Region:Middle East

Author(s):Shubham

Product Code:KRAC2263

Pages:81

Published On:October 2025

By Type:The market is segmented into Building Energy Management Systems (BEMS), HVAC Control Systems, Lighting Control Systems, Insulation Materials, Renewable Energy Integration (e.g., Solar PV, Solar Thermal), Water Conservation Technologies, Security and Access Control Systems, Fire Protection Systems, and Others. Each segment is integral to enhancing building energy efficiency: BEMS and HVAC Control Systems enable real-time monitoring and optimization of energy use; Lighting Control Systems reduce unnecessary consumption; Insulation Materials improve thermal performance; Renewable Energy Integration supports on-site generation; Water Conservation Technologies minimize resource waste; Security and Access Control Systems and Fire Protection Systems contribute to operational efficiency and safety .

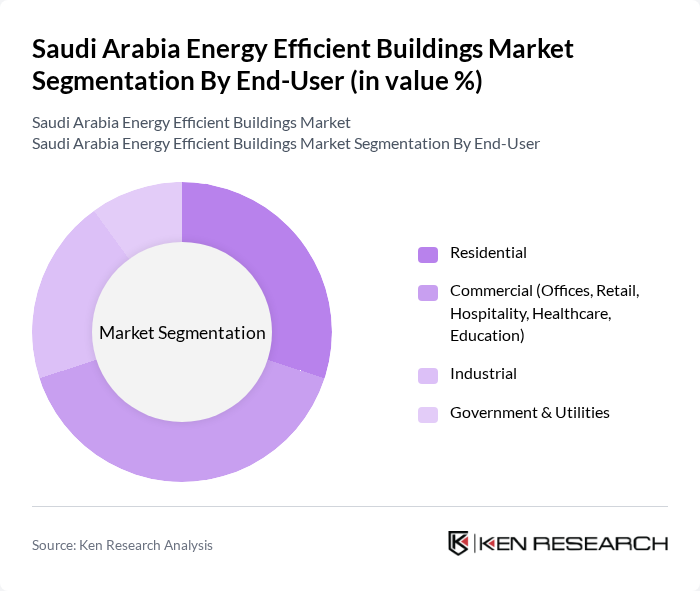

By End-User:The end-user segmentation includes Residential, Commercial (Offices, Retail, Hospitality, Healthcare, Education), Industrial, and Government & Utilities. Residential buildings increasingly adopt smart energy management and insulation to lower utility costs and improve comfort. Commercial buildings leverage advanced HVAC, lighting, and BEMS solutions for operational efficiency and sustainability certifications. Industrial facilities focus on automation and resource conservation, while Government & Utilities drive market adoption through public sector projects and regulatory compliance .

The Saudi Arabia Energy Efficient Buildings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco, Saudi Electricity Company (SEC), Zamil Industrial Investment Co. (Zamil Industrial), Al Salem Johnson Controls (YORK KSA), Alfanar, Nesma & Partners Contracting Co. Ltd., Abdullah A.M. Al-Khodari Sons Company, ElSeif Engineering Contracting Company, Al Fouzan Trading & General Construction Co., Al Kifah Holding Company, Al Zamil Group, Al Othaim Holding, Schneider Electric Saudi Arabia, Siemens Saudi Arabia, Honeywell Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the energy-efficient buildings market in Saudi Arabia appears promising, driven by increasing government support and technological advancements. As the nation continues to prioritize sustainability, the integration of smart building technologies and renewable energy sources will likely become standard practice. Furthermore, the expansion of green building certifications will encourage developers to adopt energy-efficient practices, fostering a competitive market that aligns with global sustainability trends and local environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Building Energy Management Systems (BEMS) HVAC Control Systems Lighting Control Systems Insulation Materials Renewable Energy Integration (e.g., Solar PV, Solar Thermal) Water Conservation Technologies Security and Access Control Systems Fire Protection Systems Others |

| By End-User | Residential Commercial (Offices, Retail, Hospitality, Healthcare, Education) Industrial Government & Utilities |

| By Application | New Construction Renovation Retrofitting Maintenance |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Price Range | Low-End Mid-Range High-End |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Energy-Efficient Buildings | 120 | Homeowners, Architects, Energy Consultants |

| Commercial Building Projects | 90 | Facility Managers, Project Managers, Developers |

| Government Initiatives on Energy Efficiency | 60 | Policy Makers, Regulatory Authorities, Energy Officials |

| Construction Firms Implementing Energy Solutions | 50 | Construction Managers, Sustainability Officers, Engineers |

| End-User Adoption of Energy-Efficient Technologies | 70 | Homeowners, Tenants, Business Owners |

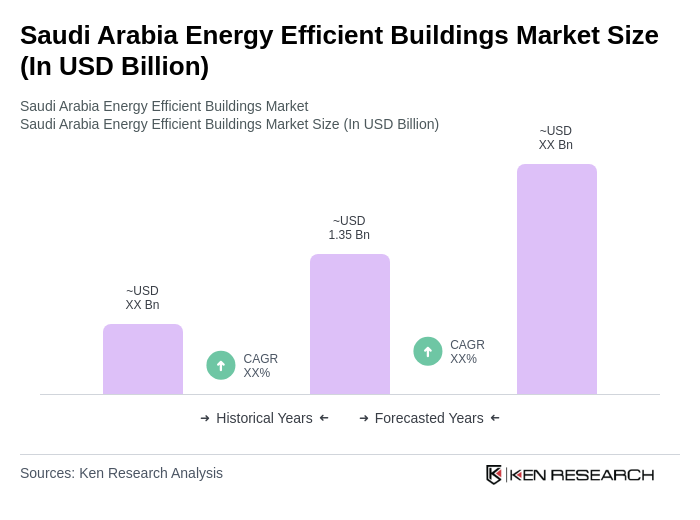

The Saudi Arabia Energy Efficient Buildings Market is valued at approximately USD 1.35 billion, driven by government initiatives, urbanization, and advancements in building technologies aimed at enhancing energy efficiency and sustainability.