Region:Middle East

Author(s):Shubham

Product Code:KRAD3597

Pages:95

Published On:November 2025

By Type:The market is segmented into various types of fire safety equipment, including Fire Extinguishers, Fire Alarms, Fire Suppression Systems, Fire Blankets, Smoke Detectors, Personal Protective Equipment (PPE), Passive Fire Protection, Emergency Shutdown Systems (ESD), Fire and Gas Monitoring Systems, and Others. Each of these subsegments plays a crucial role in ensuring safety and compliance in various environments. Detection equipment, particularly fire alarms and smoke detectors, represent the largest and fastest-growing segment due to regulatory emphasis and ease of integration into new and existing infrastructure.

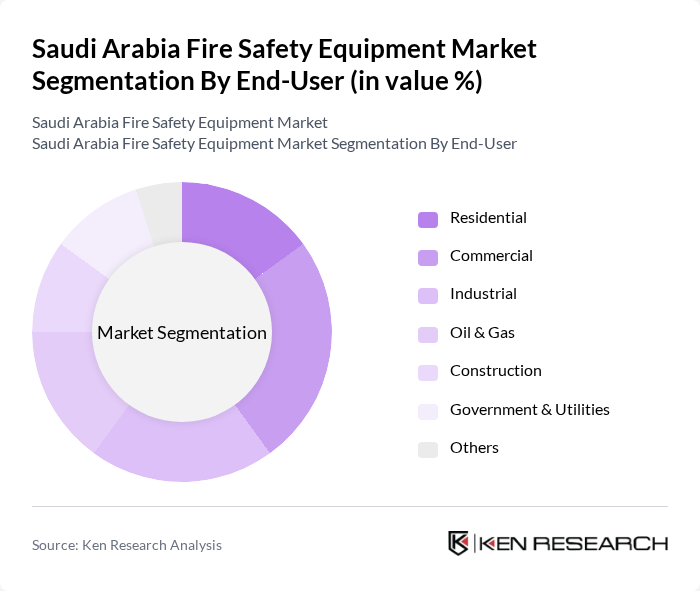

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Oil & Gas, Construction, Government & Utilities, and Others. Each segment has unique requirements and regulations that drive the demand for specific fire safety equipment tailored to their operational needs. The commercial and industrial sectors account for the largest share, reflecting the high concentration of business activity and regulatory compliance in urban centers.

The Saudi Arabia Fire Safety Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson Controls International plc (including Tyco and SimplexGrinnell), Honeywell International Inc., Siemens AG, Minimax Viking GmbH, UTC Fire & Security (Carrier Global Corporation), Ansul (a brand of Johnson Controls), Firetrace International, Kidde (a Carrier company), Hochiki Corporation, SFFECO Global (Saudi Factory for Fire Equipment Co.), NAFFCO (National Fire Fighting Manufacturing FZCO), Gulf Safety Equipment Co., Al-Jazira Fire Safety & Security, Al-Muhaidib Group, and Saudi Sicli Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia fire safety equipment market appears promising, driven by ongoing industrial growth and urban development. As the government continues to enforce stringent regulations, businesses will increasingly prioritize compliance, leading to higher investments in fire safety solutions. Additionally, the integration of smart technologies and IoT in fire safety systems is expected to enhance operational efficiency and safety standards, creating a more robust market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fire Extinguishers Fire Alarms Fire Suppression Systems Fire Blankets Smoke Detectors Personal Protective Equipment (PPE) Passive Fire Protection (e.g., Intumescent Coatings, Fireproofing Cladding, Cementitious Materials) Emergency Shutdown Systems (ESD) Fire and Gas Monitoring Systems Others |

| By End-User | Residential Commercial Industrial Oil & Gas Construction Government & Utilities Others |

| By Application | Fire Prevention Fire Detection Fire Suppression Emergency Response Others |

| By Distribution Channel | Direct Sales Online Retail Distributors and Wholesalers Specialty Stores Others |

| By Region | Central Region (including Riyadh) Eastern Region (including Dammam, Al Khobar) Western Region (including Jeddah, Makkah, Madinah) Southern Region |

| By Technology | Conventional Systems Addressable Systems Wireless Systems Smart Systems (IoT-enabled) Others |

| By Service Type | Installation Services Maintenance Services Training Services Consulting Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Fire Safety Compliance | 100 | Project Managers, Safety Compliance Officers |

| Industrial Facility Fire Safety Equipment Usage | 60 | Facility Managers, Operations Managers |

| Commercial Building Fire Safety Standards | 50 | Building Owners, Safety Inspectors |

| Oil & Gas Industry Fire Safety Protocols | 40 | Safety Managers, Risk Assessment Officers |

| Retail Sector Fire Safety Equipment Procurement | 50 | Procurement Managers, Store Safety Coordinators |

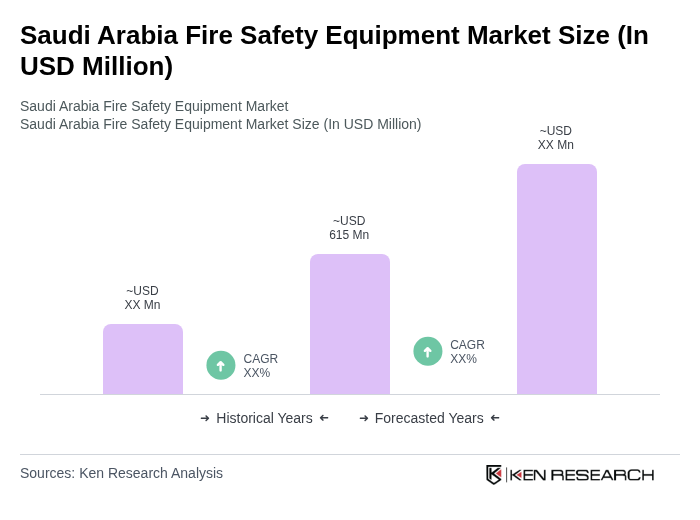

The Saudi Arabia Fire Safety Equipment Market is valued at approximately USD 615 million, driven by urbanization, stringent safety regulations, and increased awareness of fire safety among businesses and consumers.