Region:Middle East

Author(s):Shubham

Product Code:KRAD5508

Pages:95

Published On:December 2025

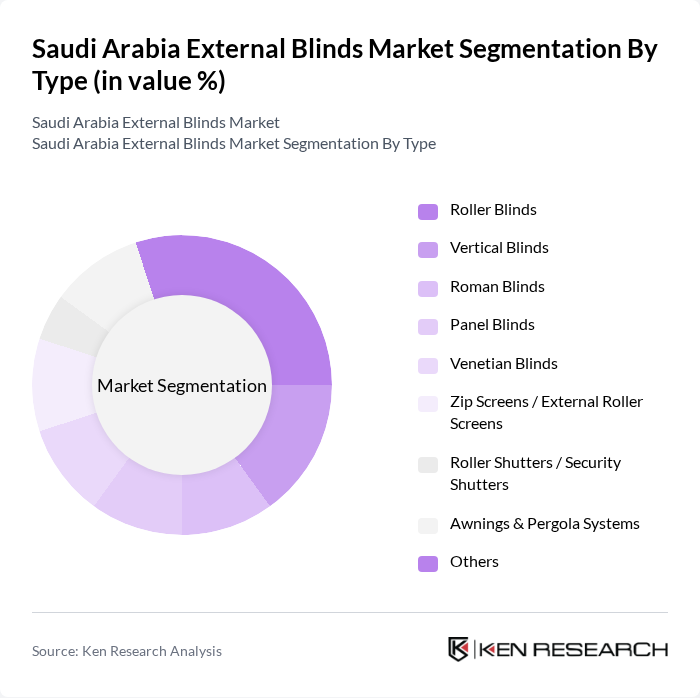

By Type:The market can be segmented into various types of external blinds, including Roller Blinds, Vertical Blinds, Roman Blinds, Panel Blinds, Venetian Blinds, Zip Screens / External Roller Screens, Roller Shutters / Security Shutters, Awnings & Pergola Systems, and Others. Each type serves different consumer needs and preferences, contributing to the overall market dynamics.

The Roller Blinds segment is currently dominating the market due to their versatility, ease of use, and aesthetic appeal. They are favored in both residential and commercial applications for their ability to provide effective light control and privacy. Additionally, the growing trend of minimalistic interior design has further propelled the demand for Roller Blinds, as they can seamlessly blend with various decor styles. The convenience of installation and maintenance also makes them a popular choice among consumers.

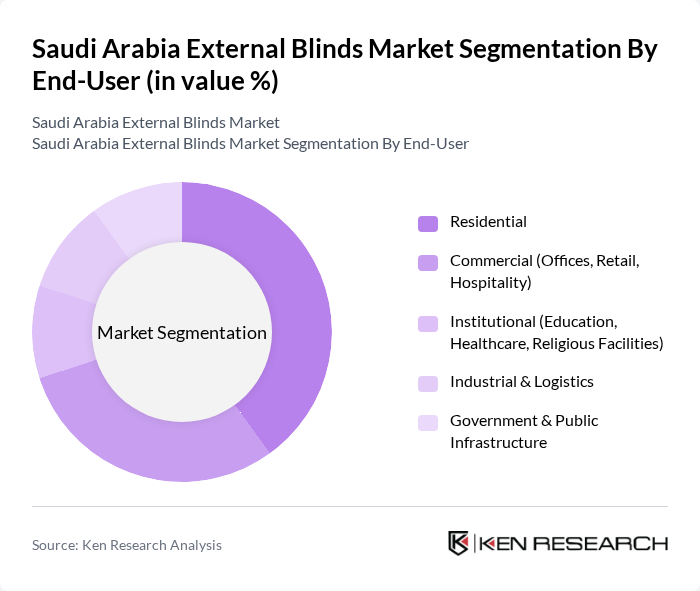

By End-User:The market can be segmented into Residential, Commercial (Offices, Retail, Hospitality), Institutional (Education, Healthcare, Religious Facilities), Industrial & Logistics, and Government & Public Infrastructure. Each end-user segment has distinct requirements and preferences, influencing the types of external blinds utilized.

The Residential segment is the largest end-user category, driven by the increasing focus on home aesthetics and energy efficiency. Homeowners are increasingly investing in external blinds to enhance their living spaces while reducing energy costs. The trend towards smart home technology has also led to a rise in demand for automated and motorized blinds, further boosting this segment's growth. Additionally, the growing population and urbanization in major cities contribute to the expansion of the residential market.

The Saudi Arabia External Blinds Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hunter Douglas N.V., Somfy Group, Warema Renkhoff SE, Al Nafi Trading Est. (Al Nafi Blinds & Curtains), Al-Abdulkader Group (Al Abdulkader Furniture & Blinds), Al-Jazeera Curtains & Blinds Co., Riyadh Curtains & Blinds, Zamil Architectural Industries (Sun Control & Shading Systems), Al Kuhaimi Metal Industries (Shutters & Security Blinds Division), Gulf Shade LLC, Shade Systems Arabia, Al-Futtaim IKEA Saudi Arabia (Curtains & Blinds Division), Al Sorayai Trading & Industrial Group (Home Furnishings), Saudi Modern Factory Co. (Sunshade & Outdoor Solutions), Al-Fanar Curtain & Blind Factory contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia external blinds market is poised for significant growth, driven by increasing urbanization and a shift towards energy-efficient solutions. As the government continues to invest in sustainable building practices, the demand for innovative and automated external blinds is expected to rise. Additionally, the integration of smart technologies will enhance functionality, appealing to tech-savvy consumers. Overall, the market is likely to evolve, presenting new opportunities for manufacturers and suppliers in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Roller Blinds Vertical Blinds Roman Blinds Panel Blinds Venetian Blinds Zip Screens / External Roller Screens Roller Shutters / Security Shutters Awnings & Pergola Systems Others |

| By End-User | Residential Commercial (Offices, Retail, Hospitality) Institutional (Education, Healthcare, Religious Facilities) Industrial & Logistics Government & Public Infrastructure |

| By Material | Aluminum and Other Metals PVC and Other Plastics Technical Fabrics (Acrylic, Polyester, Screen Fabrics) Wood & Natural Materials Others |

| By Operation | Manual Motorized Smart / Automated (Sensor- or App-controlled) |

| By Installation | New Construction Retrofit |

| By Price Range | Economy Mid-Range Premium Luxury / Project-Spec Custom |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential External Blinds Market | 140 | Homeowners, Interior Designers |

| Commercial Building Applications | 110 | Facility Managers, Architects |

| Industrial Sector Installations | 90 | Procurement Managers, Operations Directors |

| Retail Distribution Channels | 70 | Retail Managers, Sales Representatives |

| Energy Efficiency Initiatives | 60 | Sustainability Officers, Building Inspectors |

The Saudi Arabia External Blinds Market is valued at approximately USD 235 million, driven by the increasing demand for energy-efficient solutions and the growth of outdoor living spaces in residential and commercial buildings.