Region:Middle East

Author(s):Rebecca

Product Code:KRAB1953

Pages:86

Published On:October 2025

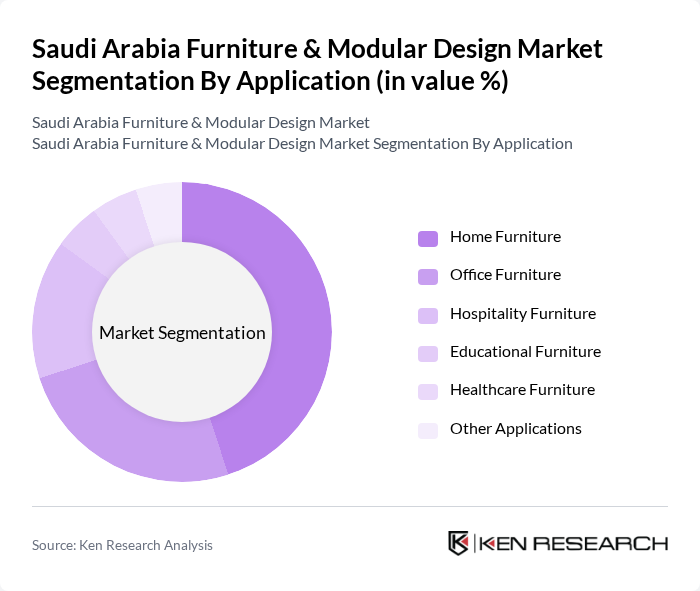

By Application:The market is segmented into home furniture, office furniture, hospitality furniture, educational furniture, healthcare furniture, and other applications. Home furniture is the leading segment, driven by the growing trend of home renovations, increased consumer spending on interiors, and demand for stylish and functional living spaces. Office furniture follows, supported by business expansion, modern work environment requirements, and the development of new commercial spaces under Vision 2030 .

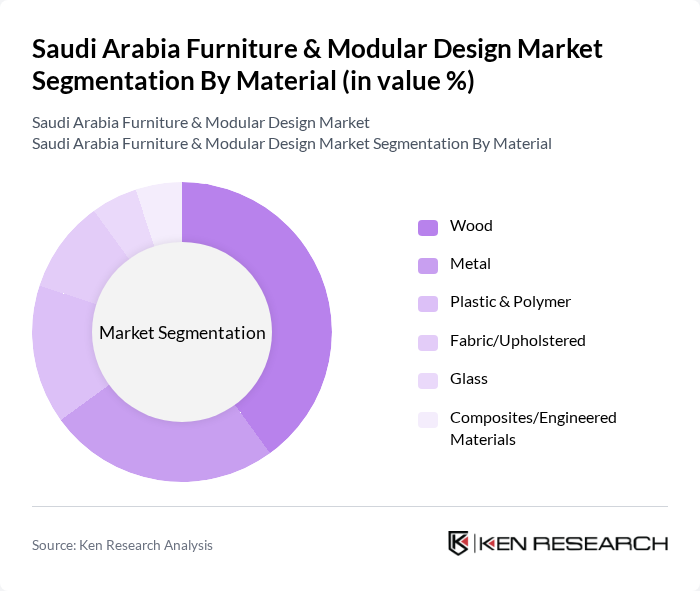

By Material:The market is segmented by material into wood, metal, plastic & polymer, fabric/upholstered, glass, and composites/engineered materials. Wood remains the dominant material due to its aesthetic appeal, durability, and cultural preference, while metal is gaining traction for its modern look and strength. Engineered materials and glass are increasingly used for innovative designs and to create a sense of space and openness, reflecting a trend towards sustainability and contemporary aesthetics .

The Saudi Arabia Furniture & Modular Design Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Saudi Arabia (Ghassan Ahmed Al Sulaiman Furniture Trading Co. Ltd.), Almutlaq Furniture, Home Centre (Landmark Group), Pan Emirates Home Furnishings, Al-Muhaidib Group, Al-Hokair Group, Al-Jedaie Furniture, Al-Rugaib Furniture, Royal Furniture, United Furniture, Al-Sarh Group, Al-Muhaidib Furniture, Al-Faisaliah Furniture, Al-Mahmal Furniture, RIS Store KSA contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia furniture and modular design market is poised for significant growth, driven by urbanization, rising incomes, and government housing initiatives. As consumers increasingly seek personalized and sustainable furniture solutions, manufacturers will need to adapt to these evolving preferences. The integration of technology in furniture design and the expansion of e-commerce platforms will further shape the market landscape. Companies that embrace innovation and sustainability will likely lead the way in capturing emerging opportunities in this dynamic sector.

| Segment | Sub-Segments |

|---|---|

| By Application | Home Furniture (Bedroom Suites, Modular Wardrobes, Kitchen Cabinets, Living Room, Dining Sets, Sofas, Outdoor, Bathroom, etc.) Office Furniture (Chairs, Desks & Workstations, Storage Cabinets, Soft Seating, Other Office Furniture) Hospitality Furniture (Hotels, Restaurants, Resorts, Giga-Project Tenders) Educational Furniture Healthcare Furniture Other Applications (Public Places, Retail Malls, Government Offices, etc.) |

| By Material | Wood Metal Plastic & Polymer Fabric/Upholstered Glass Composites/Engineered Materials |

| By Price Range | Economy/Budget Mid-Range Premium/Luxury |

| By Distribution Channel | Specialty Stores Hypermarkets & Supermarkets Online Retail Direct Sales Showrooms |

| By End-User | Residential Commercial Hospitality Government/Education/Healthcare |

| By Design Style | Modern Traditional Contemporary Minimalist Others |

| By Brand | Local Brands International Brands Luxury Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 120 | Homeowners, Interior Designers |

| Commercial Modular Design Projects | 60 | Project Managers, Facility Managers |

| Online Furniture Retail Trends | 50 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Preferences in Furniture Styles | 90 | General Consumers, Trend Analysts |

| Impact of Sustainability on Furniture Choices | 70 | Sustainability Advocates, Product Designers |

The Saudi Arabia Furniture & Modular Design Market is valued at approximately USD 6.5 billion, driven by urbanization, real estate development, and rising disposable incomes, alongside government housing initiatives and a growing expatriate population.