| By End-User | Individuals Corporates Educational Institutions Government Agencies Non-Governmental Organizations (NGOs) Others |

| By Application | Professional Development Academic Learning Compliance Training Skill Enhancement Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Others |

| By Content Type | Video-Based Learning Text-Based Learning Interactive Learning Modules Others |

| By Certification Type | Accredited Certifications Non-Accredited Certifications Micro-Credentials Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 E-Learning Platforms | 100 | School Administrators, Curriculum Developers |

| Higher Education Online Courses | 80 | University Professors, Academic Deans |

| Corporate Training Programs | 120 | HR Managers, Training Coordinators |

| Professional Development Workshops | 70 | Industry Trainers, Learning and Development Specialists |

| EdTech Startups | 90 | Founders, Product Managers |

The Philippines E-Learning and Professional Training Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by digital learning adoption, increased internet penetration, and the demand for upskilling in a competitive job market.