Region:Middle East

Author(s):Geetanshi

Product Code:KRAB6828

Pages:80

Published On:October 2025

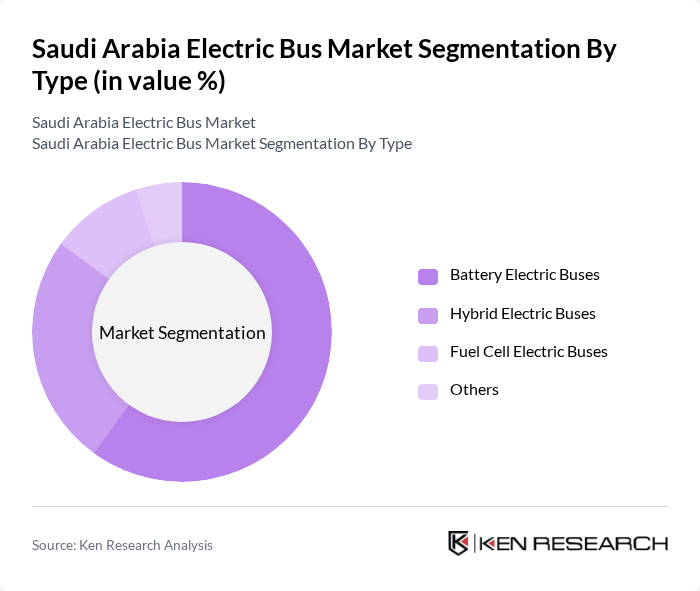

By Type:The electric bus market can be segmented into various types, including Battery Electric Buses, Hybrid Electric Buses, Fuel Cell Electric Buses, and Others. Among these, Battery Electric Buses are leading the market due to their zero-emission capabilities and advancements in battery technology, making them a preferred choice for urban transport. Hybrid Electric Buses are also gaining traction, particularly in areas where charging infrastructure is still developing. Fuel Cell Electric Buses, while less common, are being explored for their long-range capabilities and quick refueling times. The "Others" category includes niche products that cater to specific market needs.

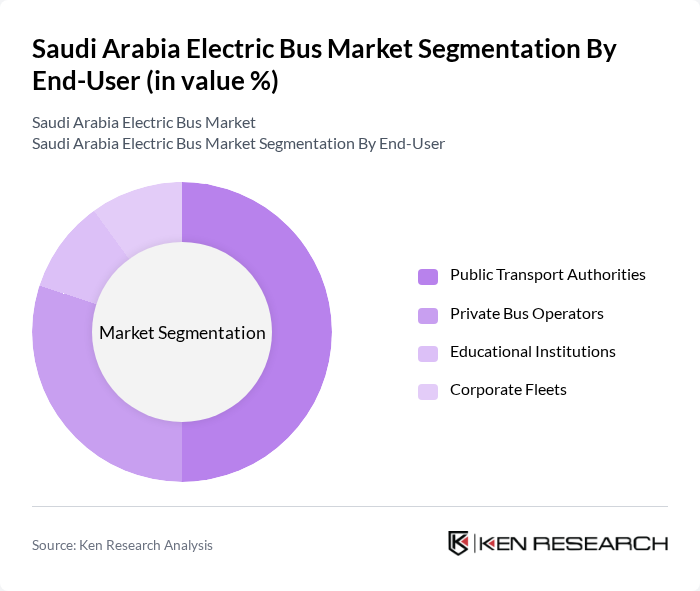

By End-User:The market is segmented by end-users, including Public Transport Authorities, Private Bus Operators, Educational Institutions, and Corporate Fleets. Public Transport Authorities are the dominant segment, driven by government initiatives to electrify public transport systems. Private Bus Operators are also significant, as they seek to reduce operational costs and improve service efficiency. Educational Institutions are increasingly adopting electric buses for student transport, while Corporate Fleets are exploring electric options to enhance their sustainability profiles.

The Saudi Arabia Electric Bus Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Babtain Power & Telecommunication, BYD Company Limited, MAN Truck & Bus SE, Scania AB, Volvo Buses, Daimler AG, Iveco S.p.A., New Flyer Industries, Proterra Inc., NFI Group Inc., Solaris Bus & Coach S.A., Alexander Dennis Limited, Gillig LLC, Wrightbus Limited, and Optare Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric bus market in Saudi Arabia appears promising, driven by government initiatives and increasing public demand for sustainable transport solutions. As urbanization continues, the need for efficient public transport systems will grow, prompting further investments in electric bus fleets. Additionally, advancements in battery technology and charging infrastructure development are expected to enhance the viability of electric buses, making them a preferred choice for public transport authorities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Battery Electric Buses Hybrid Electric Buses Fuel Cell Electric Buses Others |

| By End-User | Public Transport Authorities Private Bus Operators Educational Institutions Corporate Fleets |

| By Application | Urban Transit Intercity Transport Shuttle Services Others |

| By Charging Infrastructure | Depot Charging Opportunity Charging Fast Charging Stations Others |

| By Fleet Size | Small Fleets (1-10 Buses) Medium Fleets (11-50 Buses) Large Fleets (51+ Buses) Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Policy Support | Government Subsidies Tax Incentives Grants for Infrastructure Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transport Authorities | 100 | Transport Directors, Policy Makers |

| Electric Bus Manufacturers | 80 | Sales Managers, Product Development Heads |

| Urban Commuters | 150 | Daily Bus Users, Public Transport Advocates |

| Government Regulatory Bodies | 60 | Environmental Policy Analysts, Transportation Planners |

| Infrastructure Developers | 70 | Project Managers, Urban Planners |

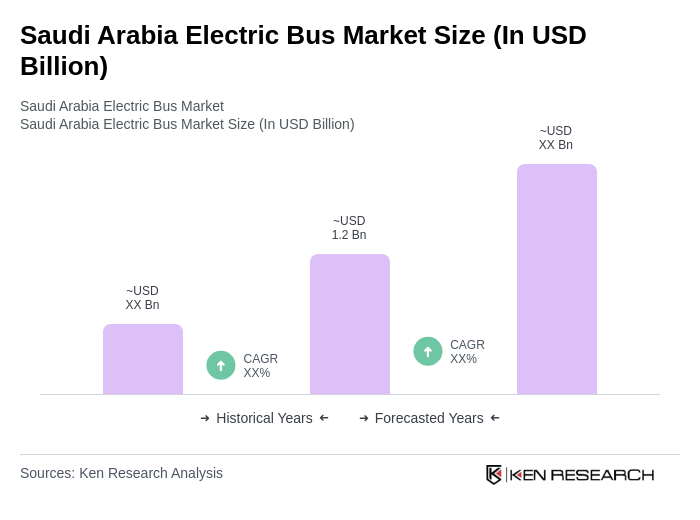

The Saudi Arabia Electric Bus Market is valued at approximately USD 1.2 billion, driven by government initiatives for sustainable transportation, urbanization, and advancements in battery technology, which enhance the feasibility of electric buses in urban settings.