Region:Middle East

Author(s):Shubham

Product Code:KRAC2242

Pages:86

Published On:October 2025

By Type:The market is segmented into various testing types, including Urine Testing, Hair Testing, Saliva Testing (Oral Fluid Testing), Blood Testing, Breath Testing, Rapid Testing Kits (Point-of-Care), Laboratory-based Confirmation Testing, and Others. Urine Testing remains the most widely used method due to its cost-effectiveness and reliability in detecting a broad range of substances. Hair Testing is gaining traction for its longer detection window, while Rapid Testing Kits are increasingly favored for their convenience and quick turnaround times. Laboratory-based confirmation testing is essential for validating initial positive results and ensuring regulatory compliance .

By End-User:The market is segmented by end-users, including Construction, Transportation & Logistics, Healthcare, Manufacturing, Energy & Utilities, Government & Public Sector, Oil & Gas, Hospitality & Tourism, and Others. The Construction sector is the largest end-user due to the high-risk nature of the industry, where drug testing is essential for ensuring safety on job sites. The Transportation & Logistics sector also plays a significant role, driven by regulations requiring drug testing for drivers and operators. Healthcare and manufacturing sectors are increasingly adopting testing protocols to maintain compliance and minimize liability .

The UAE Employer Workplace Drug Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Medical Supplies, Mediserv, Labcorp Holdings Inc., Quest Diagnostics Inc., Omega Laboratories, Aegis Sciences Corporation, Concentra, Health Street, DrugScan, Al Ain Medical Supplies, Emirates Health Services, Detecht, MedLab, BioScreen, DrugFree, First Advantage Corporation, Abbott Laboratories, Bio-Rad Laboratories Inc., Clinical Reference Laboratory, Cordant Health Solutions, DISA Global Solutions, HireRight Holdings Corporation, OraSure Technologies Inc., Psychemedics Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE employer workplace drug testing market appears promising, driven by ongoing regulatory support and a growing emphasis on employee well-being. As organizations increasingly recognize the importance of maintaining a drug-free environment, the demand for innovative testing solutions is expected to rise. Furthermore, the integration of advanced technologies, such as AI and mobile testing units, will likely enhance testing efficiency and accessibility, paving the way for broader adoption across various sectors in the UAE.

| Segment | Sub-Segments |

|---|---|

| By Type | Urine Testing Hair Testing Saliva Testing (Oral Fluid Testing) Blood Testing Breath Testing Rapid Testing Kits (Point-of-Care) Laboratory-based Confirmation Testing Others |

| By End-User | Construction Transportation & Logistics Healthcare Manufacturing Energy & Utilities Government & Public Sector Oil & Gas Hospitality & Tourism Others |

| By Testing Frequency | Pre-employment Testing Random Testing Post-accident/Incident Testing Reasonable Suspicion/Cause Testing Periodic/Annual Testing Return-to-Duty Testing Follow-up Testing Others |

| By Sample Type | Biological Samples (Urine, Blood, Saliva, Hair) Non-biological Samples Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain Others |

| By Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| By Service Type | In-house Testing Services Outsourced Testing Services Consulting & Compliance Services Mobile/On-site Testing Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Sector Drug Testing Policies | 120 | HR Managers, Compliance Officers |

| Healthcare Industry Testing Practices | 90 | Medical Directors, Safety Officers |

| Construction Industry Drug Testing Implementation | 60 | Site Managers, Safety Supervisors |

| Transport and Logistics Sector Testing Protocols | 50 | Fleet Managers, Operations Managers |

| Hospitality Industry Drug Testing Approaches | 40 | HR Directors, Operations Managers |

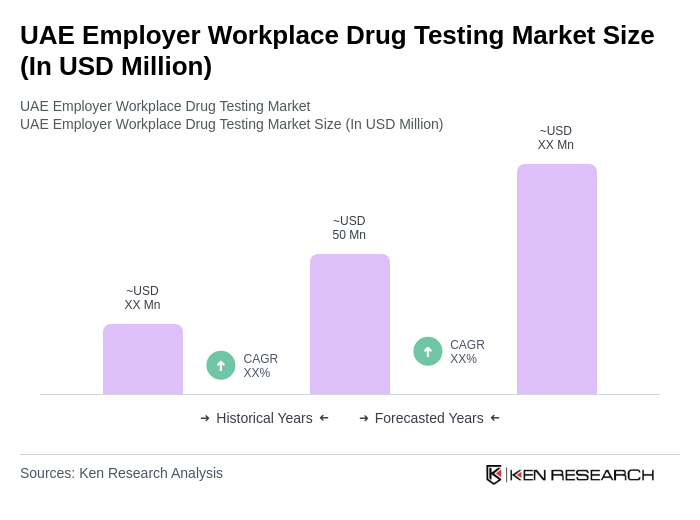

The UAE Employer Workplace Drug Testing Market is valued at approximately USD 50 million, reflecting a five-year historical analysis. This growth is attributed to increased awareness of workplace safety and stricter regulatory enforcement.