Region:Middle East

Author(s):Shubham

Product Code:KRAA8838

Pages:98

Published On:November 2025

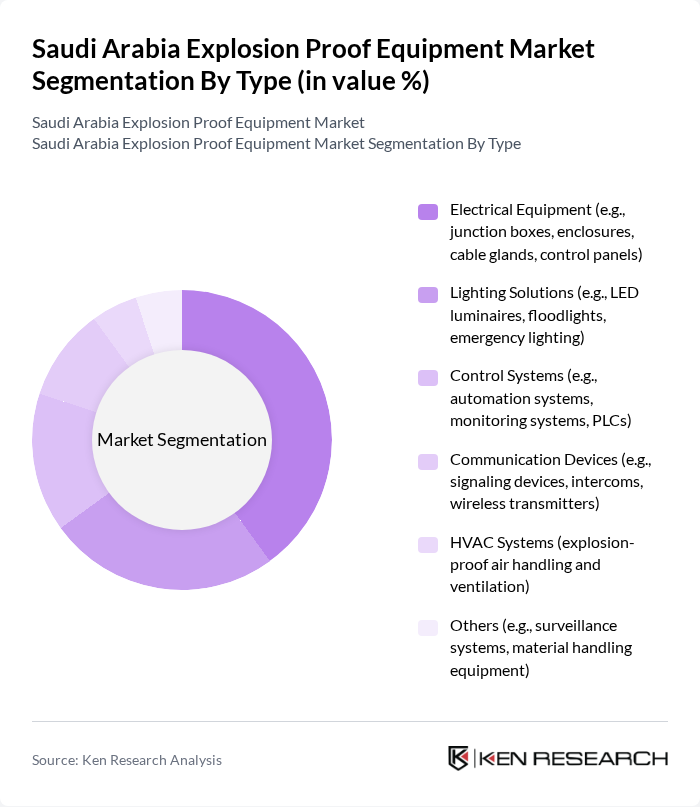

By Type:

The explosion-proof equipment market is segmented into various types, including Electrical Equipment, Lighting Solutions, Control Systems, Communication Devices, HVAC Systems, and Others. Among these, Electrical Equipment, which includes junction boxes, enclosures, cable glands, and control panels, is the leading sub-segment. This dominance is attributed to the critical role electrical components play in ensuring safety in hazardous environments, particularly in the oil and gas and chemical industries. The increasing focus on safety regulations and standards has further propelled the demand for high-quality electrical equipment, making it a key driver in the market .

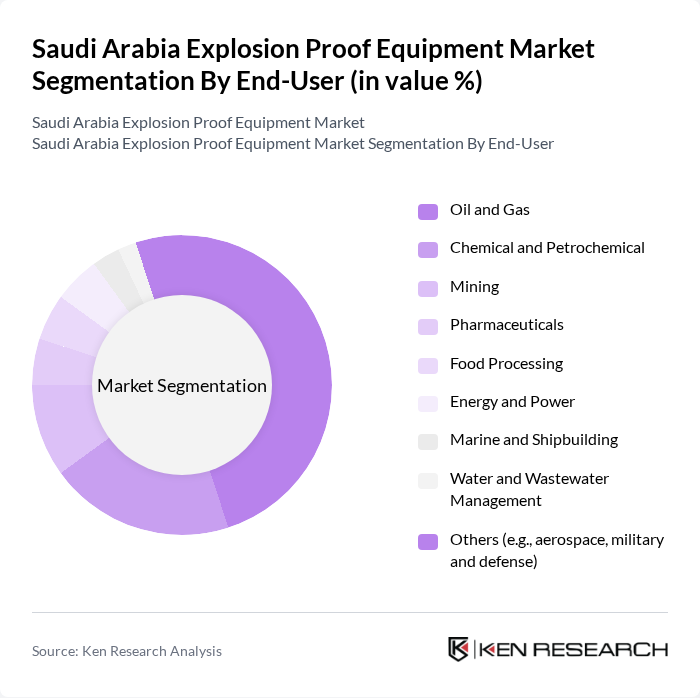

By End-User:

The end-user segmentation of the explosion-proof equipment market includes Oil and Gas, Chemical and Petrochemical, Mining, Pharmaceuticals, Food Processing, Energy and Power, Marine and Shipbuilding, Water and Wastewater Management, and Others. The Oil and Gas sector is the dominant end-user, driven by the high-risk nature of operations in this industry, which necessitates stringent safety measures. The increasing exploration and production activities in Saudi Arabia's oil fields further enhance the demand for explosion-proof equipment, making it a critical segment in the market .

The Saudi Arabia Explosion Proof Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., Siemens AG, Schneider Electric SE, Eaton Corporation plc, Honeywell International Inc., R. STAHL AG, Emerson Electric Co., Extronics Ltd., BARTEC GmbH, Pepperl+Fuchs SE, Atexor Oy, Crouse-Hinds (Eaton), Intertek Group plc, UL Solutions Inc., TÜV Rheinland AG, Al-Babtain Power & Telecom Co., National Oilwell Varco (NOV Inc.), Cooper Industries (Eaton), Hawke International (a division of Hubbell Ltd.), Weidmüller Interface GmbH & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the explosion-proof equipment market in Saudi Arabia appears promising, driven by ongoing industrialization and a strong focus on safety compliance. As the government continues to enforce stringent regulations, companies are likely to invest in advanced technologies. Additionally, the integration of IoT and smart technologies into explosion-proof equipment will enhance operational efficiency and safety. This trend, coupled with the expansion of the oil and gas sector, positions the market for substantial growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Electrical Equipment (e.g., junction boxes, enclosures, cable glands, control panels) Lighting Solutions (e.g., LED luminaires, floodlights, emergency lighting) Control Systems (e.g., automation systems, monitoring systems, PLCs) Communication Devices (e.g., signaling devices, intercoms, wireless transmitters) HVAC Systems (explosion-proof air handling and ventilation) Others (e.g., surveillance systems, material handling equipment) |

| By End-User | Oil and Gas Chemical and Petrochemical Mining Pharmaceuticals Food Processing Energy and Power Marine and Shipbuilding Water and Wastewater Management Others (e.g., aerospace, military and defense) |

| By Industry | Manufacturing Construction Transportation Utilities Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Application | Hazardous Locations (Zone 0, Zone 1, Zone 2, Zone 20, Zone 21, Zone 22) Non-Hazardous Locations Maintenance and Repair Others |

| By Technology / Method of Protection | Intrinsic Safety Flameproof / Explosion Containment Increased Safety Explosion Prevention Explosion Segregation Others |

| By Location | Indoor Outdoor |

| By Policy Support | Government Subsidies Tax Incentives Compliance Assistance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Equipment Usage | 60 | Safety Managers, Operations Managers |

| Chemical Manufacturing Compliance | 50 | Procurement Officers, Compliance Specialists |

| Construction Industry Safety Practices | 40 | Site Managers, Safety Officers |

| Mining Sector Equipment Standards | 40 | Engineering Managers, Safety Inspectors |

| Food Processing Safety Equipment | 40 | Quality Assurance Managers, Production Supervisors |

The Saudi Arabia Explosion Proof Equipment Market is valued at approximately USD 240 million, driven by the increasing demand for safety and compliance in hazardous environments, particularly in the oil and gas, chemical, and petrochemical sectors.