Region:Middle East

Author(s):Shubham

Product Code:KRAE0332

Pages:93

Published On:December 2025

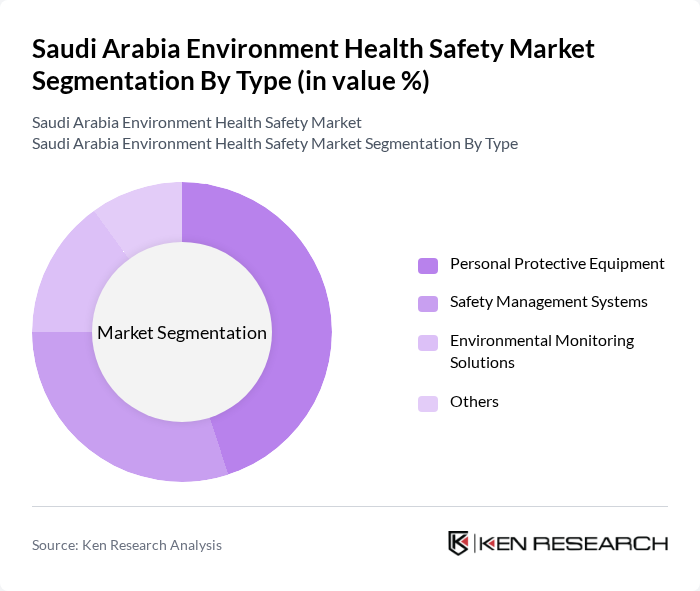

By Type:The market is segmented into various types, including Personal Protective Equipment, Safety Management Systems, Environmental Monitoring Solutions, and Others. Among these, Personal Protective Equipment (PPE) is the leading sub-segment, driven by stringent safety regulations and increasing awareness of workplace safety. The demand for PPE is particularly high in sectors such as construction and oil & gas, where the risk of accidents is significant. Safety Management Systems are also gaining traction as organizations seek to streamline compliance and enhance safety protocols.

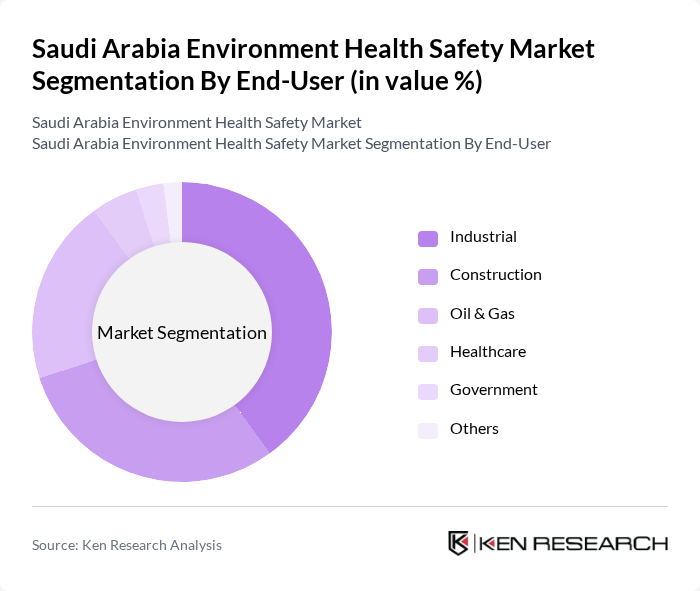

By End-User:The market is categorized by end-users, including Industrial, Construction, Oil & Gas, Healthcare, Government, and Others. The Industrial sector is the dominant end-user, driven by the need for compliance with safety regulations and the implementation of safety management systems. The Construction sector follows closely, as it is heavily regulated and requires extensive safety measures due to the high-risk nature of the work. The Oil & Gas sector also significantly contributes to the market, given the inherent risks associated with operations in this field.

The Saudi Arabia Environment Health Safety Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco, SABIC, National Industrialization Company (Tasnee), Ma'aden, Alfanar, Saudi Electricity Company, Saudi Arabian Oil Company (Saudi Aramco), Al-Hokair Group, Al-Futtaim Engineering, AECOM, Jacobs Engineering, Golder Associates, Bureau Veritas, SGS, Intertek contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia Environment Health Safety market appears promising, driven by ongoing regulatory reforms and a growing emphasis on sustainable practices. As industries adapt to new environmental standards, the integration of advanced technologies such as AI and IoT will enhance EHS management. Furthermore, the increasing focus on employee well-being and mental health will likely shape EHS strategies, ensuring a holistic approach to workplace safety and environmental stewardship in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Protective Equipment Safety Management Systems Environmental Monitoring Solutions Others |

| By End-User | Industrial Construction Oil & Gas Healthcare Government Others |

| By Region | Central Eastern Western Southern |

| By Application | Risk Assessment Compliance Management Incident Management Others |

| By Investment Source | Public Sector Private Sector International Funding Others |

| By Policy Support | Incentives Grants Subsidies Others |

| By Technology | Software Solutions Hardware Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Safety Compliance | 100 | Safety Managers, Project Supervisors |

| Healthcare Environmental Standards | 80 | Health and Safety Officers, Facility Managers |

| Manufacturing Sector EHS Practices | 90 | Environmental Managers, Compliance Officers |

| Oil and Gas Industry Safety Protocols | 70 | Operations Managers, Safety Engineers |

| Public Health and Safety Initiatives | 60 | Public Health Officials, Community Health Workers |

The Saudi Arabia Environment Health Safety Market is valued at approximately USD 1.5 billion, reflecting a significant growth driven by regulatory compliance, workplace safety awareness, and environmental protection measures across various industries.