Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9550

Pages:80

Published On:November 2025

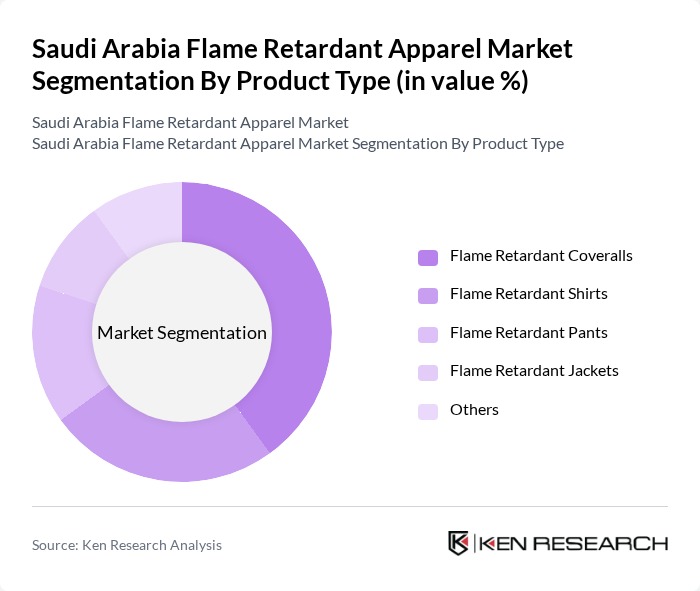

By Product Type:The product type segmentation includes various categories of flame retardant apparel designed for different applications and user needs. The subsegments are Flame Retardant Coveralls, Flame Retardant Shirts, Flame Retardant Pants, Flame Retardant Jackets, and Others. Each of these subsegments caters to specific industry requirements and user preferences, with coveralls being particularly popular due to their comprehensive protection and suitability for oil and gas and industrial environments .

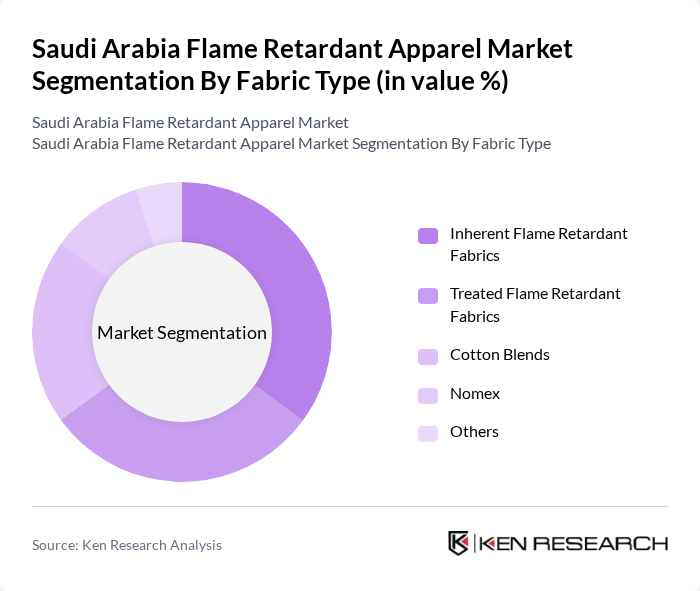

By Fabric Type:The fabric type segmentation encompasses various materials used in the production of flame retardant apparel. This includes Inherent Flame Retardant Fabrics, Treated Flame Retardant Fabrics, Cotton Blends, Nomex, and Others. Inherent fabrics are gaining traction due to their superior protective qualities and durability, while treated fabrics are popular for their cost-effectiveness and versatility. Cotton blends and Nomex are widely used for their balance of comfort and protection, with ongoing innovation in fabric technology to enhance wearer comfort and compliance with international safety standards .

The Saudi Arabia Flame Retardant Apparel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Kifah Holding Company, Al-Falak Electronic Equipment & Supplies, National Fire Fighting Manufacturing FZCO, Gulf Safety Equipment Manufacturing, Al-Muhaidib Group, Al-Babtain Group, Al-Hokair Group, Saudi Aramco (Saudi Arabian Oil Company), SABIC (Saudi Basic Industries Corporation), Al-Faisaliah Group, Al-Rajhi Holding Group, Al-Suwaidi Industrial Services, Al-Tamimi Group, and Al-Mansour Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the flame retardant apparel market in Saudi Arabia appears promising, driven by ongoing industrial growth and heightened safety awareness. As companies increasingly adopt sustainable practices, the demand for eco-friendly flame retardant materials is expected to rise. Additionally, advancements in smart textile technology will likely enhance product functionality, catering to the evolving needs of various industries. This combination of factors positions the market for significant growth in the coming years, fostering innovation and investment.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Flame Retardant Coveralls Flame Retardant Shirts Flame Retardant Pants Flame Retardant Jackets Others |

| By Fabric Type | Inherent Flame Retardant Fabrics Treated Flame Retardant Fabrics Cotton Blends Nomex Others |

| By Durability Type | Durable Flame Retardant Apparel Temporary Flame Retardant Apparel |

| By End-User Industry | Oil and Gas Petrochemicals Construction Mining Manufacturing Aerospace and Defense Healthcare Others |

| By Distribution Channel | Direct Sales to Industries Distributors and Wholesalers Online Retail Specialty Retail Stores Others |

| By Region | Central Region (Riyadh) Eastern Region (Dammam, Khobar) Western Region (Jeddah, Mecca) Southern Region Northern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Industry | 100 | Safety Managers, Procurement Officers |

| Construction Sector | 80 | Site Supervisors, Safety Compliance Officers |

| Firefighting Services | 50 | Fire Chiefs, Equipment Procurement Managers |

| Manufacturing Sector | 90 | Production Managers, Safety Officers |

| Healthcare Sector | 60 | Facility Managers, Safety Compliance Officers |

The Saudi Arabia Flame Retardant Apparel Market is valued at approximately USD 30 million, driven by increasing demand for safety apparel in high-risk industries such as oil and gas, construction, and manufacturing, along with stringent safety regulations.