Region:Middle East

Author(s):Rebecca

Product Code:KRAC0251

Pages:99

Published On:August 2025

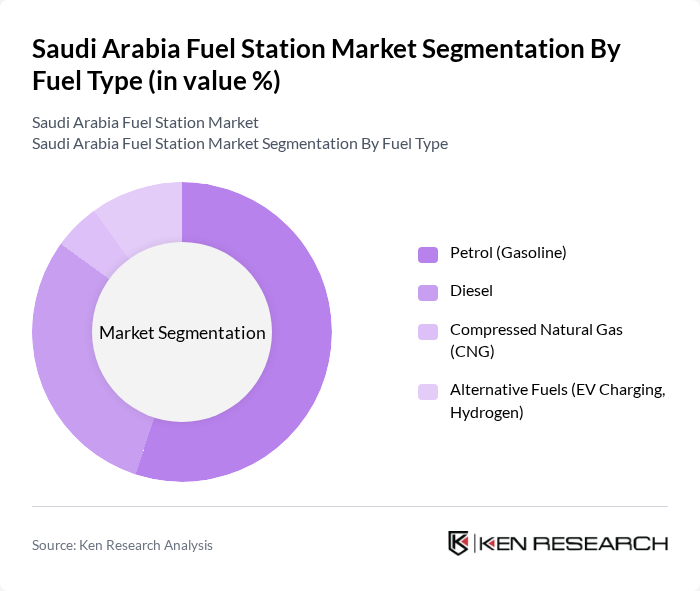

By Fuel Type:The fuel type segmentation includes petrol (gasoline), diesel, compressed natural gas (CNG), and alternative fuels such as electric vehicle charging and hydrogen.Petrol remains the dominant fuel typedue to its widespread use in passenger vehicles. Diesel is significant for commercial and industrial applications. The market is witnessing a gradual shift toward sustainability, with alternative fuels—particularly EV charging—gaining traction as operators and regulators encourage cleaner energy options .

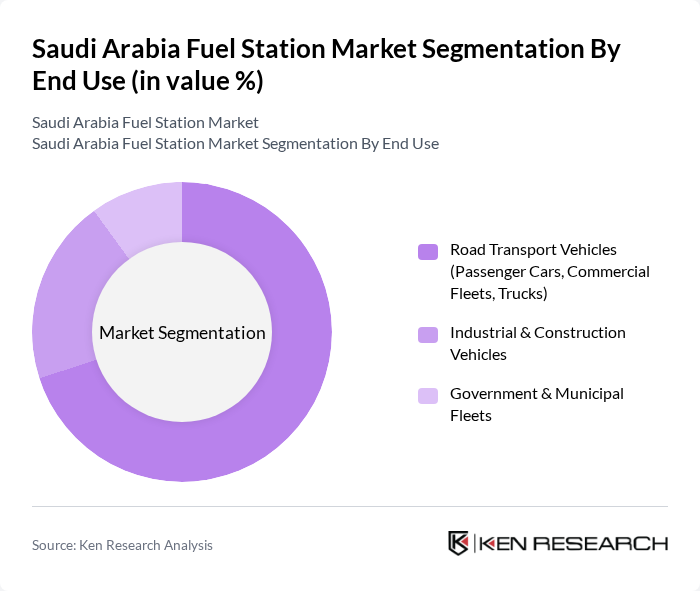

By End Use:The end-use segmentation covers road transport vehicles, industrial and construction vehicles, and government and municipal fleets.Road transport vehicles—including passenger cars, commercial fleets, and trucks—dominate fuel consumption, especially in urban centers. Industrial and construction vehicles contribute significantly, driven by infrastructure development. Government and municipal fleets are increasingly adopting alternative fuels, reflecting a shift toward sustainability in public sector transportation .

The Saudi Arabia Fuel Station Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco, Aldrees Petroleum & Transport Services Co. (Aldrees), ADNOC Distribution, Emirates National Oil Company (ENOC), Petromin Corporation, Oula Fuel Marketing Company, TotalEnergies SE, NAFT Services Company, Tas’helat Marketing Company (TMC), Watania Petroleum Company, Al Manar Gas Station Company, Al-Jomaih Energy and Water Company, Al-Muhaidib Fuel, Al-Faisaliah Group, and Al-Rajhi Group contribute to innovation, geographic expansion, and enhanced service delivery. Operators are increasingly investing in digitalization, alternative fuels, and strategic partnerships to diversify revenue streams and align with evolving consumer preferences .

The Saudi Arabia fuel station market is poised for transformation as it adapts to evolving consumer preferences and technological advancements. The integration of electric vehicle charging infrastructure and digital payment solutions is expected to redefine customer experiences. Additionally, sustainability initiatives will likely gain traction, aligning with global trends towards greener energy. As the market navigates these changes, strategic partnerships and investments in renewable energy will be crucial for long-term growth and resilience in the face of emerging challenges.

| Segment | Sub-Segments |

|---|---|

| By Fuel Type | Petrol (Gasoline) Diesel Compressed Natural Gas (CNG) Alternative Fuels (EV Charging, Hydrogen) |

| By End Use | Road Transport Vehicles (Passenger Cars, Commercial Fleets, Trucks) Industrial & Construction Vehicles Government & Municipal Fleets |

| By Service Offering | Fuel Sales Convenience Store Services Vehicle Maintenance & Car Wash Electric Vehicle Charging |

| By Location | Urban Stations Highway Stations Rural Stations |

| By Ownership | Company-Owned & Operated Franchise/Dealer-Owned Independent Operators |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Fuel Station Operations | 100 | Station Managers, Regional Directors |

| Rural Fuel Station Dynamics | 60 | Owners, Local Business Operators |

| Alternative Fuel Adoption | 40 | Policy Makers, Sustainability Managers |

| Consumer Behavior Insights | 120 | Regular Fuel Users, Fleet Managers |

| Market Trends and Innovations | 80 | Industry Analysts, Technology Providers |

The Saudi Arabia Fuel Station Market is valued at approximately USD 850 million, driven by increasing fuel demand due to rising vehicle ownership, urbanization, and government infrastructure initiatives.