Region:Asia

Author(s):Geetanshi

Product Code:KRAC3096

Pages:98

Published On:October 2025

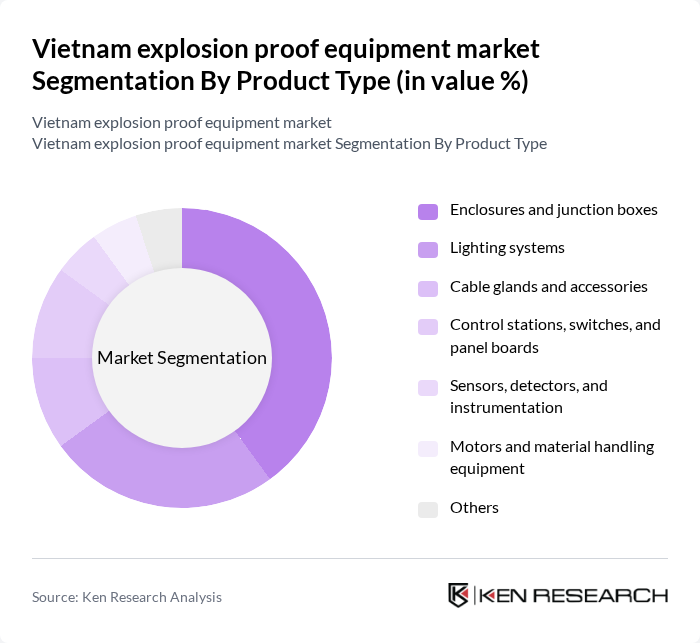

By Product Type:The product type segmentation includes various categories of explosion-proof equipment that cater to different industrial needs. The dominant sub-segment in this category is enclosures and junction boxes, which are essential for protecting electrical connections and control components in hazardous environments and are widely used across oil and gas, chemical manufacturing, and general industrial facilities. The increasing focus on safety regulations, adoption of certified electrical systems, and expansion of process industries such as petrochemicals, mining, and food processing have driven the demand for these products. Other notable sub-segments include lighting systems and control stations, which also play critical roles in ensuring visibility, operational continuity, and safe control of processes in classified hazardous zones.

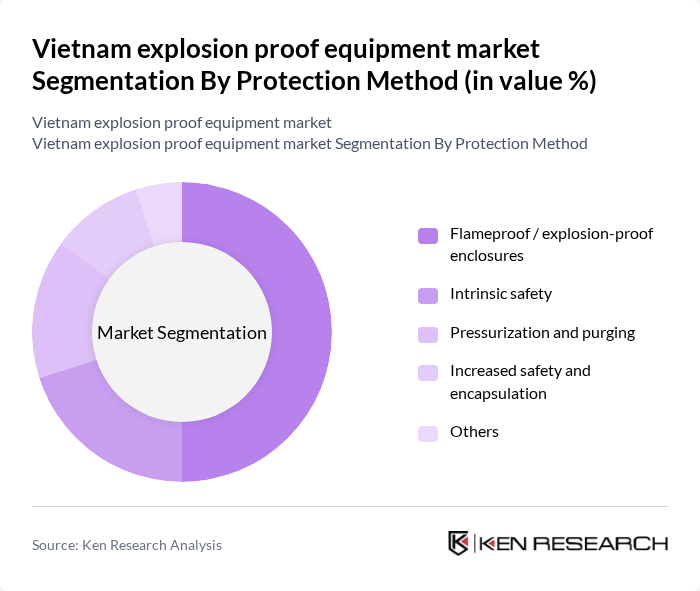

By Protection Method:The protection method segmentation categorizes explosion-proof equipment based on the technology used to prevent explosions. The leading sub-segment is flameproof/explosion-proof enclosures, which are designed to withstand and contain any internal explosion, preventing it from igniting the surrounding explosive atmosphere and are extensively used for motors, switchgear, junction boxes, and control panels in high-risk zones. This method is particularly favored in industries with high explosion risks, such as oil and gas and chemical manufacturing. Other methods, such as intrinsic safety and pressurization, are also gaining traction as industries increase automation, deploy more field instrumentation, and upgrade to smart sensors and control systems that must operate safely in hazardous areas.

The Vietnam explosion proof equipment market is characterized by a dynamic mix of regional and international players. Leading participants such as Schneider Electric SE, Siemens AG, Eaton Corporation plc, R. STAHL AG, Honeywell International Inc., ABB Ltd., Emerson Electric Co., Rockwell Automation, Inc., Adalet (a division of Scott Fetzer Company), Pepperl+Fuchs SE, Fluke Corporation, Crouse-Hinds (Eaton), Extronics Ltd., Tofino Security (Belden Inc.), Atexor Oy contribute to innovation, geographic expansion, and service delivery in this space, supplying a broad range of certified electrical equipment, lighting, junction boxes, control systems, and instrumentation for hazardous locations in Vietnam’s oil and gas, chemical, mining, and processing industries.

The Vietnam explosion-proof equipment market is poised for significant growth, driven by increasing industrial activities and a heightened focus on safety standards. As urbanization accelerates, the demand for advanced safety solutions will likely rise, particularly in high-risk sectors like oil and gas. Additionally, the integration of smart technologies and IoT in safety equipment will enhance operational efficiency and compliance, positioning the market for innovation and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Enclosures and junction boxes Lighting systems Cable glands and accessories Control stations, switches, and panel boards Sensors, detectors, and instrumentation Motors and material handling equipment Others |

| By Protection Method | Flameproof / explosion-proof enclosures Intrinsic safety Pressurization and purging Increased safety and encapsulation Others |

| By Zone Classification | Zone 0 Zone 1 Zone 2 Zone 20 Zone 21 Zone 22 |

| By End-User Industry | Oil and gas Chemical and petrochemical Mining Pharmaceuticals Food and beverage processing Power generation and utilities Others |

| By Application | Cable glands and connection systems Junction and distribution systems Lighting and signaling systems Surveillance and communication systems HVAC and motors Others |

| By Distribution Channel | Direct sales to end-users Industrial distributors and dealers EPCs and system integrators Online and catalog sales Others |

| By Region (Within Vietnam) | Northern Vietnam Central Vietnam Southern Vietnam Key industrial clusters and economic zones |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Safety Compliance | 120 | Safety Managers, Plant Operations Heads |

| Oil & Gas Industry Equipment Procurement | 90 | Procurement Managers, Safety Officers |

| Chemical Processing Safety Standards | 80 | Regulatory Affairs Specialists, Operations Managers |

| Construction Sector Equipment Usage | 70 | Site Managers, Safety Inspectors |

| Distribution Network Insights | 100 | Logistics Managers, Supply Chain Coordinators |

The Vietnam explosion proof equipment market is valued at approximately USD 140 million, driven by increasing safety demands in hazardous environments across industries such as oil and gas, chemicals, mining, and power generation.