Region:Middle East

Author(s):Shubham

Product Code:KRAD3676

Pages:99

Published On:November 2025

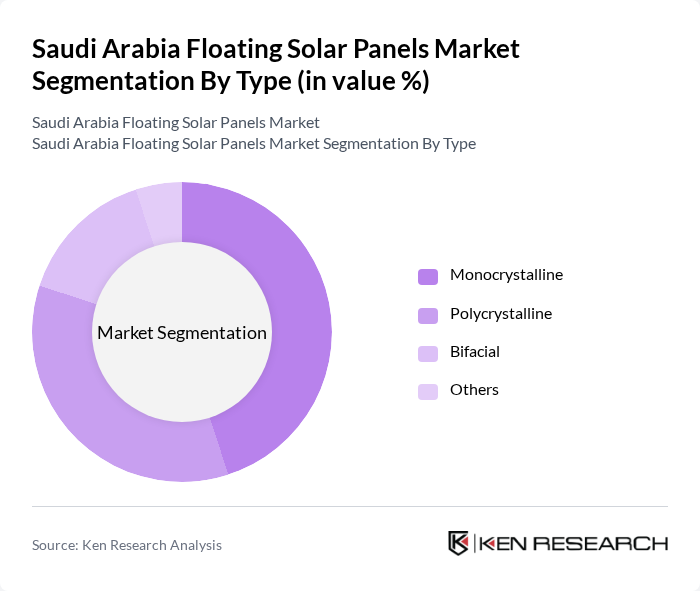

By Type:The market is segmented into various types of floating solar panels, including Monocrystalline, Polycrystalline, Bifacial, and Others. Monocrystalline panels are known for their high efficiency and space-saving design, making them a popular choice for floating solar installations. Polycrystalline panels, while slightly less efficient, are cost-effective and widely used. Bifacial panels, which can capture sunlight from both sides, are gaining traction due to their enhanced energy output. The "Others" category includes emerging technologies and innovative designs that cater to specific project requirements.

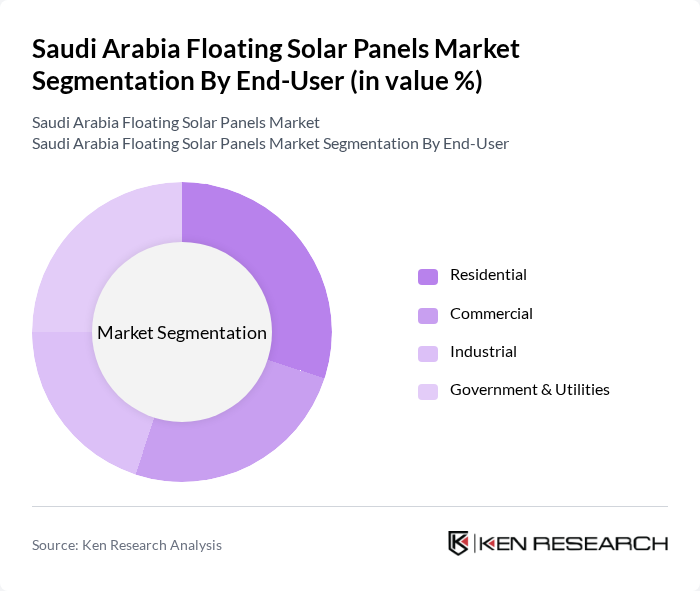

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The residential segment is witnessing increased adoption as homeowners seek sustainable energy solutions. The commercial sector is also expanding, driven by businesses aiming to reduce energy costs and carbon footprints. Industrial applications are growing due to the need for reliable energy sources, while government and utility projects are pivotal in large-scale implementations of floating solar technology. Utility-scale floating solar projects are experiencing notable growth, reflecting a shift from smaller pilot projects to larger, more ambitious installations that offer economies of scale.

The Saudi Arabia Floating Solar Panels Market is characterized by a dynamic mix of regional and international players. Leading participants such as ACWA Power, Saudi Arabian Oil Company (Aramco), NEOM Green Hydrogen Company, Alfanar Energy, Al Jomaih Energy & Water, Enerwhere Sustainable Energy, Enviromena Power Systems, TotalEnergies, EDF Renewables, Masdar, Risen Energy, LONGi Solar, JA Solar, Trina Solar, Canadian Solar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the floating solar panels market in Saudi Arabia appears promising, driven by increasing energy demands and supportive government policies. As technological advancements continue to enhance efficiency and reduce costs, floating solar systems are likely to gain traction. Furthermore, the integration of smart grid technologies will facilitate better energy management, optimizing the use of renewable resources. The market is expected to evolve with innovative financing models and collaborative efforts between public and private sectors, fostering sustainable energy solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Monocrystalline Polycrystalline Bifacial Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Floating Photovoltaic Systems Hybrid Systems Others |

| By Application | Utility-Scale Projects Off-Grid Solutions Floating Solar Farms Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Floating Solar Project Developers | 100 | Project Managers, Technical Directors |

| Government Energy Policy Makers | 80 | Energy Analysts, Regulatory Affairs Specialists |

| Environmental Impact Assessors | 60 | Environmental Scientists, Sustainability Consultants |

| Investors in Renewable Energy | 75 | Investment Analysts, Portfolio Managers |

| Utility Companies Engaged in Solar Energy | 90 | Operations Managers, Renewable Energy Directors |

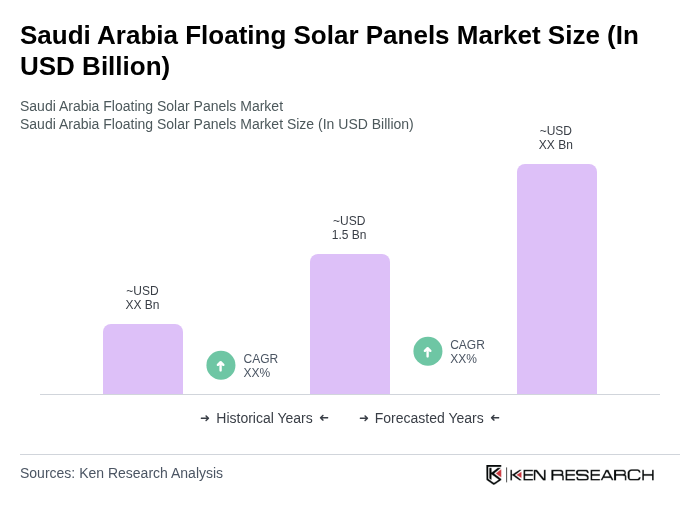

The Saudi Arabia Floating Solar Panels Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the country's commitment to renewable energy and sustainability as part of its Vision 2030 initiative.