Region:Middle East

Author(s):Shubham

Product Code:KRAD3690

Pages:97

Published On:November 2025

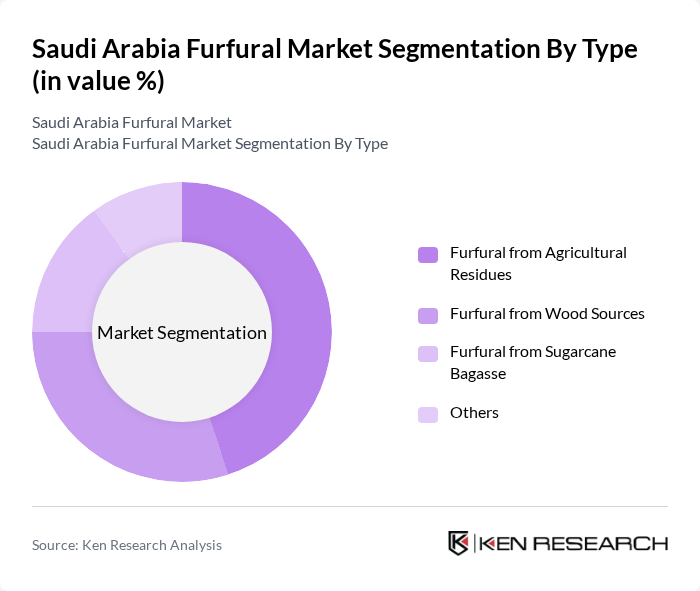

By Type:The market is segmented into various types of furfural based on the source of raw materials. The primary subsegments include furfural from agricultural residues, wood sources, sugarcane bagasse, and others. Among these, furfural from agricultural residues is gaining traction due to the increasing availability of agricultural waste and the push for sustainable production methods. This subsegment is expected to lead the market as industries seek eco-friendly alternatives.

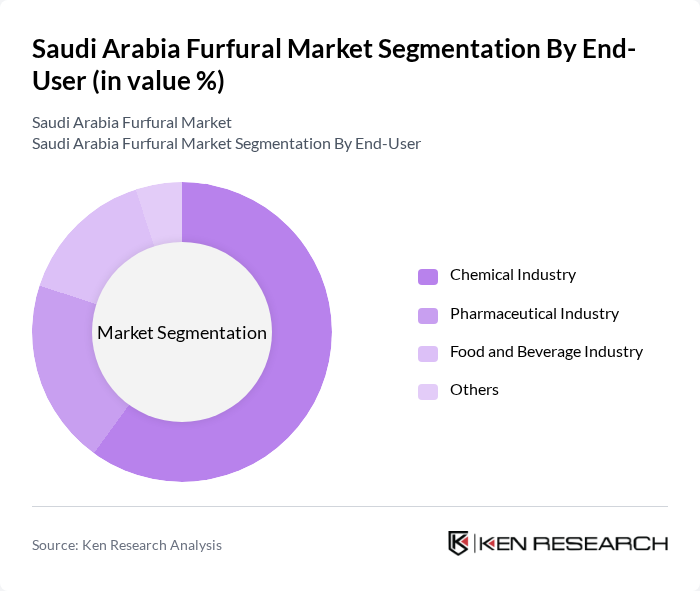

By End-User:The end-user segmentation includes the chemical industry, pharmaceutical industry, food and beverage industry, and others. The chemical industry is the dominant segment, driven by the high demand for furfural as a solvent and intermediate in resin production. The pharmaceutical sector is also growing, utilizing furfural in various applications, but the chemical industry remains the primary consumer due to its extensive use of furfural in manufacturing processes.

The Saudi Arabia Furfural Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Furfural Company, Al-Jubail Petrochemical Company (JUPC), National Petrochemical Company (NATPET), Gulf Furfural Company, Furfural Chemical Company, Saudi Basic Industries Corporation (SABIC), Al-Furat Chemical Company, Arabian Furfural Company, Al-Muhaidib Group, Al-Babtain Group, Al-Hokair Group, Al-Faisaliah Group, Al-Suwaidi Industrial Services, Al-Mansour Group, Al-Rajhi Group contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia furfural market is poised for significant growth, driven by increasing demand for sustainable products and government support for eco-friendly initiatives. As the petrochemical industry expands, furfural's role as a key intermediate will become more pronounced. Innovations in production technologies and a focus on renewable resources will likely enhance market dynamics. Additionally, the growing pharmaceutical sector presents new avenues for furfural applications, further solidifying its position in the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Furfural from Agricultural Residues Furfural from Wood Sources Furfural from Sugarcane Bagasse Others |

| By End-User | Chemical Industry Pharmaceutical Industry Food and Beverage Industry Others |

| By Application | Solvent Production Intermediate for Resins Production of Furfural Alcohol Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Region Eastern Region Western Region Others |

| By Production Method | Acid Catalysis Catalytic Hydrolysis Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Furfural Production Insights | 100 | Production Managers, Plant Engineers |

| End-User Applications in Pharmaceuticals | 80 | Product Development Managers, Quality Assurance Heads |

| Agrochemical Sector Utilization | 70 | Procurement Managers, Research Scientists |

| Food Processing Industry Feedback | 60 | Food Technologists, Supply Chain Coordinators |

| Market Trends and Regulatory Insights | 90 | Regulatory Affairs Specialists, Industry Analysts |

The Saudi Arabia Furfural Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This valuation is driven by the increasing demand for bio-based chemicals and the utilization of furfural in various industrial applications.