Region:Middle East

Author(s):Rebecca

Product Code:KRAD4342

Pages:85

Published On:December 2025

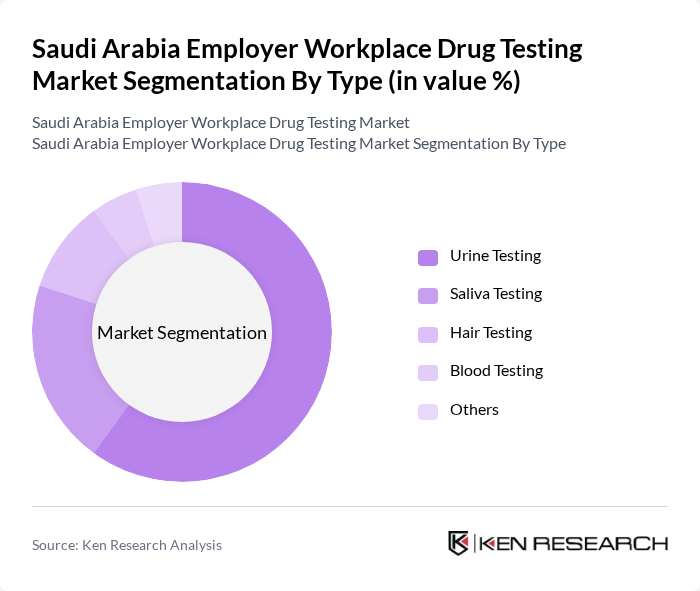

By Type:The market is segmented into various testing types, including urine testing, saliva testing, hair testing, blood testing, and others. Among these, urine testing is the most widely used method due to its cost-effectiveness and reliability in detecting a range of substances. Saliva testing is gaining traction for its non-invasive nature and quick results, while hair testing is preferred for long-term substance use detection. Blood testing, although less common, is utilized in specific scenarios requiring immediate results.

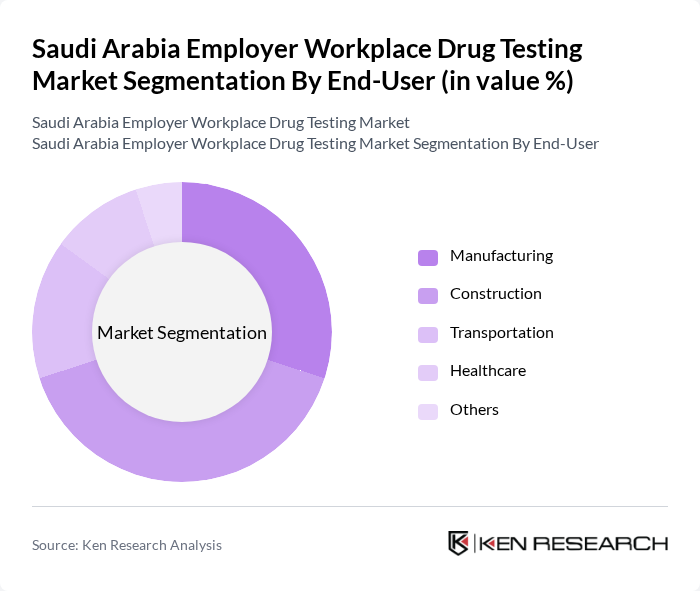

By End-User:The end-user segmentation includes manufacturing, construction, transportation, healthcare, and others. The construction sector is the largest consumer of drug testing services due to the high-risk nature of the work and the need for compliance with safety regulations. Manufacturing and transportation also represent significant segments, as companies in these industries prioritize employee safety and productivity. The healthcare sector is increasingly adopting drug testing to ensure the safety of both staff and patients.

The Saudi Arabia Employer Workplace Drug Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Harbi Trading & Contracting, Al-Faisal Holding, Al-Muhaidib Group, Al-Jazira Group, Al-Suwaidi Industrial Services, Al-Rajhi Holding, Al-Mabani General Contractors, Al-Khodari & Sons, Al-Babtain Group, Al-Muhaidib Contracting, Al-Fahd Group, Al-Salam International, Al-Mansour Group, Al-Hokair Group, Al-Saad Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia employer workplace drug testing market appears promising, driven by increasing regulatory pressures and a cultural shift towards prioritizing employee well-being. As companies invest in advanced testing technologies and integrate mental health initiatives, the demand for efficient drug testing solutions is expected to rise. Furthermore, the ongoing expansion of industries such as construction and transportation will likely necessitate more robust drug testing protocols, ensuring safer work environments and compliance with government regulations.

| Segment | Sub-Segments |

|---|---|

| By Type | Urine Testing Saliva Testing Hair Testing Blood Testing Others |

| By End-User | Manufacturing Construction Transportation Healthcare Others |

| By Testing Frequency | Pre-employment Testing Random Testing Post-accident Testing Routine Testing Others |

| By Substance Type | Marijuana Cocaine Opiates Amphetamines Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Company Size | Large Enterprises Medium Enterprises Small Enterprises Others |

| By Policy Support | Government Initiatives Corporate Policies Industry Standards Others |

The Saudi Arabia Employer Workplace Drug Testing Market is valued at approximately USD 150 million, reflecting a significant growth driven by increased awareness of workplace safety, stringent regulations, and rising substance abuse among employees.