Region:Middle East

Author(s):Rebecca

Product Code:KRAD0333

Pages:90

Published On:August 2025

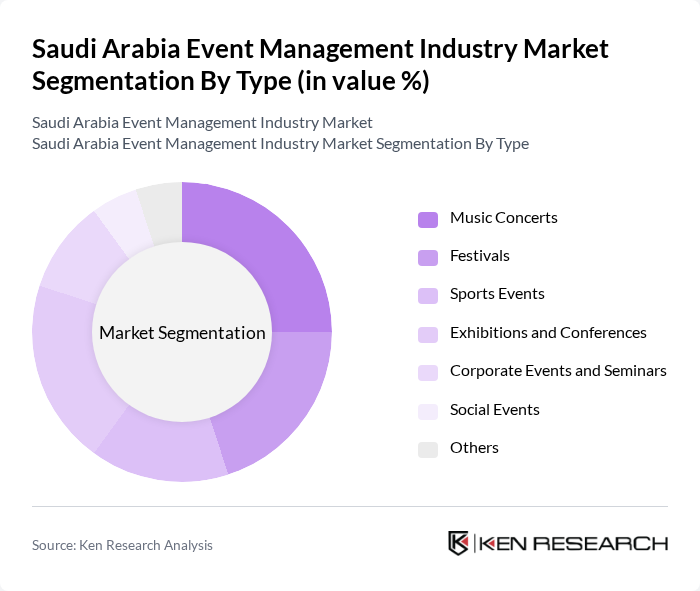

By Type:The event management industry in Saudi Arabia is segmented into various types, including music concerts, festivals, sports events, exhibitions and conferences, corporate events and seminars, social events, and others. Each of these segments caters to different audiences and purposes, contributing to the overall market dynamics. Music concerts and festivals have gained significant popularity, driven by the increasing demand for entertainment and cultural experiences. Corporate events and exhibitions are also prominent, reflecting the growing business activities in the region. The adoption of hybrid and virtual event formats is also rising, especially for conferences and seminars, as organizations seek to expand reach and engagement .

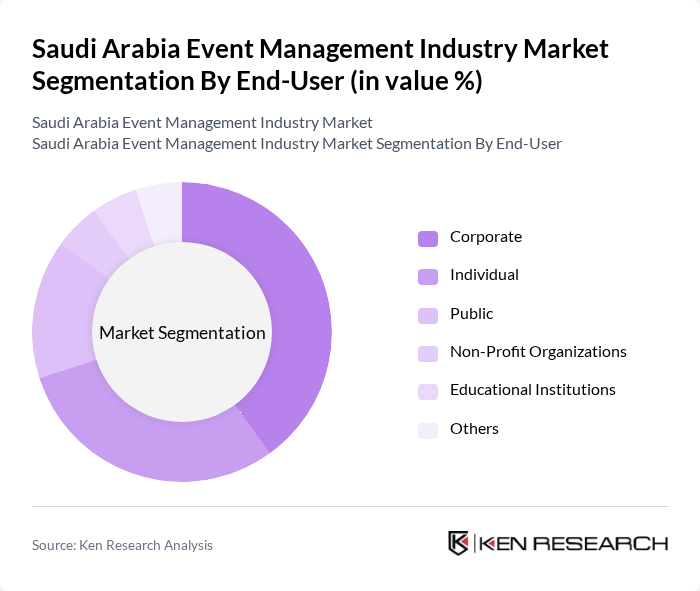

By End-User:The end-user segmentation of the event management industry includes corporate clients, individuals, public entities, non-profit organizations, educational institutions, and others. Corporate clients are the largest segment, driven by the need for business meetings, product launches, and networking events. Individuals also contribute significantly, particularly for social events like weddings and private parties. Public entities and non-profits engage in events to promote community engagement and awareness. Educational institutions are increasingly organizing academic conferences and student events, reflecting the sector's diversification .

The Saudi Arabia Event Management Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Informa Markets, MICE Arabia Group, Sela Sport Company, Benchmark Events, Eventive, Al-Faisaliah Events, Live Nation Middle East, Al-Mansour Group, General Entertainment Authority (GEA), Al-Jazirah Events, Event Management Solutions, Al-Muhaidib Group, TCE Group, Al-Muhaidib Events, Eventus contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia event management industry appears promising, driven by ongoing government support and a growing appetite for diverse events. As the Kingdom continues to invest in tourism and entertainment, the demand for innovative event solutions will rise. Additionally, the integration of technology and sustainability practices will shape the industry's evolution, ensuring that event organizers can meet the expectations of a more discerning audience while enhancing operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Music Concerts Festivals Sports Events Exhibitions and Conferences Corporate Events and Seminars Social Events Others |

| By End-User | Corporate Individual Public Non-Profit Organizations Educational Institutions Others |

| By Venue Type | Indoor Venues Outdoor Venues Virtual Platforms Hybrid Venues Others |

| By Service Type | Event Planning Event Marketing Logistics and Operations Audio-Visual Services Catering Services Others |

| By Duration | One-Day Events Multi-Day Events Ongoing Series of Events Others |

| By Geographic Distribution | Central Region Eastern Region Western Region Southern Region Others |

| By Client Type | B2B Clients B2C Clients Government Clients International Clients Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Event Management | 100 | Event Managers, Corporate Executives |

| Wedding and Social Events | 60 | Wedding Planners, Venue Owners |

| Cultural and Festival Events | 50 | Event Coordinators, Cultural Affairs Officers |

| Exhibitions and Trade Shows | 70 | Exhibition Managers, Marketing Directors |

| Virtual and Hybrid Events | 40 | Technology Providers, Event Technicians |

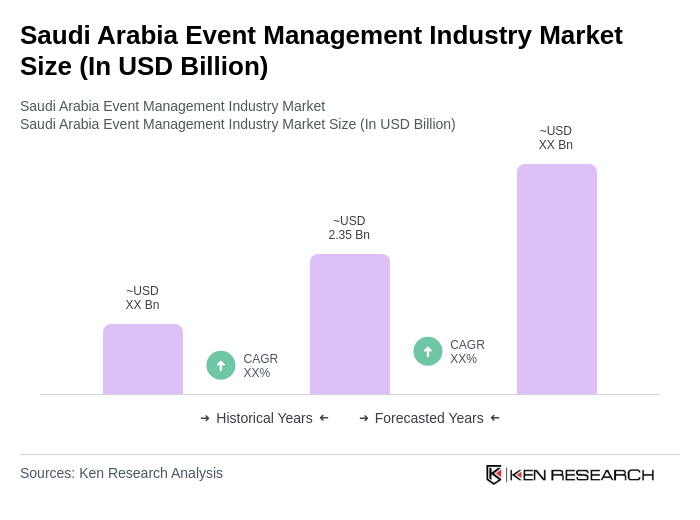

The Saudi Arabia Event Management Industry Market is valued at approximately USD 2.35 billion, reflecting significant growth driven by an increase in corporate events, exhibitions, and entertainment activities, supported by government initiatives under the Vision 2030 plan.